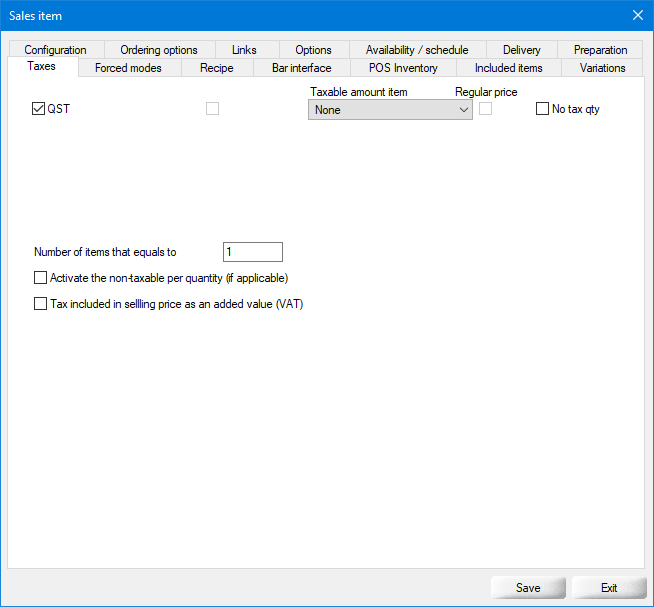

Sales Item Setup - Taxes

Taxes list

Taxable amount item

Regular price

No tax qty

Number of items that equals to

Activate the non-taxable per quantity (if applicable)

Tax included in selling price as an added value (VAT)

Last updated

Was this helpful?