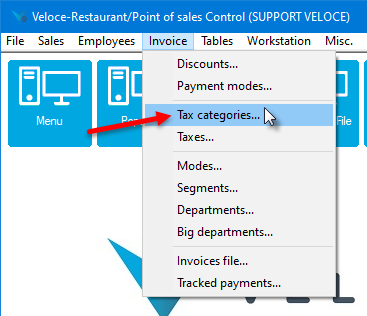

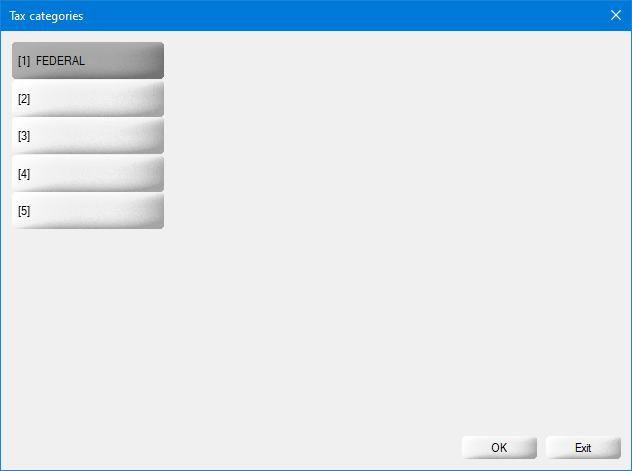

Tax Categories

Create Tax Categories

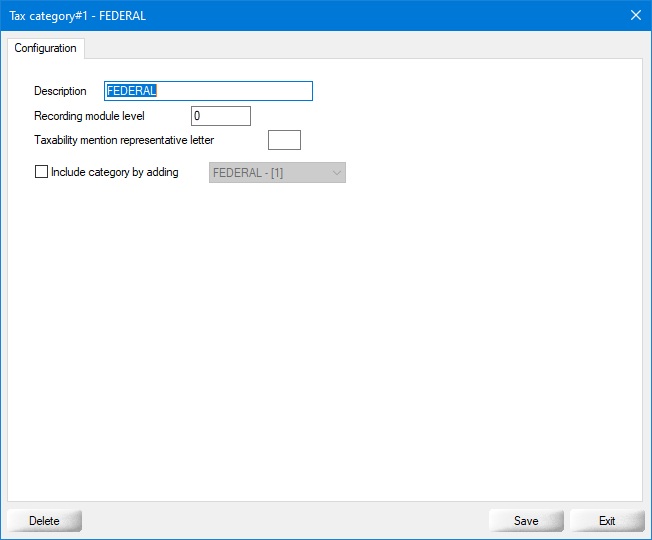

Description

Recording Module Level

Taxability mention representative letter

Include category by adding

Last updated

Was this helpful?