British Columbia Soda Tax

B.C. Soda Tax Overview

Audience

This article is intended for all Maitre'D users, resellers and support technicians, doing business or providing technical support for users in the province of British Columbia (BC), Canada.

Requirements

Maitre'D Version:

Maitre'D 7.08.00.340 or later

Overview

Effective April 1, 2021, soda beverages will no longer qualify for the exemption for food products for human consumption. PST will apply to all retail sales of soda beverages at a rate of 7%.

If you sell soda beverages and are not already registered as a PST collector, you must register to collect and remit PST. Ensure your point of sale systems are updated to charge PST on soda beverages effective April 1, 2021.

What Are Soda Beverages?

Soda beverages are carbonated or effervescent beverages that have bubbles and fizz and contain any of the following:

Sugar

Natural occurring sweeteners

Added natural sweeteners (such as honey, molasses, maple syrup, fruit juice, stevia, etc.)

Artificial sweeteners (such as aspartame, sucralose, saccharin, etc.)

Carbonation or effervescence may be either naturally occurring in drinks (as in the case of fermented non-alcoholic beverages, such as kombucha) or injected after the beverage has been manufactured (e.g. with carbon dioxide or nitrogen).

Examples of Soda Beverages Include:

Soft drinks and soda pop

Sparkling fruit juices

Carbonated or nitrogenized energy drinks

Kombucha

Nitrogenized coffee (if sweetened)

Sparkling, sweetened water

Soda beverages also include:

Frozen sweetened beverages, such as Slurpees or Frosters, that have been carbonated or have other gases added to them, and

Sweetened effervescent beverages that have any of the following added to them:

frozen desserts, such as ice cream (e.g. ice cream floats)

fruit or fruit flavouring

candy, chocolate or another type of confection

NOTE: The information from this section was taken from Notice 2021-002, issued in February 2021 by British Columbia's Ministry of Finance. The original can be consulted here:

Provincial Sales Tax (PST) Notice 2021-002

Learn more about British Columbia's Provincial Sales Tax (PST):

B.C. Provincial Sales Tax (PST)

Read the Provincial Sales Tax Act:

Specific guidelines for the restaurant and bar industry:

British Columbia Soda Tax Configuration

This article explains the Maitre'D configuration required to comply with British Columbia's Provincial Sales Tax Act.

IMPORTANT! This article assumes that your Maitre'D POS system is already configured and fully functional. Use the information from this article to update your existing Maitre'D POS system to the new regulation.

Configuration sequence

Create / Configure Tax Categories as explained in the Create Tax Categories article.

Create / Configure Taxes as explained in the Create Taxes - New Tax articles. You may also refer to the tables below for specific settings.

Assign taxes to divisions as explained in the Assign Taxes to Divisions article.

Assign all sales items that are defined as "Sodas" to taxable divisions.

Suggested Tax Categories for Maitre'D

British Columbia has two tiers of sales taxes. The first tier is managed at the provincial level, which includes the provincial sales taxes and liquor taxes. The second tier is managed at the federal level, which includes the Goods & Services Tax (GST). Therefore, it is suggested to use two Tax Categories for Maitre'D:

Provincial Taxes

Federal Tax

Required Taxes in Maitre'D

Provincial Taxes:

Provincial Sales Tax (PST) - 7%

Provincial Sales tax (PST) for liquor - 10%

Federal Taxes:

Goods and Services Tax (GST) - 5%

Detailed Tax Configurations

The following tables list all the options and settings for each tax. Refer to the Create Tax Categories article to learn how to create a new tax, and refer to the tables below for each individual setting.

Provincial Sales Tax (PST) - 7%

The provincial Sales Tax at a rate of 7% applies to sodas as explained in the B.C. Soda Tax Overview article. However, if you also sell miscellaneous goods, such as clothing, bottle openers and souvenirs (e.g. souvenir glasses or pens with your company name on them), you also need to apply the 7% PST on these items. The PST may be used as an add-on tax or an inclusive tax.

Maitre'D Tax Settings for 7% PST configured as add-on tax

Setup

Description

PST (7%)

Category

Provincial Taxes

Provincial Taxes

Fiscal Identification

0

Tax Type

UNDEFINED

Fixed Tax

Fixed Tax

OFF

Amount

$0.00

Rate

Rate

7.00000

Minimum Taxable

$0.00

Special Mode Tax

UNDEFINED

Tax Table

Use Tax Table

OFF

Options

Inclusive

OFF

Check Total

OFF

Rounding

ON

Gross Method

OFF

Separate Printout

ON

Tax Before Quantity

OFF

BC Soda Beverages Tax

ON

Apply Tax On

Taxes the Tax

OFF

Taxable Discount

OFF

Taxable Service

OFF

Tax on Delivery Charges

OFF

Tax on Charged Discounts

OFF

Taxable Gratuity

OFF

Maitre'D Tax Settings for 7% PST configured as inclusive tax

Setup

Description

PST Incl. (7%)

Category

Provincial Taxes

Fiscal Identification

0

Tax Type

UNDEFINED

Fixed Tax

Fixed Tax

OFF

Amount

$0.00

Rate

Rate

7.00000

Minimum Taxable

$0.00

Special Mode Tax

UNDEFINED

Tax Table

Use Tax Table

OFF

Options

Inclusive

ON

Check Total

OFF

Rounding

ON

Gross Method

OFF

Separate Printout

ON

Tax Before Quantity

ON

BC Soda Beverages Tax

ON

Apply Tax On

Taxes the Tax

OFF

Taxable Discount

OFF

Taxable Service

OFF

Tax on Delivery Charges

OFF

Tax on Charged Discounts

OFF

Taxable Gratuity

OFF

Provincial Sales Tax (PST) for liquor - 10%

The provincial Sales Tax at a rate of 10% applies to all alcoholic beverages containing more than 1% of alcohol per volume, such as beer, spirits and liqueurs, wine, mixed drinks, etc.

Settings for 10% PST configured as add-on tax

Setup

Description

PST Liquor (10%)

Category

Provincial Taxes

Fiscal Identification

0

Tax Type

UNDEFINED

Fixed Tax

Fixed Tax

OFF

Amount

$0.00

Rate

Rate

10.00000

Minimum Taxable

$0.00

Special Mode Tax

UNDEFINED

Tax Table

Use Tax Table

OFF

Options

Inclusive

OFF

Check Total

OFF

Rounding

ON

Gross Method

OFF

Separate Printout

ON

Tax Before Quantity

OFF

BC Soda Beverages Tax

OFF

Apply Tax On

Taxes the Tax

OFF

Taxable Discount

OFF

Taxable Service

OFF

Tax on Delivery Charges

OFF

Tax on Charged Discounts

OFF

Taxable Gratuity

OFF

Maitre'D Tax Settings for 10% PST configured as inclusive tax

Setup

Description

PST Liq. Incl. (10%)

Category

Provincial Taxes

Fiscal Identification

0

Tax Type

UNDEFINED

Fixed Tax

Fixed Tax

OFF

Amount

$0.00

Rate

Rate

10.00000

Minimum Taxable

$0.00

Special Mode Tax

UNDEFINED

Tax Table

Use Tax Table

OFF

Options

Inclusive

ON

Check Total

OFF

Rounding

ON

Gross Method

OFF

Separate Printout

ON

Tax Before Quantity

ON

BC Soda Beverages Tax

OFF

Apply Tax On

Taxes the Tax

OFF

Taxable Discount

OFF

Taxable Service

OFF

Tax on Delivery Charges

OFF

Tax on Charged Discounts

OFF

Taxable Gratuity

OFF

Goods and Services Tax (GST) - 5%

The federal Goods and Service Tax (GST) at a rate of 5% applies on all goods and services, including food, beverages, alcohol, clothing, souvenirs, etc. The GST may be used as an add-on tax or an inclusive tax.

Maitre'D Tax Settings for 5% GST configured as add-on tax

Setup

Description

GST (5%)

Category

Federal Tax

Fiscal Identification

0

Tax Type

UNDEFINED

Fixed Tax

Fixed Tax

OFF

Amount

$0.00

Rate

Rate

5.00000

Minimum Taxable

$0.00

Special Mode Tax

UNDEFINED

Tax Table

Use Tax Table

OFF

Options

Inclusive

OFF

Check Total

OFF

Rounding

ON

Gross Method

OFF

Separate Printout

ON

Tax Before Quantity

OFF

BC Soda Beverages Tax

OFF

Apply Tax On

Taxes the Tax

OFF

Taxable Discount

OFF

Taxable Service

ON

Tax on Delivery Charges

ON

Tax on Charged Discounts

ON

Taxable Gratuity

OFF

Maitre'D Tax Settings for 5% GST configured as inclusive tax

Setup

Description

GST Incl. (5%)

Category

Federal Tax

Fiscal Identification

0

Tax Type

UNDEFINED

Fixed Tax

Fixed Tax

OFF

Amount

$0.00

Rate

Rate

5.00000

Minimum Taxable

$0.00

Special Mode Tax

UNDEFINED

Tax Table

Use Tax Table

OFF

Options

Inclusive

ON

Check Total

OFF

Rounding

ON

Gross Method

OFF

Separate Printout

ON

Tax Before Quantity

ON

BC Soda Beverages Tax

OFF

Apply Tax On

Taxes the Tax

OFF

Taxable Discount

OFF

Taxable Service

ON

Tax on Delivery Charges

ON

Tax on Charged Discounts

ON

Taxable Gratuity

OFF

Division Tax Settings for British Columbia

Audience

The settings explained in this article only applies to businesses located in the Canadian province of British Columbia.

Aim

The aim of this article is to explain how to setup Maitre'D divisions to comply with the British Columbia Provincial Sales Tax Act. These setings will ensure that sodas are taxed according to Provincial Sales Tax (PST) Notice 2021-002, which came into effect on April 1st 2021. At the same time, this configuration will ensure compliance with all other provisions of the Provincial Sales Tax Act pertaining to the restaurant and bar industry, as defined in Bulletin PST 119 - Restaurant and Liquor Sellers.

Before you begin

Make sure that all required taxes are created and properly configured. See B.C. Soda Tax Configuration.

To learn how to access tax settings for each division and read definitions for each setting, see Assign Taxes to Divisions.

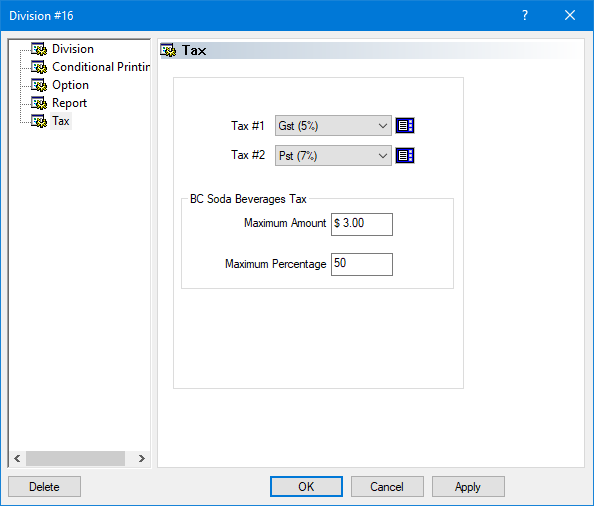

Divisions containing soda beverages

For definitions of what is considered a "Soda Beverage", see B.C. Soda Tax Overview.

The divisions used for sodas are taxable by both the GST (5%) and PST (7%). Here are the required settings:

Tax #1

Select GST (5%) from the drop-down list.

Tax #2

Select PST (7%) from the drop-down list.

BC Soda Beverages Tax

This section becomes available because the BC Soda Beverage Tax option is enabled in the PST (7%) tax settings.

Maximum Amount

Set this value to $3.00.

Maximum Percentage

Set this value to 50.

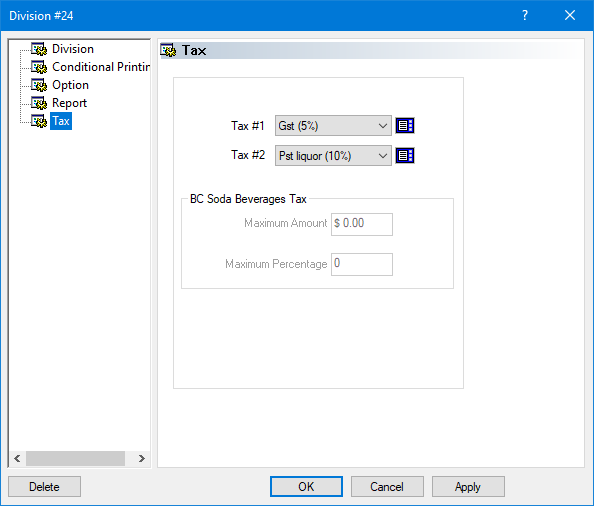

Divisions containing alcoholic beverages

The divisions used for alcohol products are taxable by both the GST (5%) and PST Liquor (10%). Here are the required settings:

Tax #1

Select GST (5%) from the drop-down list.

Tax #2

Select PST Liquor (10%) from the drop-down list.

BC Soda Beverages Tax

This section is not available because the BC Soda Beverage Tax option is disabled in both the PST Liquor (10%) and GST (5%) tax settings.

Maximum Amount

Unavailable.

Maximum Percentage

Unavailable.

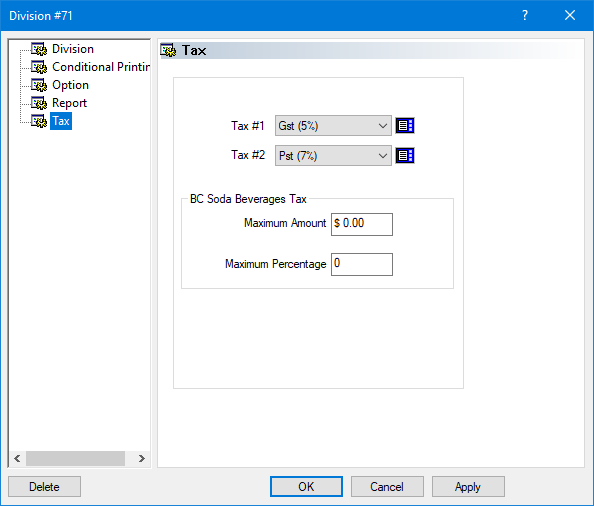

Divisions containing other taxable items

The divisions used for non-food items are taxable by both the GST (5%) and PST (7%). Here are the required settings:

Tax #1

Select GST (5%) from the drop-down list.

Tax #2

Select PST (7%) from the drop-down list.

BC Soda Beverages Tax

This section becomes available because the BC Soda Beverage Tax option is enabled in the PST (7%) tax settings. However, these settings must be left at zero for "non-soda" divisions.

Maximum Amount

Set this value to $0.00.

Maximum Percentage

Set this value to 0.

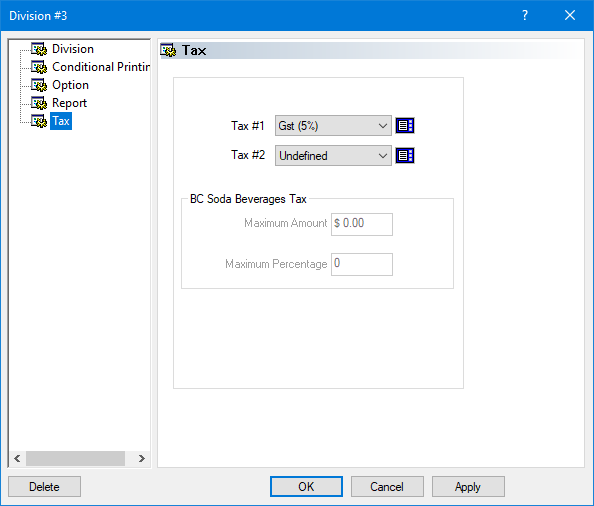

Divisions containing food or other non-PST-taxable items

The divisions containing food items are taxable only by the GST (5%). Here are the required settings:

Tax #1

Select GST (5%) from the drop-down list.

Tax #2

Select Undefined from the drop-down list.

BC Soda Beverages Tax

This section is not available because the BC Soda Beverage Tax option is disabled in the GST (5%) tax settings.

Maximum Amount

Unavailable.

Maximum Percentage

Unavailable.

Examples of PST application on sodas

This article will cover some common scenarios that can be encountered when the PST is applied to soda beverages in British Columbia, and a brief overview of the required configuration.

British Columbia "Soda Tax" recap

Here is a quick recap of British Columbia's Provincial Sales Tax (PST) rules which applies to soda beverages. For complete and up-to-date documentation regarding taxes, please consult the official British Columbia government site at https://www2.gov.bc.ca/gov/content/taxes/sales-taxes.

PST applies to all retail sales of soda beverages at a rate of 7%.

If you offer the beverage for sale without the food or other good, you charge PST on the lesser of:

the ordinary purchase price of that beverage, and;

the total purchase price of the other good and beverage together.

Or

If you offer the beverage for sale only with the food or other good, the lesser of:

50% of the total purchase price of the food or other good and beverage together, and;

$3

Also, don't forget that almost all items sold in restaurants, including soft drinks, are also taxable by the federal Goods and Services Tax (GST) at a rate of 5%.

IMPORTANT! While the new regulations are often referred to as "B.C. Soda Tax", it is important to understand that the government of British Columbia did not create a new tax specifically for sodas. Instead, the updated law simply extends the reach of the existing Provincial Sales Tax to soda beverages.

For your POS system, this means that you should not have a separate tax for sodas. You should use the PST at a rate of 7%.

Example #1

You offer an all-you-can-eat buffet with access to a soda fountain for $30.00. Access to the soda fountain is not sold separately and it is not listed on the menu, therefore it does not have its own price. The $3.00 / 50% rule applies: Since $3.00 is lesser than 50% of $30.00 ($15.00), the PST will be calculated on $3.00.

Configuration for Example #1

Configure a revenue item called "Buffet - Adult" with a price of $30.00. Make this item part of a food division.

Configure a free item called "Soda Fountain". Make this item part of a Soda/Soft Drink division.

Link the Buffet - Adult item to the Soda Fountain item through a Weight Modifier and a variable list.

Example #2

You offer an all-you-can-eat buffet for $28.00. You offer access to a soda fountain for an additional $2.00. Because access to the soda fountain is listed separately on the menu, the PST is calculated on the sale price of $2.00 for this item.

Configuration for Example #2

Configure a Revenue item called "Buffet - Adult" with a price of $28.00. Make this item part of a food division.

Configure a Modifier item called "Soda Fountain" with a price of $2.00. Make this item part of a Soda/Soft Drink division.

Configure a Modifier item called "Water" with a price of $0.00. Make this item part of a "non-soda beverages" division.

Link the Buffet - Adult item to the Soda Fountain and water items through a Weight Modifier and a variable list.

This will allow the server to select between "Soda Fountain" (pst-taxable) and "Water" (non-pst-taxable).

Example #3

You sell a hot-dog and large soda combo for $5.00. The soda is not listed on the menu and not sold on its own. The $3.00 / 50% rule applies: Because 50% of $5.00 ($2.50) is lesser than $3.00, the PST will be calculated on $2.50.

Configuration for Example #3

Configure a revenue item called "Hot-Dog Combo" with a price of $5.00. Make this item part of a food division.

Configure a free item called "Soda - Included". Make this item part of a Soda/Soft Drink division.

Link the Hot-Dog Combo item to the Soda - Included item through a Weight Modifier and a variable list.

Example #4

You sell a hot-dog and large soda combo for $5.00. The Hot-Dog on its own is $3.25 and the drink on its own is $2.25, which are both listed on the menu. In this instance, the PST will be calculated on the ordinary sale price of the soda, which is $2.25.

Configuration for Example #4

Configure a revenue item called "Hot-Dog Combo" with a price of $5.00. Make this item part of a food division and enable the Main Combo Item option for this item.

Configure a revenue item called "Hot-Dog" with a price of $3.25. Make this item part of a food division.

Configure a revenue item called "Large Soda" with a price of $2.25. Make this item part of a Soda/Soft Drink division.

Create and configure a combo meal which will include the hot-dog and a soft drink.

To order this combo, you can rely on combo detection or create variable lists and Weighted Modifiers.

Example #5

You sell a hot-dog and large soda combo for $5.00. The Hot-Dog on its own is $3.25 and the drink is $2.25, which are both listed on the menu. You have a special promotion which gives 75% off hot-dog combos that day, which brings the total price of the combo down to $1.25. In this instance, the PST will be calculated on the total price of the combo, which is now $1.25.

Configuration for Example #5

Use the same configuration as Example #4.

Create a 75% Off promotion which will apply on the Hot-Dog combo.

Last updated

Was this helpful?