Example #3: Combo with listed soda

This article explains how to create a combo item which contains a soda item, where the taxable soda item is listed on the menu and available for sale on its own.

Prerequisites:

Configure the British Columbia Provincial Sales Tax (PST) as detailed here.

Configure the federal Goods and Services Tax (GST) as detailed here.

Configure all your taxable soda items as described in Example #1: Simple item.

Create an item screen that will contain "Included Item" versions of all your sodas. Give an appropriate name to this item screen, such as "Included beverages" for example. You may refer to the Item Screens article to learn more about item screens.

Create an "Included Item" version of each of your sodas, with a price of $0.00. Follow the instructions and information provided in the Create Sales Items article for more details.

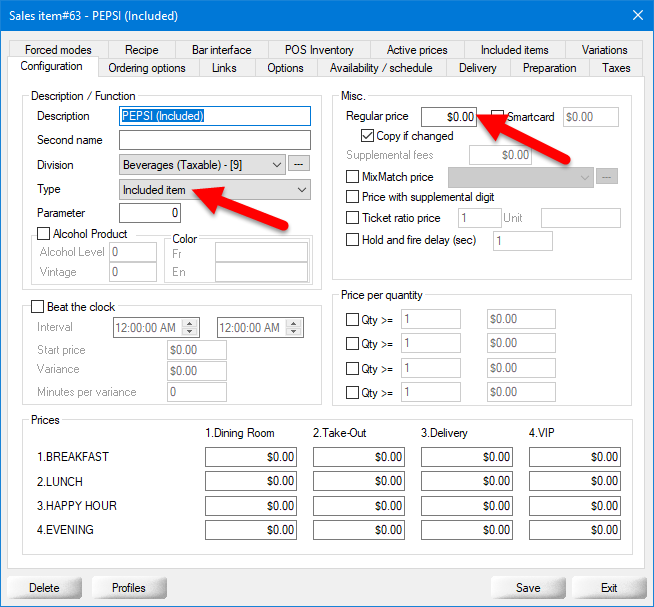

Description

Type a meaningful description. It is also recommended to add a descriptor such as "(included)" to differentiate this item from its regular counterpart.

Type

Set the item's type to Included item.

Regular price

Set the item's price to $0.00, since this item will be included with the purchase of a combo.

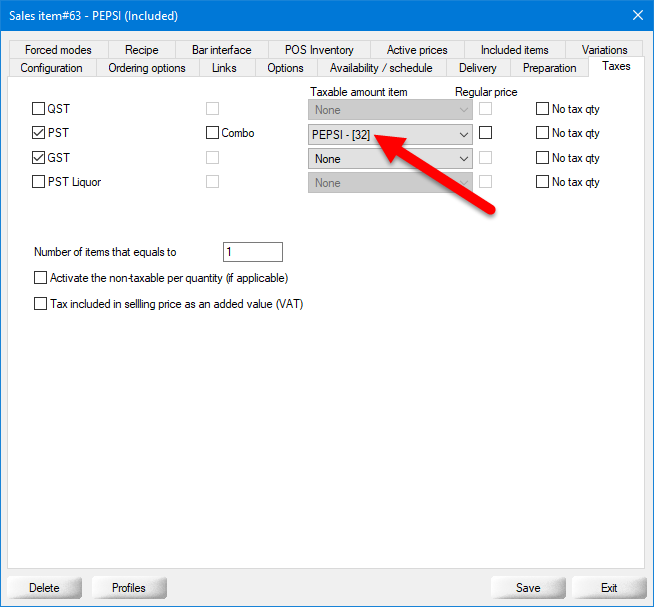

For each included item, configure the taxes as follows:

Tax selection

Enable the PST (Provincial sales tax at 7%) and GST (federal Goods and Services Tax at 5%) for all soda Included items.

Exception (Combo)

Disable this option on all Included items. This checkbox only becomes available when the Exception option is enabled in the tax configuration (POS Control > Invoice > Taxes... > [select a tax] > Rate tab > Exception). The text which appears here (Combo in the screenshot) is determined by the text field in the exception configuration.

Taxable amount item

On the PST line, select the regular item that will be used to determine the price to use for the purpose of tax calculation. For example, if you are creating the "PEPSI (included)" item, select the "PEPSI" regular item. This will cause Veloce to use the ordinary selling price of the Pepsi ($2.00) to calculate the PST.

Regular price

This checkbox will become available once you select an item from the drop-down list. Leave it disabled for all taxes.

No tax qty

Leave this option disabled for all taxes.

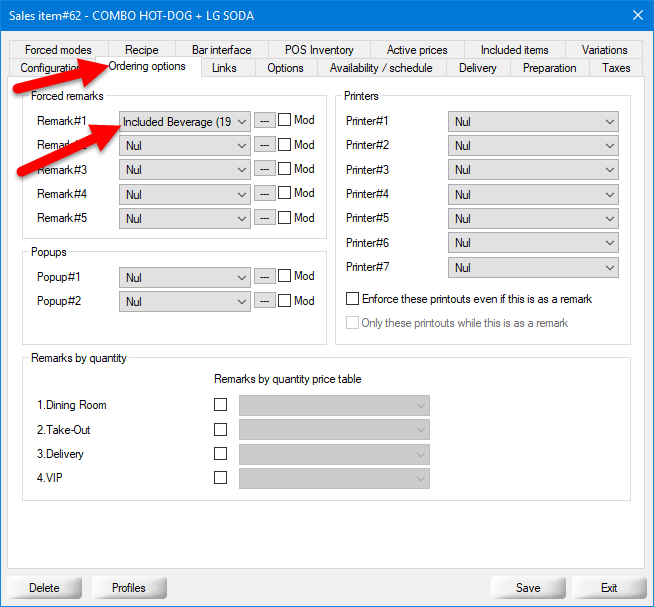

Create Regular sales items for each type of combo. Follow the instructions and information provided in the Create Sales Items article for more details.

For each combo item, go to the Ordering options tab and make sure to use Forced Remarks to call up the Included Beverages Item Screen:

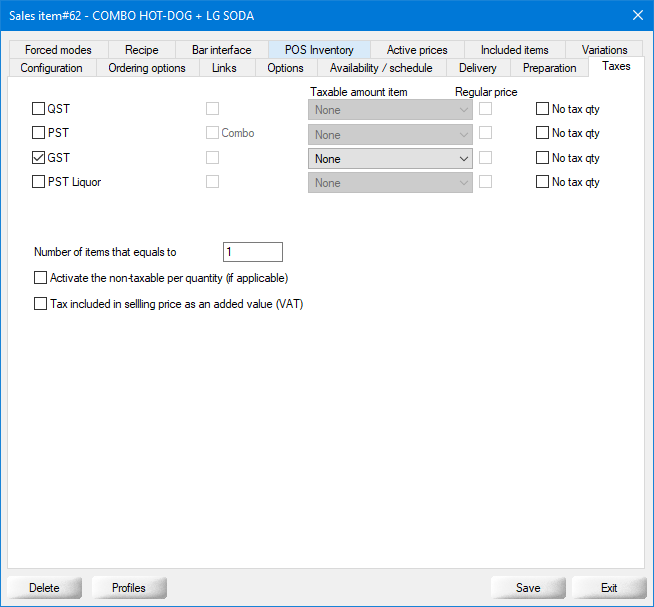

For each combo item, configure the tax as follows:

Tax selection

Enable the GST (federal Goods and Services Tax at 5%) only.

Exception (Combo)

This option is grayed out and shall therefore remain disabled for all taxes.

Taxable amount item

Select None on each line.

Regular price

This option is grayed out and shall therefore remain disabled for all taxes.

No tax qty

Leave this option disabled for all taxes.

Save this configuration and repeat for all combo items.

Process at the POS

The employee logs on to the POS.

Employee orders a $5.00 combo item.

The list of included beverages automatically appears, as the combo calls the beverages item screen through a forced remark.

The employee selects a taxable beverage.

The employee prints the invoice and charges the customer.

The GST is calculated on the full price of the combo ($5.00).

The PST is calculated on the ordinary selling price of the soda beverage ($2.00).

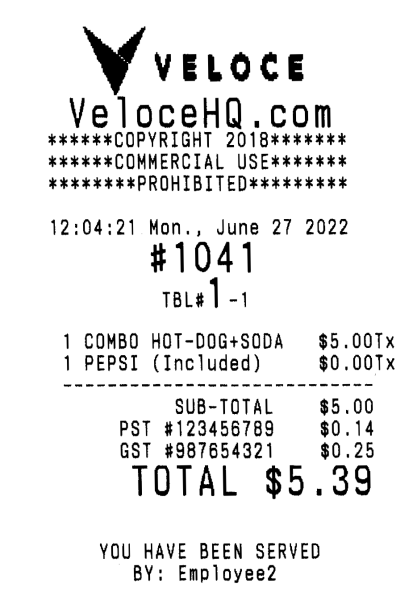

Result on the invoice

With this configuration, the PST is calculated on the ordinary selling price of the included taxable beverage, while the GST is calculated on the price of the combo:

SUB-TOTAL: $5.00

PST: $0.14 ($2.00 * 0.07 = $0.14)

GST: $0.25 ($5.00 * 0.05 = $0.25)

TOTAL: $5.39

hint

IMPORTANT! There is a known issue with Veloce which causes taxes to be calculated incorrectly if the price of the combo falls below the price of the soda item on its own. For instance, if you were to apply a 75% discount on a $5.00 combo, the price would fall to $1.25, which is lower than the price of the soda on its own. The same issue occurs if you create a combo with a base price lower than the price of the soda.

According to the BC tax law, if you offer the beverage for sale without the food or other good, you charge PST on the lesser of:

the ordinary purchase price of that beverage, and

the total purchase price of the other good and beverage together.

In this instance, the problem is that Veloce keeps calculating the PST on the ordinary purchase price of the beverage, while it should calculate it on the price of the combo, because the price of the combo is lesser than the ordinary sale price.

See Jira issue LP-3451.

Last updated

Was this helpful?