Example #1: Simple item

Prerequisites:

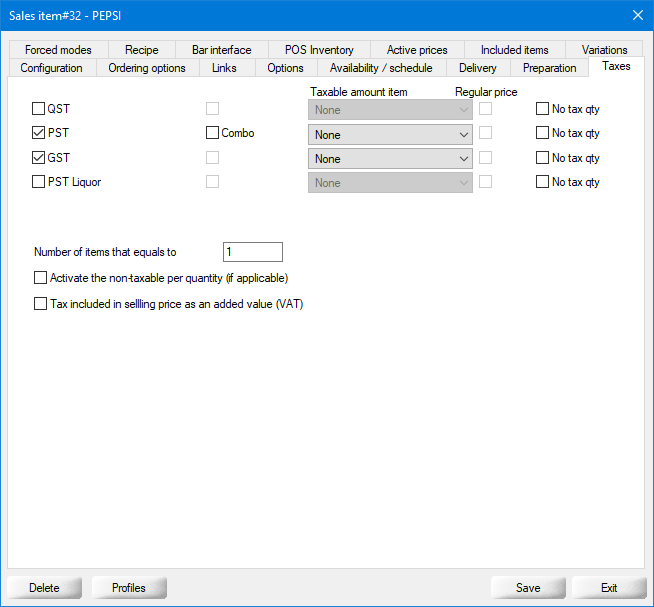

Configuration

Tax selection

Exception (Combo)

Taxable amount item

Regular price

No tax qty

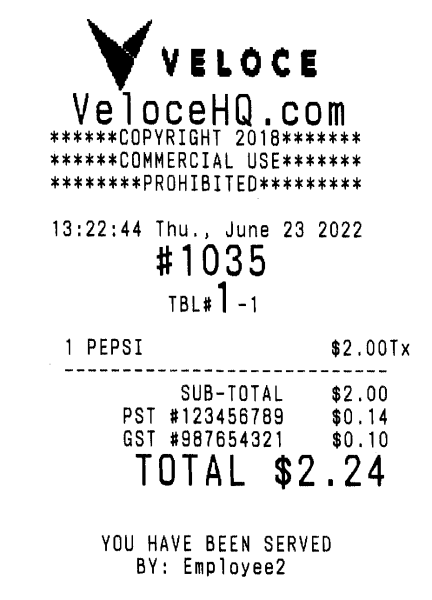

Result on the invoice

Last updated

Was this helpful?