Electronic Funds Transfer Setup

Before you begin:

IMPORTANT! Make sure that the RTI-SIPA plugin is installed and functional, and that the EFT module is already configured with the EFT-RTI v 1.0 interface for SecurePay. Please see the SecurePay Online User Guide for more information and detailed setup instructions.

Bar Tab EFT Configuration:

Logon to the Maitre’D Back-Office with appropriate credentials. (Distributor or System Owner)

Start the Electronic Funds Transfer module.

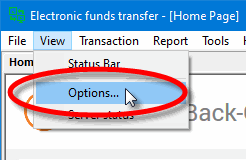

Click on the View menu and select Options...

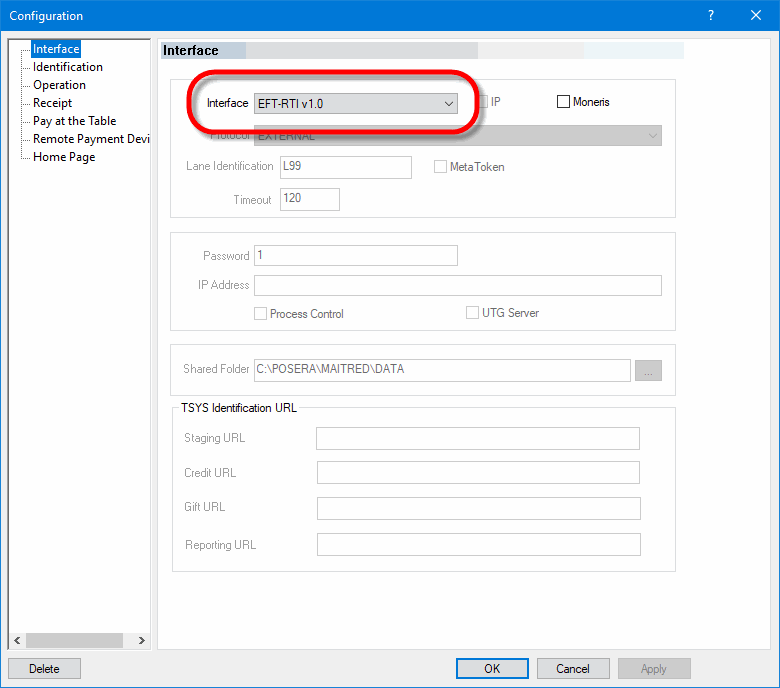

The options will open to the Interface screen. Make sure that the interface is set to EFT-RTI v1.0.

IMPORTANT! If the RTI-SIPA plugin is not already installed and functional, or that the EFT-RTI v 1.0 option is not available, please see the SecurePay Online User Guide for more information and detailed setup instructions.

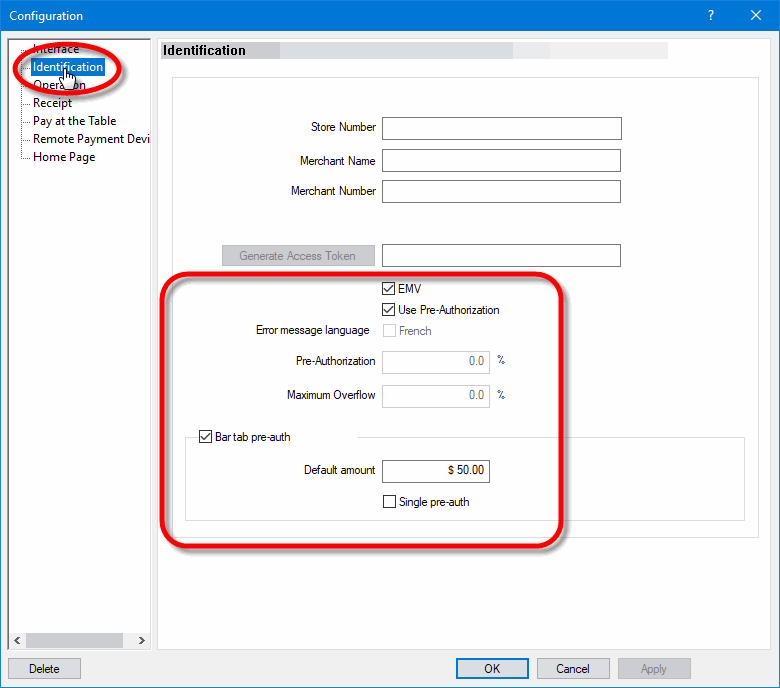

Click on the Identification branch.

EMV

Enable this option. This is required for the EFT-RTI v 1.0 interface to work properly.

Use Pre-Authorization

Enable this option to allow the EFT-RTI v 1.0 interface to perform pre-authorizations, which consists of validating that enough credit is available and setting aside a predetermined amount to cover eventual purchases. This is required to use Bar Tabs.

Bar tab pre-auth

This option becomes available only after Use Pre-Authorization is enabled. Enable this option to use Bar Tabs.

Default Amount

Enter the default amount to be used for authorization when opening a bar tab with a credit card. This amount is also used as a default increment value if the total of items already ordered surpasses the starting amount. For example, if the default amount is $25.00, Maitre'D will increment the suggested amount in $25.00 slices, going from $25.00 to $50.00 and then to $75.00 and so on, as needed to cover the current amount of the running tab.

NOTE: Employees can always enter a different amount than the default when opening a new bar tab or when prompted to increment a bar tab that has reached its initial authorized amount.

Single pre-auth

Enable this option to force the bar tab to be closed when the authorized amount of the bar tab is reached. If the customer wishes to purchase more items, a new bar tab will need to be started and the customer's credit card will need to be physically inserted at the payment terminal again. While this involves more work on the POS and additional handling of the customer's credit card, this method ensures that there is always credit available to cover the customer's purchases.

If this option is left disabled, an incremented pre-authorization will be made once the initial amount is reached, without requiring the customer's credit card to be physically inserted at the payment terminal. While this avoids having to close the bar tab and opening a new one, this method introduces the possibility of getting a decline if there is not enough credit available to cover the additional amount.

Click Apply and then OK to save changes and close the options screen.

Close the Electronic Funds Transfer module.

NOTE: For more information on options not covered here, please see the SecurePay Online User Guide.

Last updated

Was this helpful?