Taxes

Taxes

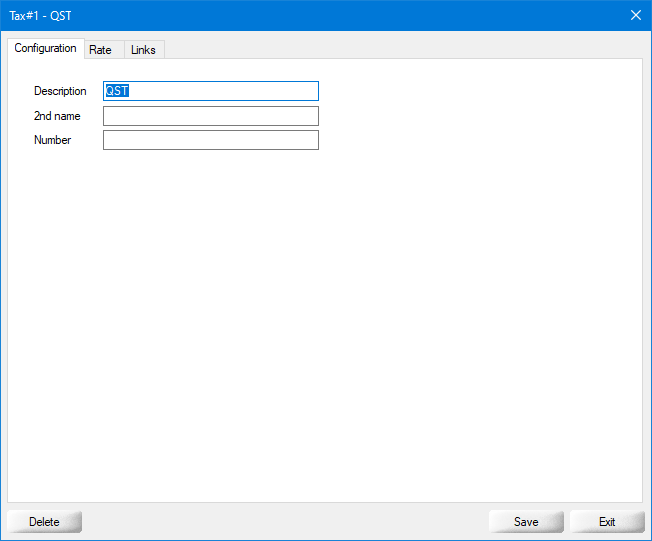

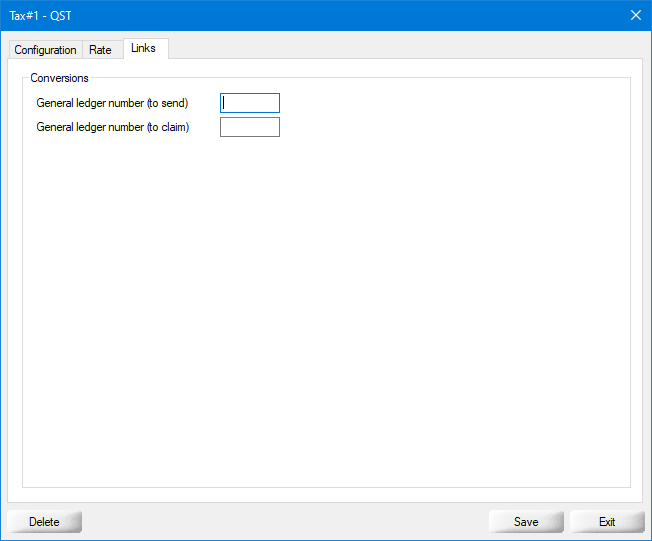

Creating Taxes

Veloce Back-Office Icon

Point of Sale Control Icon

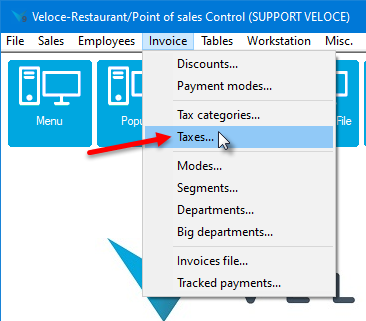

Invoice Menu - Taxes...

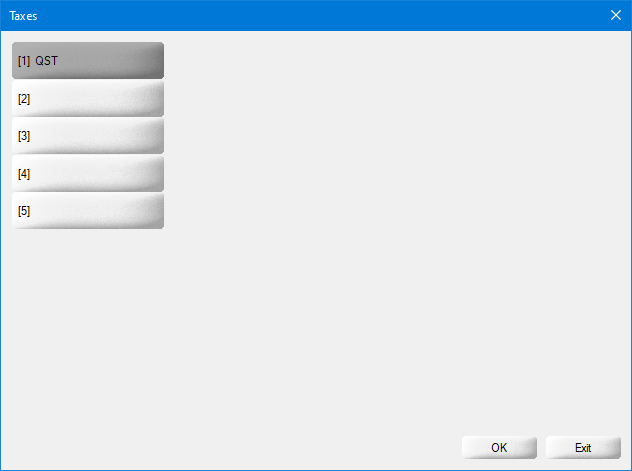

Taxes List

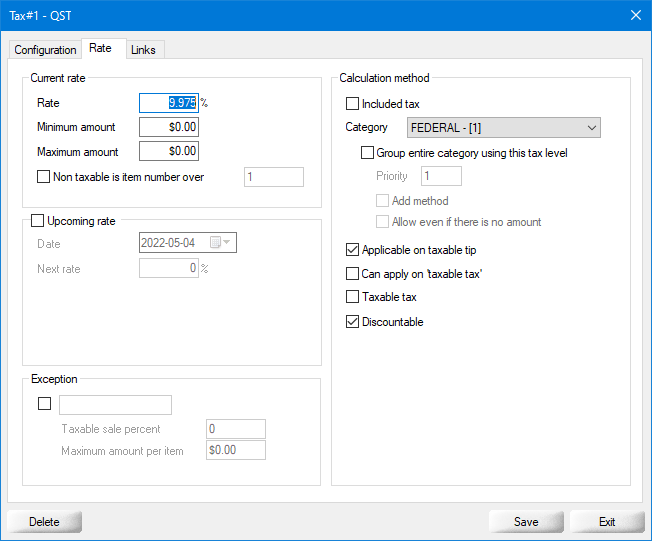

Current Rate

Rate

Minimum Amount

Maximum Amount

Non taxable if item number over

Upcoming Rate

Date

Next Rate

Exception

Taxable sale percent

Maximum amount per item

Button - Delete

Button - Save

Button - Exit

Last updated

Was this helpful?