DSR

Maitre'D DSR Report (Daily Summary Report) compares sales (gross sales), taxes, media types, discounts and daily deposit for the selected week or date range. This report shows you a cash deposit only if you have the field "daily deposit" selected under the P.O.S. Control / view / option.

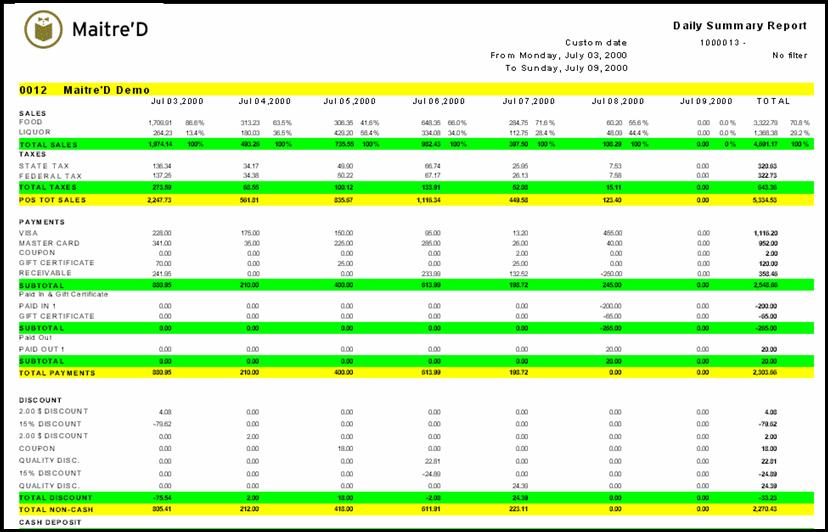

The following is a sample of DSR report:

Sales:

Represents the gross sales before any discount and before any taxes. For each day you get the $ sales per category and the percentage (category sales divided by total sales x 100) it represents from the total gross sales. In this section you also have a total sales and a total %.

Taxes:

Represent each tax's total and then total taxes.

POS TOT SALES:

Total sales + Total Taxes

Payment:

The 1st part of this section shows you total for the media type, 2 to 25, the total for payment received against a receivable account or a room charge. The 2nd part of this section adds up paid in and gift certificate sold to the 1st part and then the last part adds up the paid out to the 2nd part.

TOTAL PAYMENTS:

Total of all subtotals from the payment section.

Discount:

Lists all discounts used with their total $ amount and then a total of all discounted $ amount

TOTAL NON-CASH:

TOTAL PAYMENTS + TOTAL DISCOUNTS

CASH DEPOSIT:

Shows you a cash deposit only if you have the field "daily deposit" selected under the P.O.S. Control / view / option at the restaurant site. When this option isselected at the restaurant site, the end of the day prompts the restaurant owner/manager for the cash deposit. This cash deposit will then be included in the DBF conversion and will be transferred to the head office.

SALES - PAYMENT - DISCOUNT

What your cash deposit should be

TOTAL RECEIPTS:

TOTAL NON-CASH + CASH DEPOSIT

OVER/SHORT

TOTAL NON-CASH less POS TOT SALES + CASH DEPOSIT

OR if daily deposit not activated under POS Control then TOTAL NON-CASH less POS TOT SALES

Last updated

Was this helpful?