Example #2: Combo with unlisted soda

This article explains how to create a combo item which contains a soda item, where the taxable soda item is not listed on the menu and not available for sale on its own. Here are a few common examples:

A "hamburger combo" meal which includes a large soda and a choice of sides.

A "pizza special" that comes with a 2-litre bottle of soda.

A buffet which includes access to a soda fountain.

The important element to remember for this specific configuration is that in all of these examples, the soda is not listed on the menu and therefore not available for purchase on its own.

Prerequisites:

Configure the British Columbia Provincial Sales Tax (PST) as detailed here.

Configure the federal Goods and Services Tax (GST) as detailed here.

Create an appropriate item screen as explained here.

Create Regular sales items for each type of combo. Follow the instructions and information provided in the Create Sales Items article.

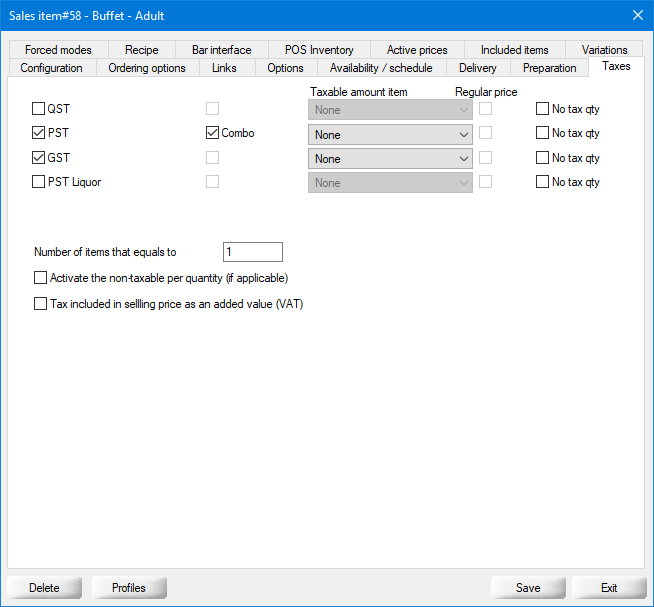

For each combo item, configure the tax as follows:

Tax selection

Enable the PST (Provincial sales tax at 7%) and GST (federal Goods and Services Tax at 5%) for all combo items.

Exception (Combo)

Enable this option for the PST tax only, on all regular items that are combos, but only if they include a soda item which cannot be purchased on its own. This checkbox only becomes available when the Exception option is enabled in the tax configuration (POS Control > Invoice > Taxes... > [select a tax] > Rate tab > Exception). The text which appears here (Combo in the screenshot) is determined by the text field in the exception configuration.

Taxable amount item

Leave this drop-down list to None for all taxes.

Regular price

This checkbox is grayed-out. Leave it disabled for all taxes.

No tax qty

Leave this option disabled for all taxes.

Save this configuration and repeat for all combo items that include a soda item which cannot be purchased on its own.

NOTE: If the customer can replace the soda with a non-taxable beverage such as bottled water, you need to create a separate combo item and disable the PST for that item.

Result on the invoice

In this scenario, the 7% PST will be calculated on the lesser of:

50% of the total purchase price of the food or other good and beverage together, and;

$3

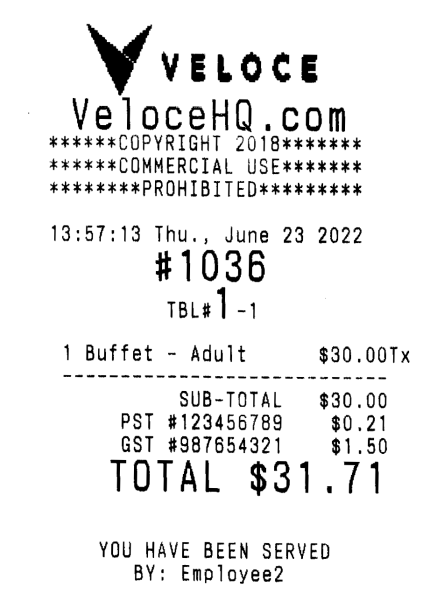

Item price $6.00 or more

If the item price is $6.00 or more, the "$3 rule" applies, and the PST is calculated on $3.00 as shown in the example below:

SUB-TOTAL: $30.00

PST: $0.21 ($3.00 * 0.07 = $0.21)

GST: $1.50 ($30.00 * 0.05 = $1.50)

TOTAL: $31.71

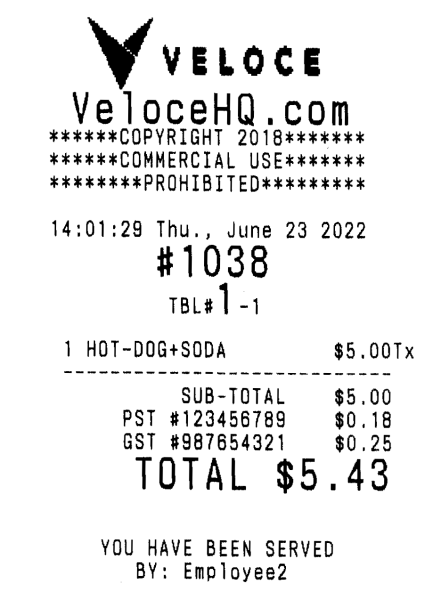

Item price less than $6.00

If the item price is $5.99 or less, the "50% rule" applies, and the PST is calculated on 50% of the item's selling price as shown in the example below:

SUB-TOTAL: $5.00

PST: $0.18 (($5.00 / 2) * 0.07 = 0.175 = $0.18)

GST: $0.25 ($5.00 * 0.05 = $0.25)

TOTAL: $5.43

IMPORTANT! There is a known issue in Veloce which causes the "50% rule" not to apply if the price of the item is brought down below $6.00 through the application of a discount. For instance, if the item is priced at $10.00 and a 50% discount is applied, bringing the price down to $5.00, the tax will still be calculated on $3.00 instead of $2.50.

See Jira issue LP-1873.

Last updated

Was this helpful?