Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

This document will cover the configuration required to operate SecurePay with integration to POS systems through the Retail Terminal Interface for Semi-Integrated Payment Applications (RTI-SIPA) plugin.

The SecurePay Android application is a bi-directional interface which links the PayFacto payment application to a POS system such as Maitre'D or Veloce. SecurePay automates some operations which previously had to be carried out by the clerk, such as the entry of the sales amount and card brand selection. SecurePay is especially well-suited to quick service environments and drive-through windows, with or without tip management.

The RTI-SIPA plugin is part of the STPISecure installer package and can be installed as a standalone component. RTI-SIPA's main purpose is to link the POS system and its POS workstations to the SecurePay application which resides on each payment terminal. This plugin will be installed on the POS system's main back-office PC as well as each POS workstation where a payment terminal will be used.

The integration of SecurePay with various POS systems allows the payment terminal to retrieve guest check data from the POS System. Once a payment has been processed by the payment terminal, SecurePay sends the payment data back to the POS System for reporting purposes. Payment amounts, tip amounts and card brand used are all automatically transmitted to the POS system to allow for accurate reporting.

SecureTable and SecurePay can both be used on the same POS system. This allows merchants to use any combination of stationary Pay-at-the-Counter terminals and wireless Pay-at-the-Table terminals. SecureTable and SecurePay share a similar user interface which provides a consistent user experience for customers and employees.

he STPISecure Installer, the STPISecure client software for SecureTable and the RTI-SIPA plugin for SecurePay requires the installation of Java for Windows software. This can be downloaded and installed for free from Oracle’s Java website, Here.

Please download and install the latest version of Java for Windows for your specific Windows edition (32-bit or 64-bit)

NOTE: Please consult Oracle's Java website for detailed licensing conditions and support.

Here is a quick overview of the entire installation and setup process:

Install/enable Microsoft .NET Framework 3.5 SP1.

Install the latest version of Oracle’s Java for Windows.

Use the STPISecure to installer to install the RTI-SIPA plugin.

Configure your POS System.

Connect, power up and configure payment terminals.

By default, the payment terminals using SecurePay will communicate with the POS system over TCP port 9999.

Open TCP port 9999 on the corporate firewall.

Open TCP port 9999 on the Windows Defender Firewall on the POS system's Back-Office as well as on all POS workstations.

The wireless network (for wireless payment terminals) needs to be able to communicate with the POS System.

Each payment terminal needs access to the Internet.

Maitre’D version 7.08.000.280 or later.

Any supported Windows operating system with all latest updates.

Java SE Runtime Environment.

Microsoft .NET Framework 3.5.

Retail Terminal Interface for Semi-Integrated Payment Applications (RTI-SIPA) plugin. (Included with the STPISecure Installer

SecurePay-Compatible Payment terminal(s)

1 Gbps (Gigabit) Ethernet (wired) network or better.

WiFi network (802.11 ac or better)

High-Speed Internet connection.

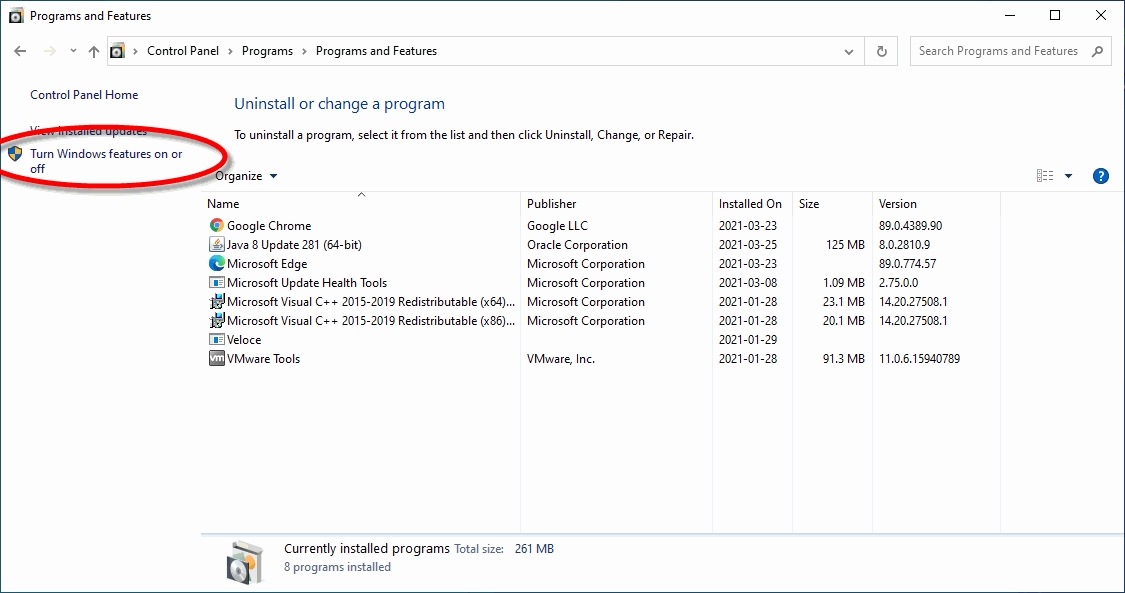

The .NET Framework (pronounced as "dot net") is a software framework developed by Microsoft that runs primarily on Microsoft Windows. Microsoft .NET Framework version 3.5 Service Pack 1 is required before the STPISecure installer can be used to install the STPISecure client or other components, such as the RTI-SIPA plugin.

On Windows 10, starting with version 1809, Microsoft .NET Framework 3.5 SP1 is included as a standard Windows feature and enabled by default. However, older versions of Windows 10, Enterprise or IoT editions, could be missing this essential component. Here is the procedure to check whether .NET Framework 3.5 SP1 is installed and how to enable it on Windows 10:

Click on the Windows 10 Start button and type Control Panel.

The Control Panel app should appear as a search result. Click on Open.

Within the Control Panel app, click on Programs.

Under Programs and Features, select Turn Windows features on or off.

The Windows Features list will appear.

Look for the feature called .NET Framework 3.5 (includes .NET 2.0 and 3.0).

a. If this feature is not listed, install .NET Framework manually. (See below)

b. If you see a black square in this checkbox, .NET Framework 3.5 is already enabled and no further action is required.

c. If the checkbox is blank, enable it.

NOTE: The black square in the check box means that the feature itself is enabled, but that some optional components are disabled. The optional components are not required for STPISecure or RTI-SIPA, so leave them disabled.

Click OK on the Windows Features list. This will close the list and apply any changes.

Files may be copied and you may be required to restart the PC.

or versions of Windows prior to Windows 10 1809, or for some older Enterprise or IoT editions, Microsoft .NET Framework 3.5 SP1 may need to be downloaded and installed manually.

The full installer can be obtained from the official Microsoft download site here:

Microsoft .NET Framework 3.5 SP1

Download the file and double-click it to start the installation process. Follow the on-screen instructions and restart your PC as required.

IMPORTANT! If the link provided here does not work, please use your preferred search engine and look for "Microsoft .NET Framework 3.5". Be sure to download the files from the official Microsoft download site. For security reasons, please avoid non-Microsoft sources.

The following instructions describes the installation and configuration process for the Maitre’D POS System.

On a Maitre'D POS system, the latest version of the STPISecure Installer is bundled with each service pack update. To obtain the latest compatible version of the STPI Secure Installer and ensure optimal compatibility, please install the latest service pack update for your Maitre'D POS system.

Once the Maitre'D service pack update is installed, the STPISecure installer will be located here:

C:\POSERA\MaitreD\PRG\Setup

Locate the STPISecureX.X.X.X.exe file, then right-click the file and select Run as administrator.

You may see a UAC prompt. Click Yes.

Please read the End-User Licence Agreement. If you agree with the terms, select I accept the agreement and click Next>.

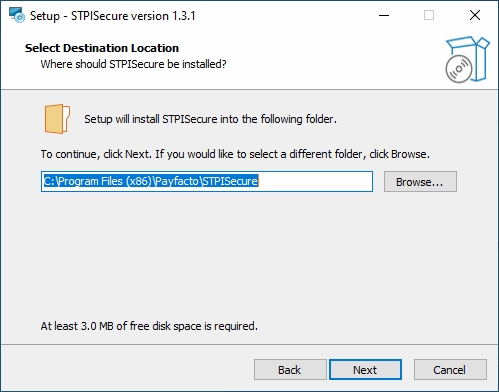

Select the installation destination for STPISecure files. Accept the default path by clicking Next>.

Select the components you wish to install and click Next>. A brief description of each available component is provided below. Install only what you need.

STPISecure Component selection

STPI Client v2.x.x.x

This component is required to use the SecureTable application with wireless payment terminals in a table service environment, with a POS system like Maitre'D, Veloce and others. It can be installed alone or alongside RTI-SIPA v1.xx.x.x if a combination of Wireless PATT terminals and fixed terminals are used.

NOTE: If you don't use wireless payments terminals with SecureTable, you don't need to install this component.

TPI Client v1.x.x

This component is only required with older versions of Maitre'D, such as 7.05.x.x. Do NOT install this component with newer versions of Maitre'D.

Client InstallAsService Guide

This component is optional and copies documents to the install folder with instructions on how to setup various clients as services.

MTI v2.30

This component is required for the Micros POS system only.

TPixel Client v1.0.12

This component is required for the Pixel Point POS system only.

TPosi Client v1.1.0

This component is required for the Positouch POS system only.

VirtualTerminal v1.0.1

This is an optional component that allows for the software to be tested and demonstrated.

RTI-SIPA v1.xx.x.x

This component installs the Retail Terminal Interface for Semi-Integrated Payment Application (RTI-SIPA) plugin files for use with the SecurePay application. This component needs to be installed on the POS system's main Back-Office PC as well as on all POS workstations that will manage a payment terminal. It can be installed alone or alongside STPI Client v2.x.x.x if a combination of Wireless PATT terminals and fixed terminals are used.

Select the All Others (POS 4) option and click Next>.

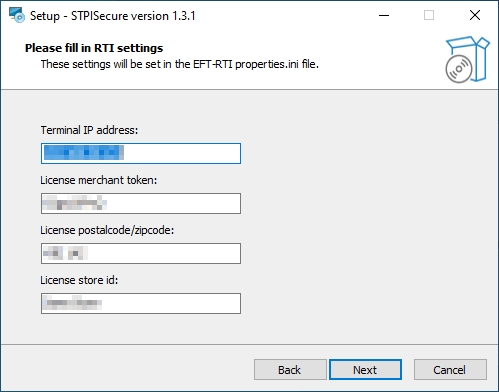

Fill in the settings for the RTI-SIPA plugin:

Terminal IP address

Type in the IP address of the payment terminal that will be managed by the POS Workstation where this instance of the RTI-SIPA plugin is being installed.

License merchant token

Type in the License Token that was supplied with the STPISecure license.

License postal code / zip code

Type the Canadian Postal Code or U.S. Zip Code of the merchant.

License store ID

Type the store ID or store name as it appears on the documentation that came with the STPI license.

The setup wizard is now ready to begin the automated installation process. Review your settings and click the Install button.

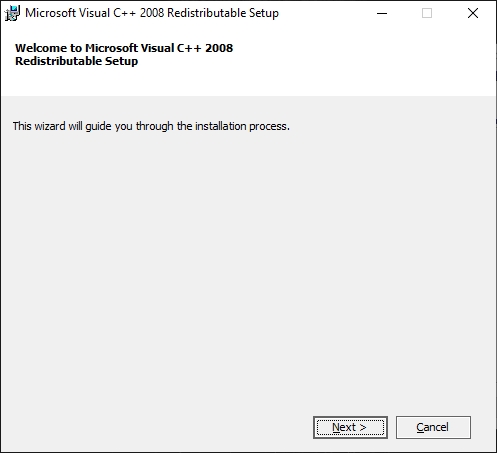

You will see various progress bars during the installation process. This could take a few minutes.

a. During the installation, you could see the installation of required components like Microsoft C++ 2008 Redistributables. This will only appear if the component is missing from your system. Otherwise, you will not see this.

b. Select I have read and accept the license terms and click Install.

c. A progress bar will be displayed during the installation process.

d. When the process completes, a confirmation will appear. Click Finish.

Once the installation completes, you will see the screen pictured below. Click the Finish button.

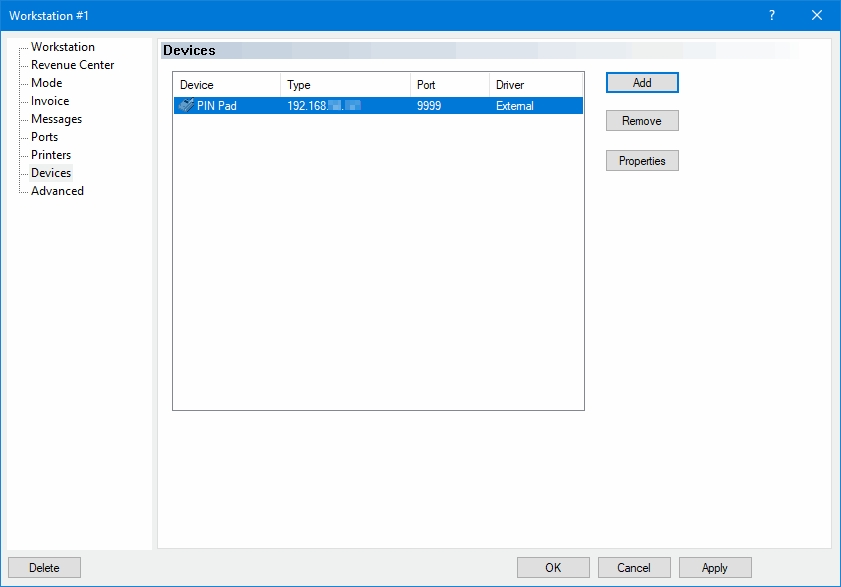

Each payment terminal using SecurePay needs to be assigned to a POS Workstation. Note that each POS workstation can only drive one payment terminal, therefore the number of payment terminals using SecurePay shouldn't exceed the number of POS workstations.

The following procedure is required to assign a specific payment terminal to a specific POS workstation in Maitre'D.

Logon to the Maitre’D Back-Office with appropriate credentials. (Distributor or System Owner)

Start the Point of Sale Control Module.

Click the Workstation menu, and select Options...

The list of available POS workstations will appear. Select the POS Workstation to which you want to assign a payment terminal and click Modify.

The POS workstation's options will appear. Click the Devices branch on the left of the window, then click the Add button to start adding a new device.

In the Add Device dialog, select PIN Pad and click the Setup button.

Setup the device as follows:

Select Network from the drop-down list.

This setting is disabled and cannot be configured. Ignore it.

Select External from the drop-down list.

Enter the IP address of the payment terminal.

Enter the TCP port number used by the payment terminal. The default value for SecurePay is 9999.

This setting is disabled and cannot be configured. Ignore it.

This setting is disabled and cannot be configured. Ignore it.

Enter the payment terminal's identity, which is supplied by the payment processor. This is also referred to as Terminal ID or TID.

This option has no effect with SecurePay payment termimals, as it will be overridden by the configuration of the SecurePay application installed on the payment terminal.

This setting is disabled and cannot be configured. Ignore it.

Click OK on the Device Setup dialog to save your changes. The new device will appear in the list:

Click OK to save changes to the workstation setup and close this window.

Close the POS workstation list, or select another POS workstation and repeat steps 4 to 9 to configure more payment terminals.

Make sure that each payment terminal using SecurePay is assigned to a POS workstation.

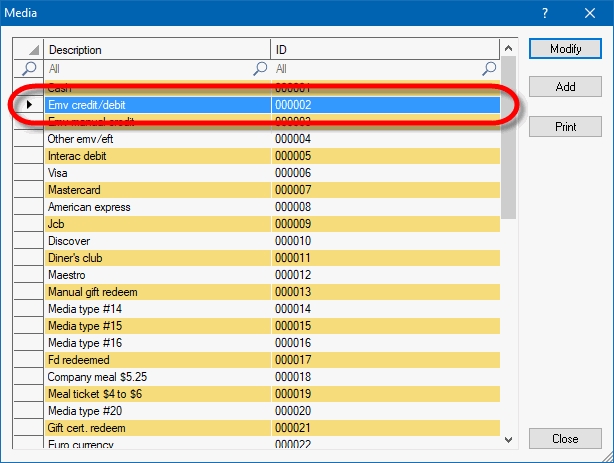

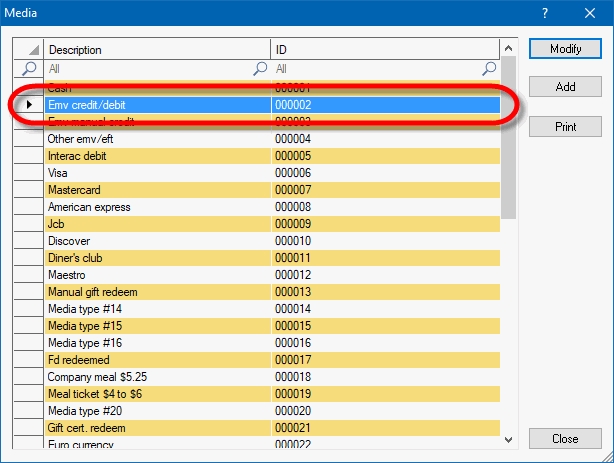

Main Media Type for SecurePay

With semi-integrated protocols such as SecurePay, a main media type is required to start processing any card payment. The purpose of this media type is to activate the payment terminal and initiate the transaction process.

IMPORTANT! The media type described here is essential to process card payments. While it is technically possible to process card payments without any additional media types configured, media types known as "mappings" are required to generate accurate reporting data for each card brand accepted by the merchant. See for more details.

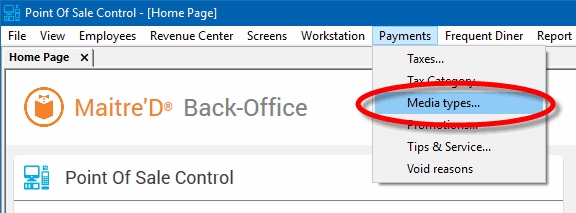

Logon to the Maitre’D Back-Office with appropriate credentials. (Distributor or System Owner)

Start the Point of Sale Control Module.

Click the Payments menu, and select the Media Types… option.

The list of all current media types will be displayed. Click the Add button.

A blank Media Type window will open directly on the Media Type branch. Configure according to the information below:

Media Type ID #

The Media Type ID number is automatically determined by Maitre’D when the Media Type is created. Maitre’D will always use the lowest available number between #2 and #23 inclusively.

Description

Enter a meaningful description for this media type. This should be as generic as possible, as the sole purpose of this media type is to initiate a card payment with any card brand. A common name used for this media type is simply CREDIT/DEBIT.

Payment Type

Select the External Pinpad option from the drop-down list.

Payment Surplus

Select Tip Entry if the merchant accepts tips for servers.

Select NULL if the merchant does not accept tips.

Configure remaining options per the customer’s needs and preferences.

Click on the Option branch

Print Receipt (Optional)

Enable this option to allow for a receipt to be printed after the transaction has been processed.

Check on Receipt (Optional)

Enable this option to have the detailed check print on the receipt.

Folio

Disabled. This option needs to be disabled for cards to be read properly.

Keyboard Input

Disabled. This option cannot be used since the Folio option above also needs to be disabled.

Included in Report

Enable this option so that this media type is shown in Back-Office reports (Recommended). Disabling this option will cause this media type to be hidden in the reports (NOT recommended).

Open Drawer (Optional)

Enable this option to make the cash drawer open when this media type is used.

Configure remaining options per the customer’s needs and preferences.

Click on the Card Property branch.

EFT Category

Set this drop-down list to Others.

Type

Set this drop-down list to Other.

Discount Rate

This option is not supported with EMV protocols and semi-integrated protocols like SecureTable or SecurePay. Leave this value at 0.00.

Tips Credit Fees

Enter the percentage of tips paid to the waiters that will be withheld to cover for fees charged by payment processors. If you do not wish to use this feature, leave it at 0.00.

NOTE: Some jurisdictions don't allow transaction or credit card processing fees to be passed down to employees. Please verify your local regulations before using this feature.

Electronic Funds Transfer

Disable this option. This option needs to be disabled on the main EMV Credit media type. Leaving it enabled will cause unwanted effects.

Hide Card Number

Disable this option. This option needs to be disabled on the main EMV Credit media type. Leaving it enabled will cause unwanted effects.

Show on Merchant Copy

Disable this option. It should be grayed-out anyways.

Credit Only

This option is not usable (grayed-out) with most EFT protocols. It is only used with the Datacap - DSIEMVUS semi-integrated protocols to allow Pre-Authorization and PreAuth Capture with select processors that support this feature.

Validation

Disable this option. Validation is only used with fully integrated EFT protocols and has no effect with semi-integrated protocols such as SecureTable or SecurePay.

Expiration

Disable this option. This option automatically becomes enabled when Electronic Funds Transfer is enabled. Make sure to DISABLE it. Otherwise, the POS will request the credit card’s expiration date, which will slow down your operations. This information is already checked by the payment terminal and does not need to be re-validated by the POS.

Debit Card

Disable this option. This option needs to be disabled on the main EMV Credit media type. Leaving it enabled will cause unwanted effects.

Card Validation

All the options in this section must be cleared. Make sure to clear the Custom Card checkbox as well as all the fields in the Card Validation section.

Click OK to save changes. The new media type will appear in the list.

Click the Close button to close this list and return to the POS Control module.

This completes the configuration of the main media type used to activate the payment terminal and initiate the transaction process.

While it is technically possible to start processing card payments right away without creating additional media types, doing so is not recommended. Without additional mappings, all card payments will report under the generic media type. This means that data and statistics for each card brand will not be available, therefore you will not be able to differentiate Visa, Mastercard, Amex, Debit or any other type of card payment.

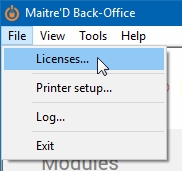

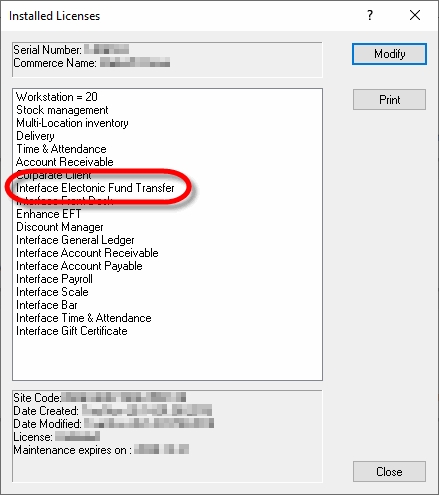

Make sure that the Maitre’D Electronic Funds Transfer Interface option is included on the Maitre’D license. To confirm this, simply logon to the Maitre’D Back-Office using appropriate credentials, click on the File menu and select the Licenses option.

This will bring up the license’s properties. Only one option is required for SecurePay to operate properly:

Interface Electronic Fund Transfer.

If this option is missing, it will need to be purchased before you can use SecurePay. Please contact your local sales representative.

Logon to the Maitre’D Back-Office with appropriate credentials. (Distributor or System Owner)

Start the Electronic Funds Transfer Module.

Click the View menu, and select Options…

The Configuration screen opens on the Interface branch.

Interface

Select EFT-RTI v1.0 from the drop-down list.

Ignore the remainder of the settings on this page.

Click on the Identification branch.

Store Number

Leave this field blank.

Merchant Name

Leave this field blank.

Merchant Number

Leave this field blank.

Generate Access Token

Ignore this option.

EMV

Enable this option.

Use Pre-Authorization

Enable this option to enable pre-authorization options for bar tabs. This feature only works with select payment processors in the United States.

Error Message Language

This field is grayed out and cannot be used with SecurePay.

Pre-Authorization %

This field is grayed out and cannot be used with SecurePay.

Maximum Overflow

This field is grayed out and cannot be used with SecurePay.

Automatic EFT Pre-Autho.

This option will become available once the Use Pre-Authorization option is enabled. Enable this option to use bar tabs. This feature only works with select payment processors in the United States.

Default Automatic EFT

Enter the default amount to be used for authorization when opening a bar tab with a credit card. This amount is also used as an increment value if the total of items already ordered is higher than the default amount. For example, if the default value is $25.00, Maitre'D will increment the suggested amount by $25.00 slices, going from $25.00 to $50.00 and then to $75.00 and so on, as needed to cover the current amount of the running tab.

Single Auto EFT Pre-Autho.

Enable this option to modify and re-use the existing pre-athorization when the authorized amount is exceeded. Disabling this option will cause a new pre-authorization to be processed every time the authorized amount is exceeded, which requires the card to be re-swiped. Some payment processors don't allow existing pre-authorizations to be modified while others may explicitly require it, so please check with your processor whether you should enable or disable this option.

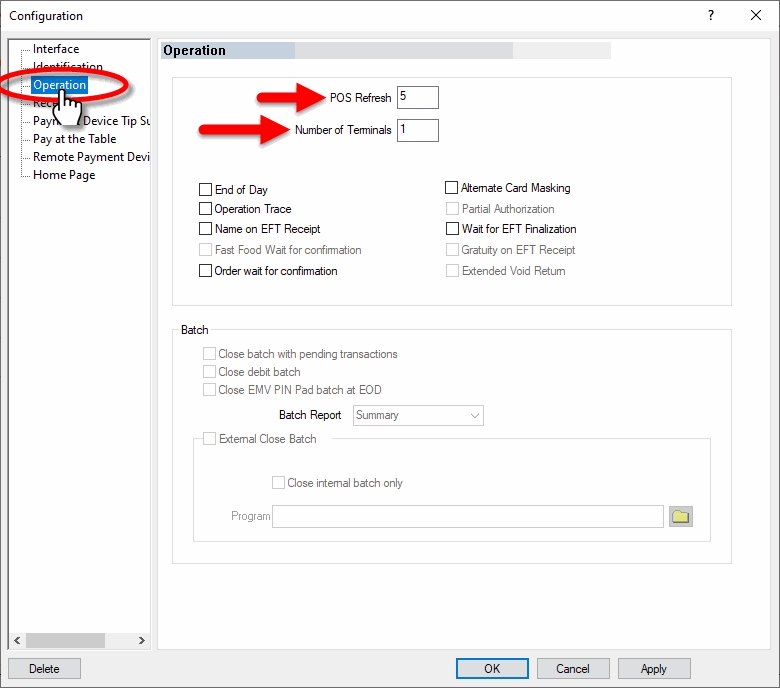

Click on the Operation branch.

POS Refresh

Set this value to 5.

Number of terminals

Set this value to the number of SecurePay terminals that will be in use.

End of Day

Disable this option.

Operation Trace

Disable this option.

Name on EFT Receipt

Disable this option.

Order Wait for Confirmation

Disable this option.

Alternate Card Masking

Disable this option.

Wait for EFT Finalization

Disable this option.

Other options

All the remaining options are grayed-out and cannot be changed. Ignore them.

The settings from the Receipt, Payment Device Tip Suggestion, Pay at the Table, Remote Payment Device and Home Page branches don't have any effect on the operation of SecurePay. Please make sure not to change or remove any settings found in these pages, as these could affect the operation of other payment terminals operating with SecureTable.

Click OK to save changes and close the options window.

See

Installation Process Overview

Install Microsoft .NET Framework 3.5 SP1

Install Java for Windows

Install the RTI-SIPA Plugin

This section will cover the general workflow that users and customers will see when using SecurePay. The workflow will vary slightly based on the SecurePay application's configuration.

With SecurePay, the payment process is always initiated by the POS system. SecurePay cannot be used to initiate a payment directly at the payment terminal.

If you need assistance with the functions of your POS system, please consult the documentation specific to the POS system you are using. Generally speaking, the following operations need to be carried out at the POS before a payment can be applied:

Ring / order sales items.

Print a check.

Select a payment type.

In most POS systems, selecting the payment type that is assigned to card payments will initiate the transaction process on the payment terminal.

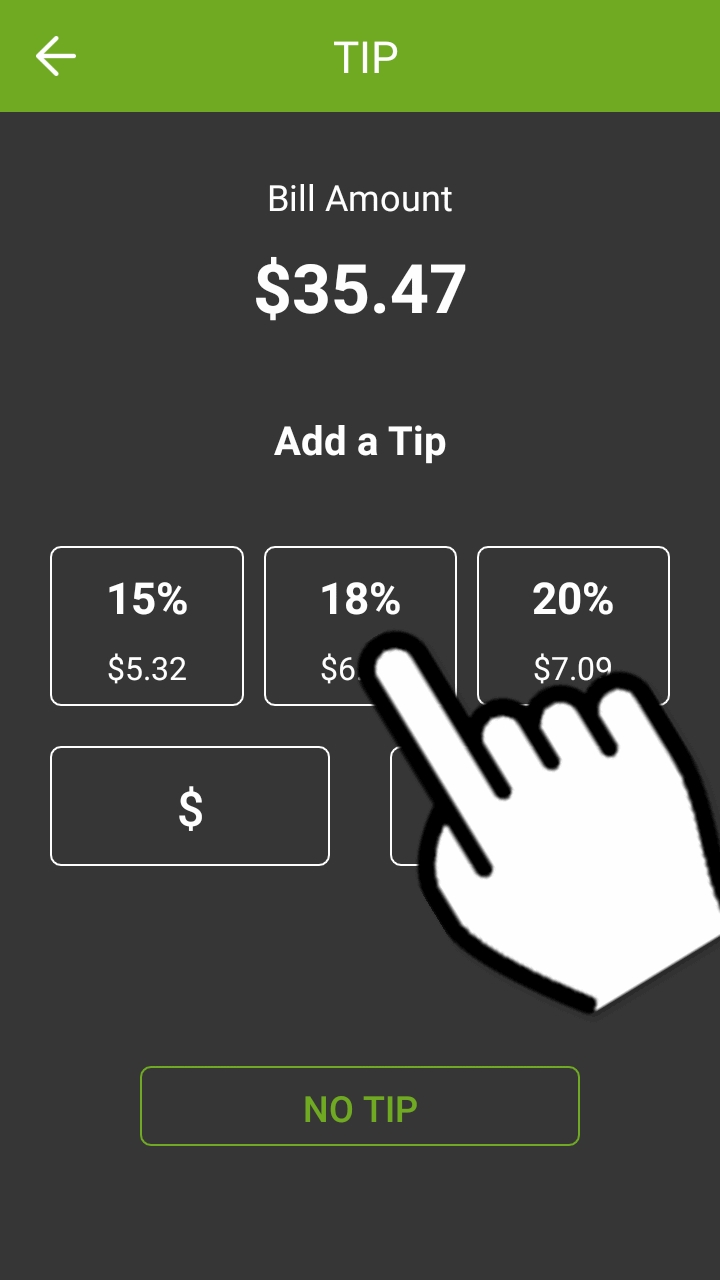

f the Tip option is enabled in the SecurePay application settings, the tip calculation screen will be displayed.

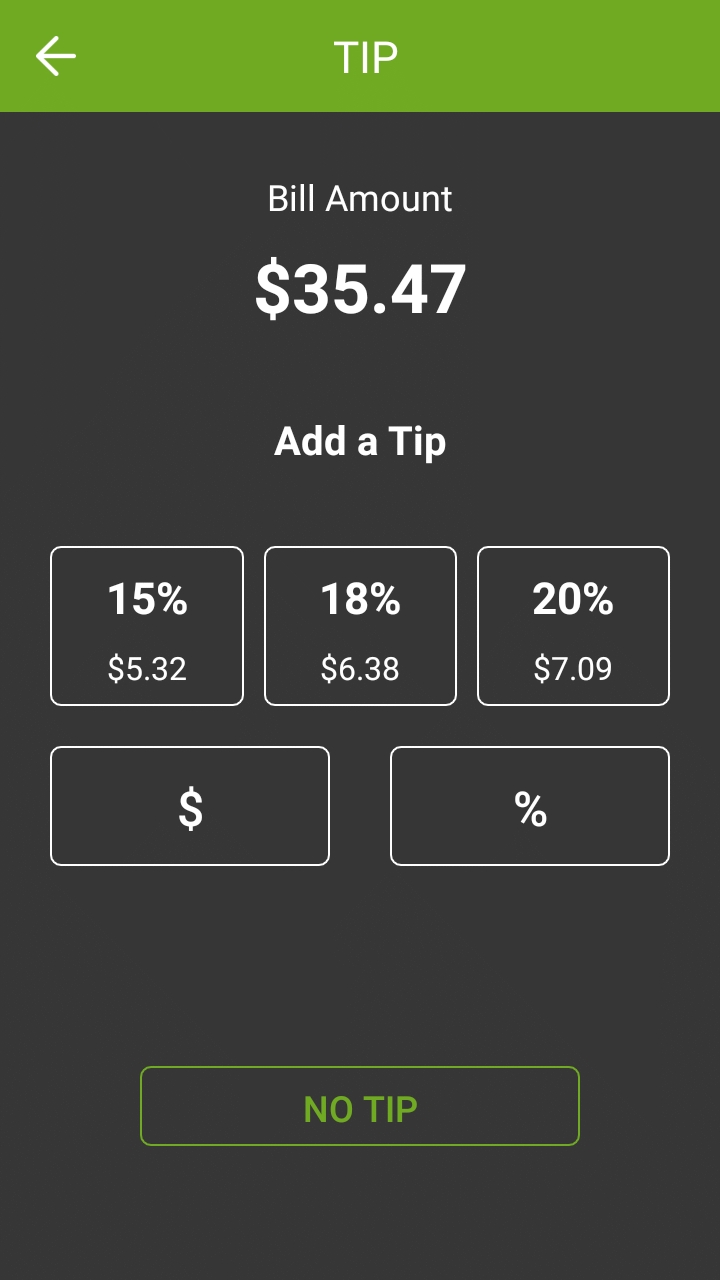

When the Tip calculation screen appears, the payment terminal needs to be turned towards the customer. The customer has the following options:

Select one of the pre-set percentages;

Enter a custom dollar amount;

Enter a custom percentage;

Leave no tip at all.

Bill Amount

This section shows the total amount to be paid.

Add a Tip

Touching a preset automatically adds the stated tip amount to the transaction.

$

Touch the $ button to enter a custom dollar amount as tip instead of using a preset.

%

Touch the % button to enter a custom percentage of tip instead of using a preset.

NO TIP

Touch this button to skip the tip entry process altogether and leave no tip.

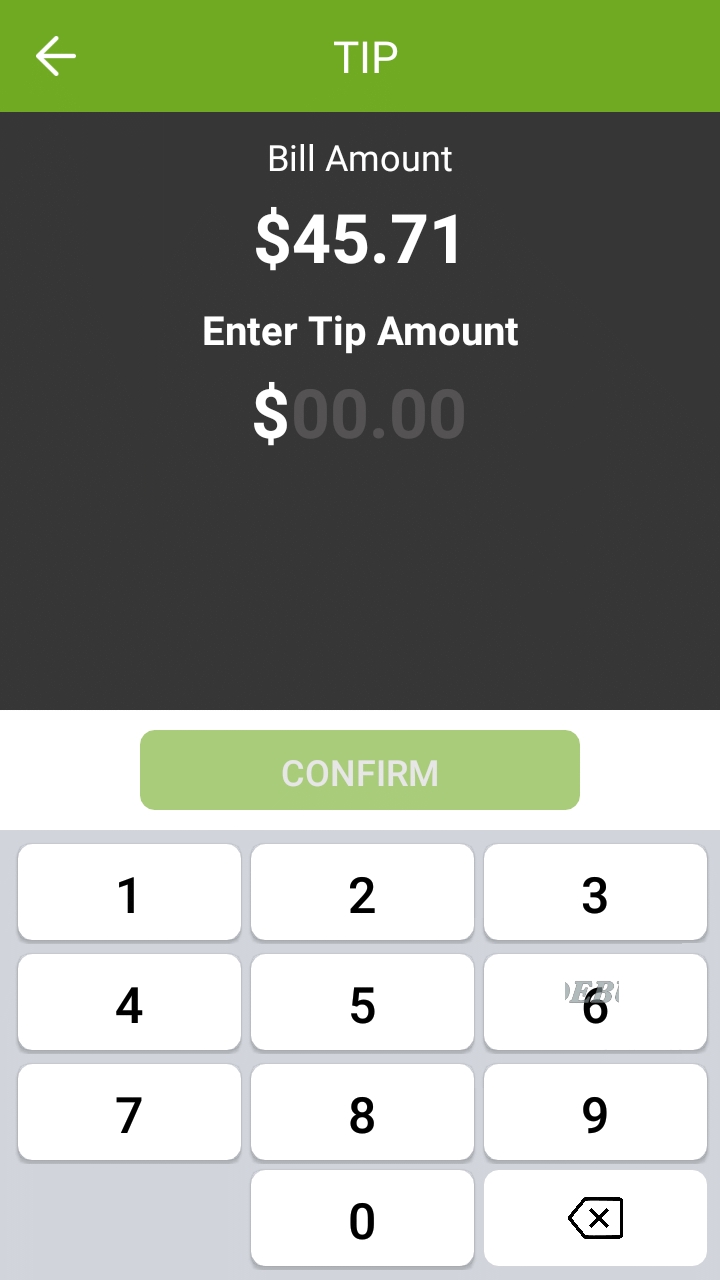

The screen below only appears if the customer touches the $ button to enter a custom tip amount.

The customer uses the provided keypad to enter a tip amount, which will make the green CONFIRM button available.

The customer can use the backspace key to correct typing mistakes.

When ready, the customer presses the green CONFIRM button.

NOTE: On devices equipped with a physical keypad, the on-screen keypad will not be displayed. The physical keypad buttons will be used instead.

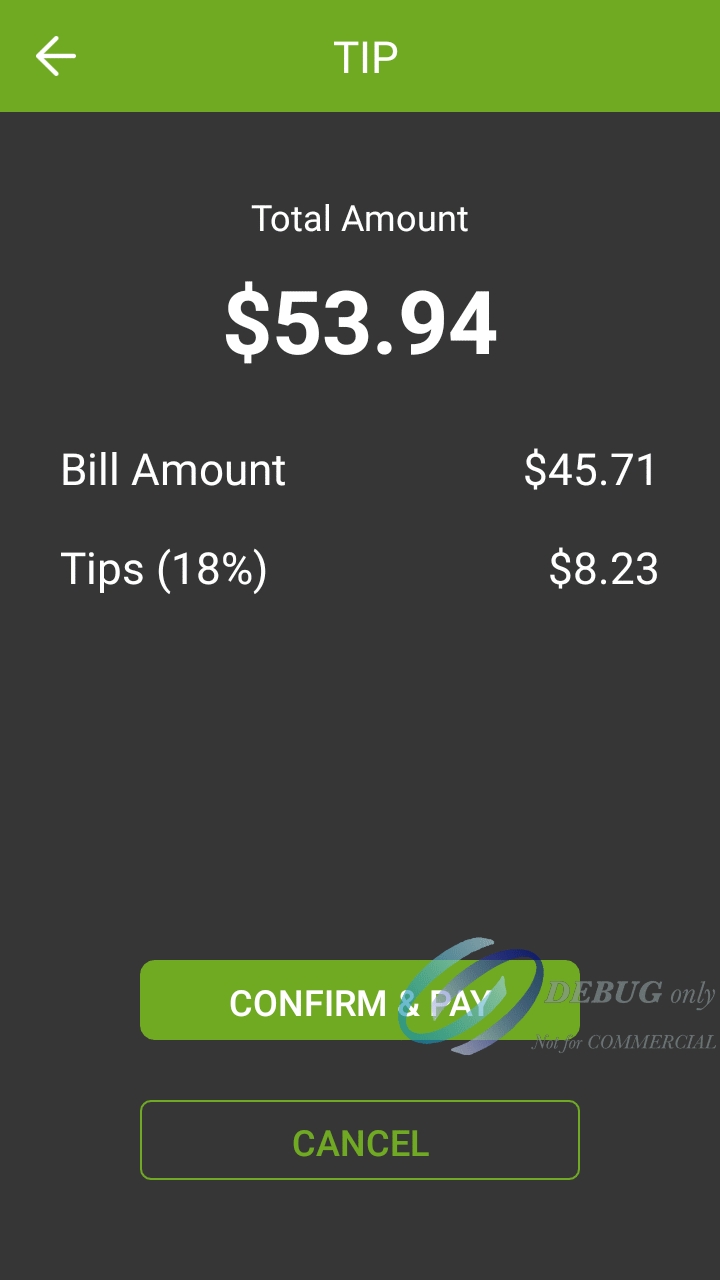

If the Enable Confirmation option is enabled in the SecurePay application settings, the tip confirmation screen will appear. This is the last confirmation before the actual payment.

Total amount

This is the total amount to be paid, which is calculated from the check amount plus tip amount.

Bill Amount

This is the amount that was passed from the POS system. It is also known as the Check amount or Invoice amount, depending on the terminology used by the POS system.

Tips (__%)

This field displays the tip amount added. The percentage between parenthesis is calculated from the Bill amount vs. tip amount, and is always rounded to the nearest percentage point.

CONFIRM & PAY

Touch this button to proceed with the actual payment.

CANCEL

Touch this button to cancel the transaction and return to the home screen to start over. A confirmation screen will be displayed before actually cancelling the operation.

At this point, SecurePay will call the payment application installed on the payment terminal. The prompts that the customer will see will depend on the payment application used and the card type used. For more information on this specific part of the workflow, please consult your payment application's documentation.

After the payment has been authorized by the payment application, the payment data will be sent to the POS system. Note that only non-sensitive data is exchanged between SecurePay and the POS system.

Once this is done, the application will return to its home screen.

The payment workflow with SecurePay is now complete, and the application is ready to process the next payment.

From the SecurePay home screen, touch the cog wheel icon ( ) at the top-right of the screen.

The FUNCTIONS menu will be displayed. Touch the CONFIGURATION button.

You will be prompted to enter a password before you can access settings. Enter the password and press the OK key.

The SETTINGS screen will be displayed.

NOTE: The default password after a new installation is 1234.

IP Address

This is the IP address currently assigned to the payment terminal.

Advanced Settings

Touch this link to access the Advanced Settings screen.

Functions Menu

Touch this link to access the Functions Menu screen.

OK

Touch this button to return to the home screen.

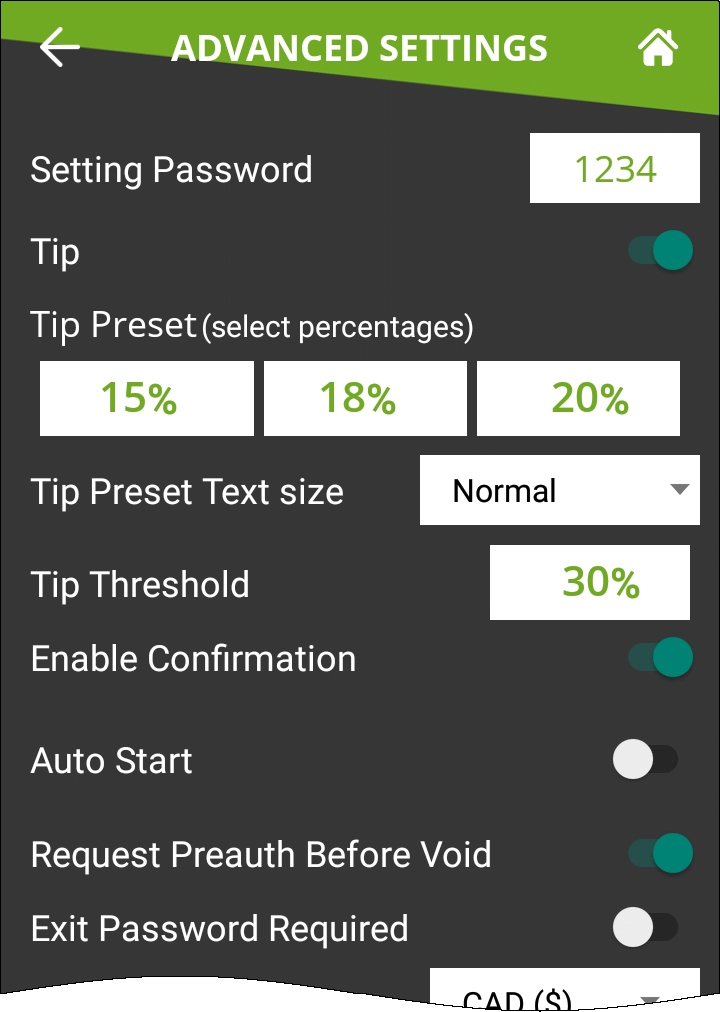

Setting Password

Configure the password used to access settings. This is also the password that will be requested if the customer enters a tip amount that exceeds the Tip Threshold.

Tip

Enable this option to have the SecurePay application prompt for tip entry. Disable this option to prevent tip entry. Disabling this option will also hide all the tip-related options below.

Configure preset tip percentages that the customer will see when prompted for tip. Up to 3 presets can be configured. If you do not wish to use all of them, presets that are set to 0% will not be displayed to the customer.

Tip Preset Text Size

Select the text size used to display preset tip percentages. Available choices are Normal, Medium and Large.

Tip Threshold

Enter the maximum allowed tip percentage. Any tip amount that exceeds this percentage will require the settings password to be entered. Setting the percentage to 0% disables the tip threshold validation.

Enable Confirmation

Enable this option to present a dedicated tip confirmation screen for the customer. If this option is disabled, the tip confirmation screen will be skipped when selecting a tip preset or the NO TIP option. If using custom $ or custom % with this option disabled, the tip amount, percentages and resulting totals will be updated in real-time as the customer types the numbers in, but no additional confirmation screen will be presented before the actual payment.

Auto Start

Enable this option to have the SecurePay application start automatically when powering on the payment terminal.

Request Preauth Before Void

This option is used to determine the behaviour of incremental preauthorizations for bar tabs, when the sale amount exceeds the original preauth amount.

When this option is enabled, a new preauth request will be processed before voiding the old one. The advantage is that the merchant will know for sure that the new preauth is approved before voiding the old one. However, there is a risk that the new preauth could be declined, due to the card's credit limit being exceeded, as both preauths will coexist until the original preauth is voided.

When this option is disabled, the original preauth will be voided before the request for the new preauth is made. With this method, the risk of getting a decline is somewhat lower, but still exists nonetheless. As the new preauth amount is generally higher than the original preauth amount, it could potentially exceed the card's credit limit.

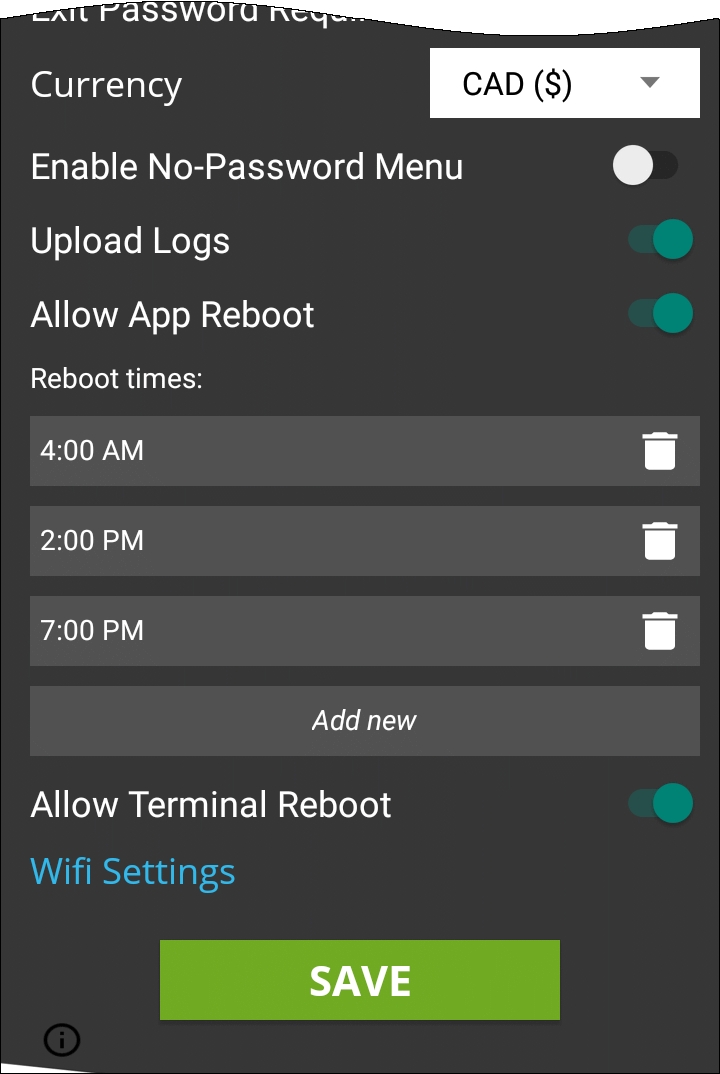

Exit Password Required

With this option enabled, the SecurePay application will request the settings password before closing.

Currency

Select the default currency for your region. Supported currencies are:

Canadian Dollar (CAD ($))

United States Dollar (USD ($))

United Kingdom Pound (GBP (£))

European Union Euro (EUR (€))

Australian Dollar (AUD ($))

Enable this option to allow users to access and print the Detailed Report and Summary Report from the No-password menu. If this option is disabled, the reports can still be printed from the FUNCTIONS menu, which requires the settings password.

Enable this option to activate the Reprint Receipt option in the No-password menu. If this option is disabled, the receipts can still be reprinted from the FUNCTIONS menu, which requires the settings password.

Upload Logs

Enable this option to upload the SecureTable application logs to the PayFacto Cloud services. It is recommended to leave this option enabled.

Allow App Reboot

Enable this option to allow the SecurePay application to restart itself. Note that this only re-initializes the application, and does not involve a full terminal reboot.

Reboot times

This is only visible if Allow App Reboot is enabled. By default, SecurePay is preconfigured with 3 reboot time entries.

You can edit existing entries by touching the time. A clock will appear which allows you to change the reboot time.

You can delete existing entries by touching the trash can icon to the right of each entry.

You can add more entries by touching the Add new button at the bottom of the list.

Allow Terminal Reboot

Enable this option to allow the terminal to reboot after an automatic batch settlement. It is recommended to leave this option enabled.

WiFi Settings

Use this shortcut to configure the payment terminal's WiFi settings.

SAVE

Touch this button to save your changes and return to the home screen.

NOTE: The payment terminal MUST be connected to your WiFi or Ethernet network and have internet access. Otherwise, payments cannot be processed and payment information cannot be transmitted to the POS system.

IMPORTANT! Be sure to touch the SAVE button to save your changes. Using any other button to exit from the settings screen will discard all changes.

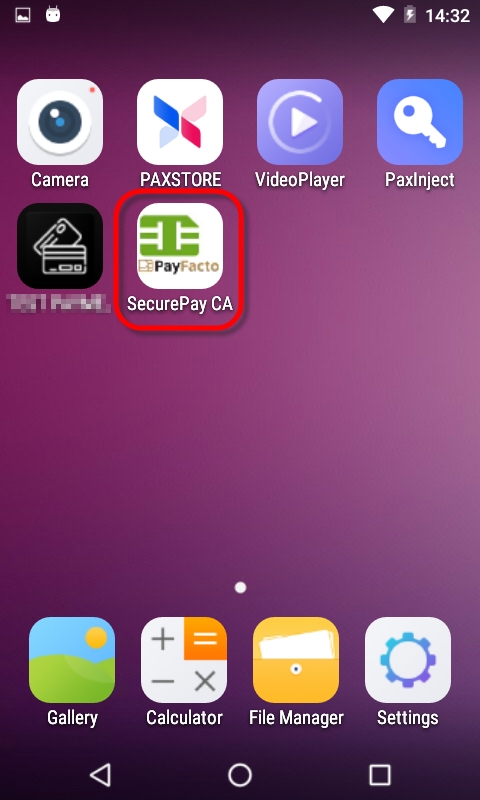

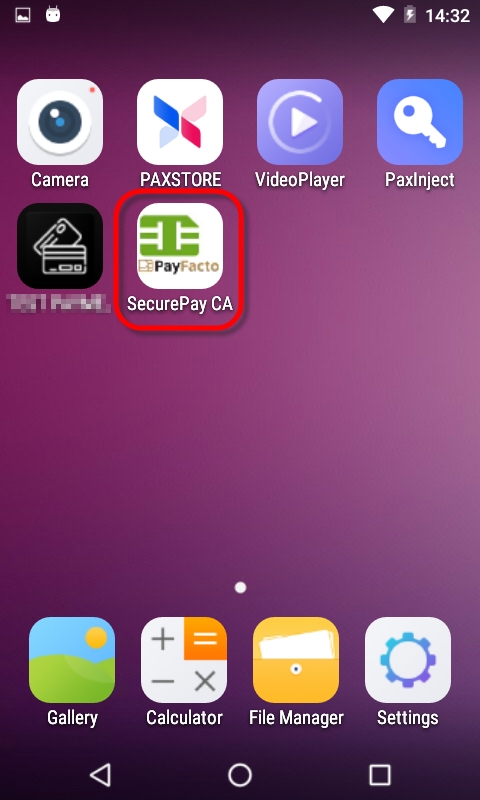

If the SecurePay application does not start automatically, simply touch the appropriate icon on the Android home screen. A splash screen will briefly be displayed, followed by the SecurePay home screen.

The Settings button is used to access SecurePay's configuration options. This icon appears in the top-right corner of the SecurePay home screen.

When available, the Home button will appear in the top-right corner of the screen. Use it to jump directly to the SecurePay home screen without saving changes.

Back

When available, the Back button will appear in the top-left corner of the screen. Use it to go back to the previous screen without saving changes.

The SecurePay application settings are protected by a password. The default password on a new installation is 1234

NOTE: It is highly recommended to change the default password as soon as possible. See SecurePay Application Configuration for the detailed procedure.

To exit the SecurePay application, swipe the terminal's screen either from the top edge going down, or the bottom edge going up, then touch the Android Home (circle) button.

You will be prompted to enter a passcode to exit the application. Enter the passcode and touch the OK button.

NOTE: The default passcode after a new installation is 1234. It is the same as the settings password.

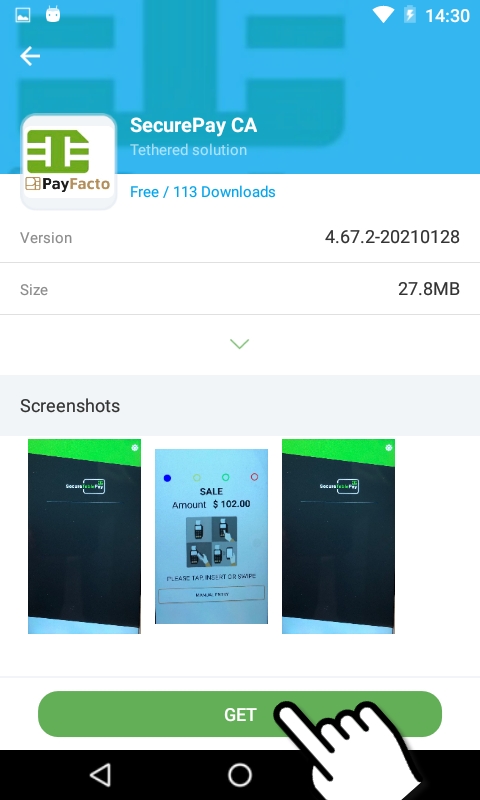

After the Retail Terminal Interface for Semi-Integrated Payment Application (RTI-SIPA) plugin has been installed, configured and running properly on the POS system's Back-Office and POS workstations, make sure that all payment terminals are properly configured so they can communicate with the POS system and the Internet. Android payment terminals are generally shipped with all the necessary applications pre-installed by PayFacto, including the latest version of SecurePay and the latest version of the Payment application. If the SecurePay application appears to be missing, install it using the instructions below.

The instructions below were created using the PAX A920 and PAX A80 Android-based Payment terminals and the PAX store. However, the instructions are the same for all Android-based payment terminals, such as other models offered by PAX, AMP terminals or Clover Flex. For brands other than PAX, the mechanism they use to install apps may look different, but the general principle should remain the same.

PAX A920 PAX A80

Before installing SecurePay on your payment terminal, please make sure that the appropriate payment application is installed and configured properly. You may also want to check out our documentation on the PAX A920, A920Pro or A80 terminals or any other Android-based terminal you may be using with SecurePay.

Android PayFacto Application - Manual setup of application

PayFacto Quick Reference Guide

Link

NOTE: The SecurePay application can be installed on certified payment terminals only. It cannot be used on regular phones or tablets.

Power-up your terminal, and make sure it is connected to the Internet.

If any application start automatically, shut them down to reach the Android home screen.

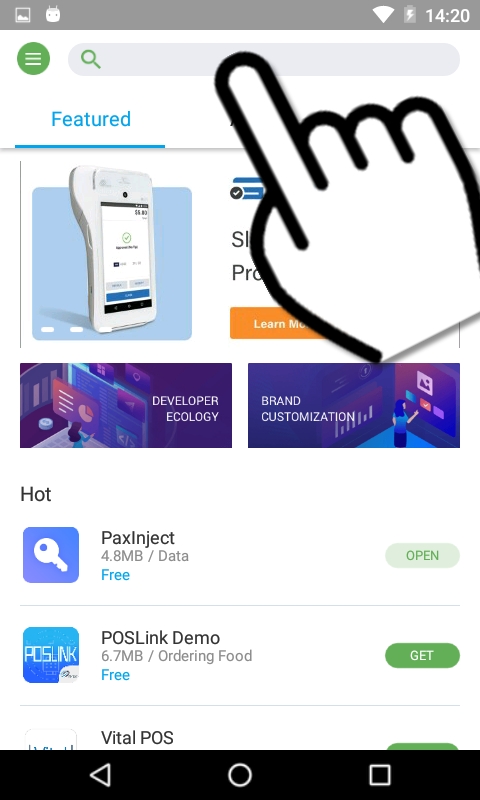

From the Android home screen, start the PAXSTORE by touching the appropriate icon.

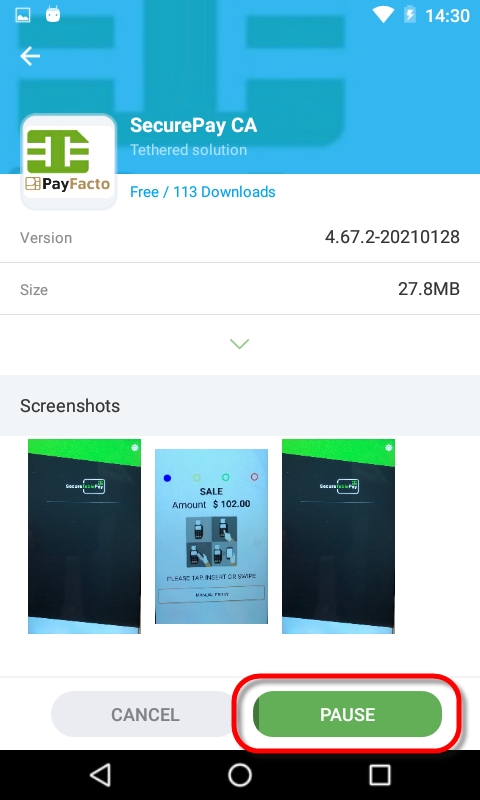

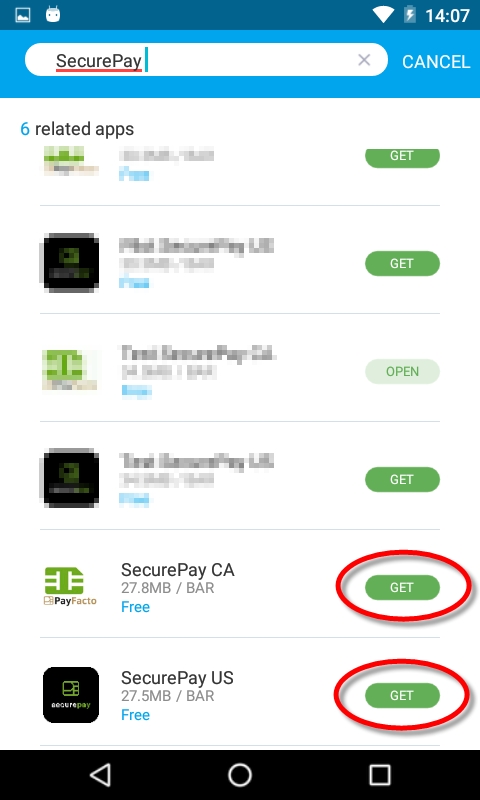

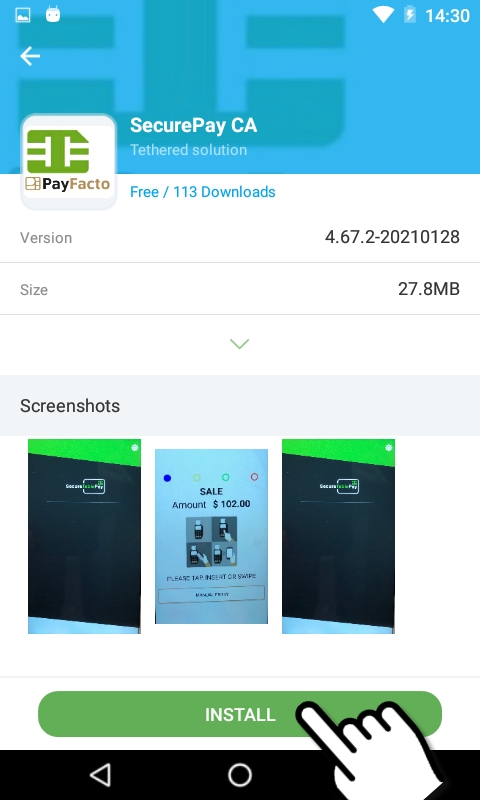

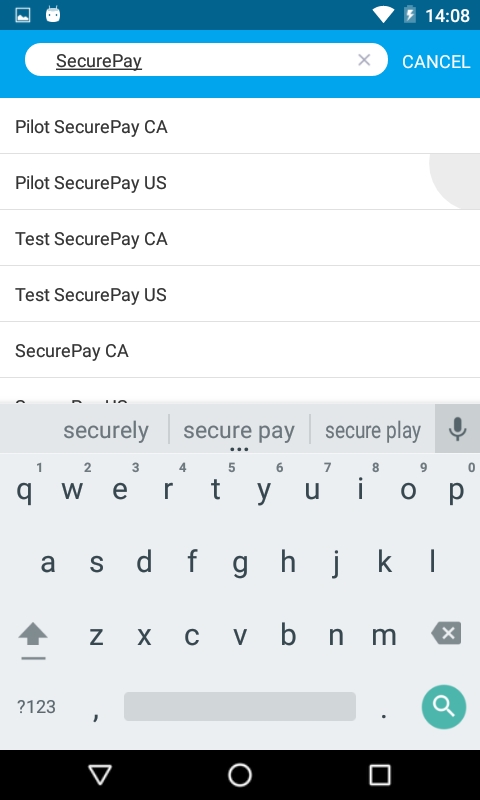

In the PAXSTORE (Application Marketplace), search for SecurePay.

Locate the version which is appropriate for your region, and touch the GET button to start thedownload and installation process

The details of the application will be displayed. Then, to install the application:

Touch GET

Download starts

Touch INSTALL

Installing

Touch OPEN

You can also use the Android Back button to return to the Android home screen and use the installed shortcut to start the application.

The installation of the SecurePay Android application is now complete.

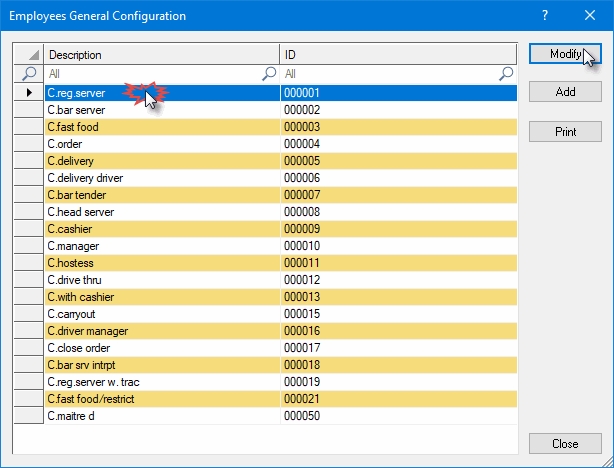

To process card payments, employees only need to have access to the Main Credit/Debit media type. This section explains how to achieve the correct configuration for the Maitre'D POS system.

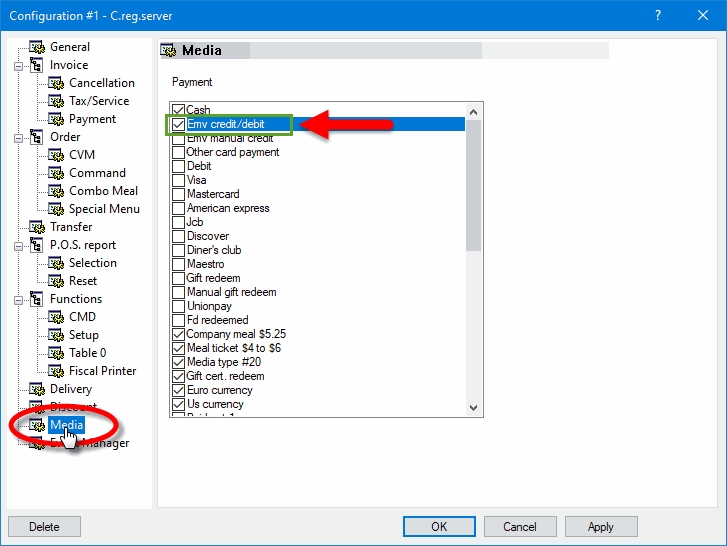

Logon to the Maitre’D Back-Office with appropriate credentials. (Distributor or System Owner)

Start the Point of Sale Control Module.

Click the Employees menu, and select Configuration...

The list of all current employee configurations will be displayed. Select the configuration that needs to be modified and click the Modify button.

Click on the Media branch.

Enable the Credit / Debit media type, as well as any other media type required by this employee configuration, such as Cash, Gift Cards, foreign currencies, Room Charge, etc.

IMPORTANT! Be sure to DISABLE access to ALL media types that were created as mappings. These include card brands like Visa, Mastercard, American Express, etc. Also disable access to debit and generic card payment mappings.

Click OK to save changes and close this window.

Back to the list of employee configurations, select another employee configurations and repeat steps 4 through 6. Do this for all employee configurations.

Once all of your employee configurations are properly configured, you can close the list and close the Point of Sale Control module.

This configuration is optional for most merchants. Before proceeding, make sure that the main media type and individual media type mappings are created for each accepted card brand.

A generic media type mapping may be required to cover the rare cases where a customer may pay with a card that is accepted by the merchant, but not already configured as a mapping in Maitre'D media types. If a dedicated media type mapping does not already exist, the payment would be recorded against the main media type, generally called "CREDIT/DEBIT". The goal of the generic mapping is to have such payments recorded against a media type with a more meaningful name, something like "Other Card Payment" for instance.

NOTE: SecureTable and SecurePay can be used at the same time on the same POS system. Therefore, the merchant can have any combination of stationary terminals using SecurePay and mobile terminals using SecureTable. Both types of terminals will share the same generic media type mapping.

Logon to the Maitre’D Back-Office with appropriate credentials. (Distributor or System Owner)

Start the Point of Sale Control Module.

Click the Payments menu, and select the Media Types… option.

The list of all current media types will be displayed. Click the Add button.

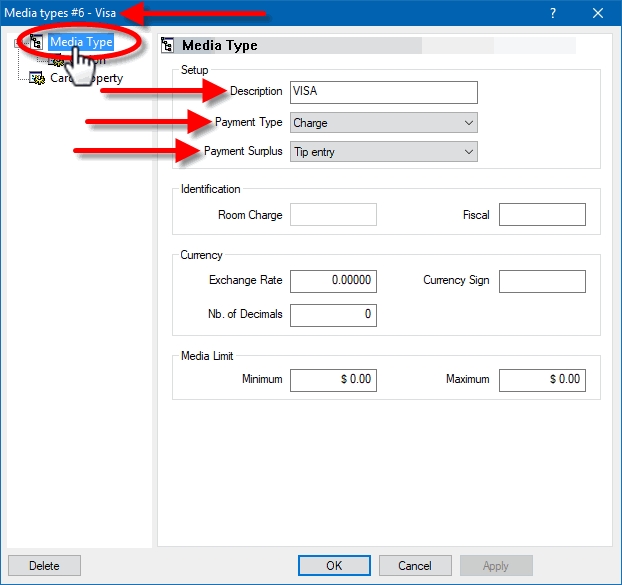

A blank Media Type window will open directly on the Media Type branch. Configure according to the information below:

Media Type ID #

The Media Type ID number is automatically determined by Maitre’D when the Media Type is created. Maitre’D will always use the lowest available number between #2 and #23 inclusively.

Description

Enter a meaningful description for this media type. For the Generic mapping, this could be Other Card Payments or something similar. This description will be shown on customer receipts and media reports.

Payment Type

Select the Charge option from the drop-down list.

Payment Surplus

Select Tip Entry if the merchant accepts tips for servers.

Select NULL if the merchant does not accept tips.

Configure remaining options per the merchant’s needs and preferences.

Click on the Option branch.

Print Receipt (Optional)

Enable this option to allow for a receipt to be printed after the transaction has been processed.

Check on Receipt (Optional)

Enable this option to have the detailed check print on the receipt.

Folio

Disabled. This option needs to be disabled.

Keyboard Input

Disabled. This option cannot be used since the Folio option above also needs to be disabled.

Included in Report

Enable this option so that this media type is shown in Back-Office reports (Recommended). Disabling this option will cause this media type to be hidden in the reports (NOT recommended).

Open Drawer (Optional)

Enable this option to make the cash drawer open when this media type is used.

NOTE: Print Receipt, Check on Receipt and Open Drawer options have no effect on wireless payment terminals using SecureTable. However, payment terminals with SecurePay will be affected.

Configure remaining options per the merchant's needs and preferences.

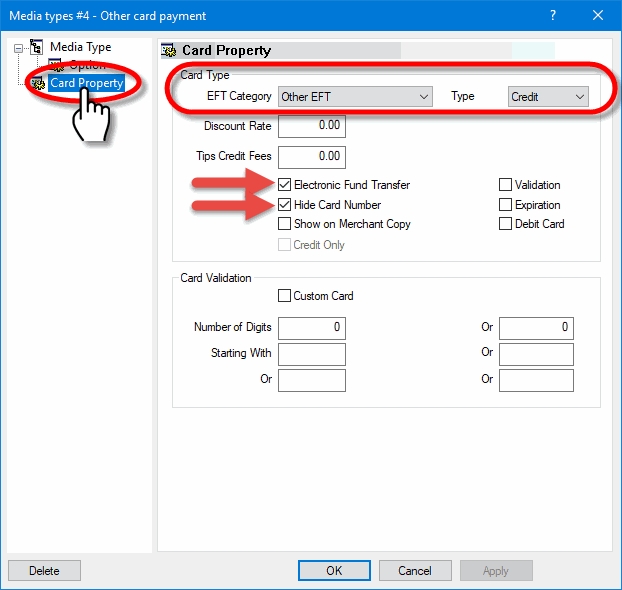

Click on the Card Property branch.

EFT Category

Set this drop-down list to Other EFT.

Type

Set this drop-down list to Credit.

Discount Rate

This option is not supported with EMV protocols and semi-integrated protocols like SecureTable or SecurePay. Leave this value at 0.00.

Tips Credit Fees

Enter the percentage of tips paid to the waiters that will be withheld to cover for fees charged by payment processors. If you do not wish to use this feature, leave it at 0.00.

NOTE: Some jurisdictions don't allow transaction or credit card processing fees to be passed down to employees. Please verify your local regulations before using this feature.

Electronic Funds Transfer

Enable this option. This option needs to be enabled to block operations that are not compatible with EMV payments, such as Cancel/Reopen Check.

Hide Card Number

Enable this option. It automatically becomes enabled when Electronic Funds Transfer is enabled, so leave it enabled.

Show on Merchant Copy

Disable this option. This option was used by older, non-integrated protocols and caused the credit card number to be printed on the merchant copy of EFT transaction records. This option has no effect with any Electronic Funds Transfer protocol, semi-integrated protocols, SecureTable or SecurePay.

Credit Only

This option is not usable (grayed-out) with most EFT protocols. It is only used with the Datacap - DSIEMVUS semi-integrated protocols to allow Pre-Authorization and PreAuth Capture with select processors that support this feature.

Validation

Disable this option. Validation is only used with fully integrated EFT protocols and has no effect with semi-integrated protocols such as SecureTable or SecurePay.

Expiration

Disable this option. This option automatically becomes enabled when Electronic Funds Transfer is enabled. Make sure to DISABLE it. Otherwise, the POS will request the credit card’s expiration date, which will slow down your operations. This information is already checked by the payment terminal and does not need to be re-validated by the POS.

Debit Card

Disable this option for the generic media type mapping.

Card Validation

All the options in this section must be cleared. Make sure to clear the Custom Card checkbox as well as all the fields in the Card Validation section.

Click OK to save changes. The new media type will appear in the list.

The configuration of the generic media type mapping is now completed.

While attempting to install STPISecure, an error message is displayed:

STPISecure requires Microsoft .NET Framework 3.5.

Please use Windows Update / Windows Features to install this version, and then re-run the installer.

Install Microsoft .NET Framework 3.5 through Windows Update or use the "Turn Windows features on or off" option from Add/Remove programs to enable .NET Framework 3.5.

Once Microsoft .NET Framework 3.5 is installed, retry installing STPISecure.

While attempting to install STPISecure, an error message is displayed:

STPISecure requires Java version 1.8 or newer.

Please install this separately and then re-run the installer.

Download and install Java from the Oracle website:

Once Java is installed on your system, retry installing STPISecure.

Being specifically designed with the Hospitality industry in mind, tip management is an integral part of SecurePay. This section focuses on the various options available in SecurePay to facilitate tip management.

Tip options are found in SecurePay's . Here is a summary of available tip options:

Tip

Enable this option to have the SecurePay application prompt for tip entry. Disable this option to prevent tip entry. Disabling this option will also hide all the tip-related options below.

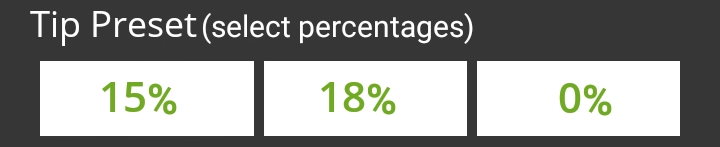

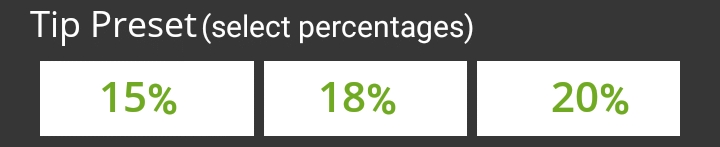

Tip Preset (Select percentages)

Configure preset tip percentages that the customer will see when prompted for tip. Up to 3 presets can be configured. If you do not wish to use all of them, presets that are set to 0% will not be displayed to the customer.

Tip Preset Text Size

Select the text size used to display preset tip percentages. Available choices are Normal, Medium and Large.

Tip Threshold

Enter the maximum allowed tip percentage. Any tip amount that exceeds this percentage will require the settings password to be entered. Setting the percentage to 0% disables the tip threshold validation.

Enable Confirmation

Enable this option to present a dedicated tip confirmation screen for the customer. If this option is disabled, the tip confirmation screen will be skipped when selecting a tip preset or the NO TIP option. If using custom $ or custom % with this option disabled, the tip amount, percentages and resulting totals will be updated in real-time as the customer types the numbers in, but no additional confirmation screen will be presented before the actual payment.

Tip presets are used to simplify and speed up the tipping process by allowing customers to select between pre-calculated tip percentages that are commonly used. Any percentage can be configured, but they need to be realistic for the market in which the terminal is used.

Up to 3 tip presets can be configured.

Presets configured at 0% are not displayed.

The space used by each preset button is automatically adjusted to fit the width of the screen, as demonstrated in screenshots below.

The Tip Preset Text Size drop-down allows you to change the font size used to display percentages and amounts in each tip preset. The screenshots below illustrate each available size.

Normal

Medium

Large

The Tip Threshold is a control measure to prevent accidental over-tipping. If the tip amount exceeds the set threshold, SecurePay will request the administrator password before applying the tip.

IMPORTANT! Be sure to carefully evaluate how tips work in the establishment before setting this value. With low value items, the threshold percentage can be exceeded very quickly. For example, buying a water bottle for $2.00 and leaving $1.00 as a tip is already 50% in tip value.

Tip amount is higher than 30% threshold

The tip confirmation screen is an extra step which allows the customer to review the details of the payment in a clear, minimalist display, without any other distractions on the terminal screen.

Add tip

Confirmation screen

Payment

If tip confirmation is disabled, the confirmation screen is skipped and the terminal proceeds directly to the payment. If the customer notices a mistake once the payment process is started, the transaction needs to be canceled at the payment application which will bring the customer back to the tip calculation screen.

Add tip

Payment

For more details and to quickly see the difference between various configurations, click the drop-downs below:

The No Password Menu is a simplified version of the Functions menu. It contains basic functions that are useful to employees, while manager functions remain hidden.

NOTE: Before the No Password menu can be used, the corresponding option needs to be enabled in the SecurePay application settings. Please consult the in the SecurePay application settings for more details.

From the SecurePay home screen, touch the cog wheel icon ( ) at the top-right of the screen.

The FUNCTIONS menu will be displayed. The options available from this menu will vary based on your SecurePay application settings.

The Print Reports section will be displayed if the option is enabled in the SecurePay Application Settings.

PRINT DETAILED REPORT

This option prints a report with the details of every card payment processed at the terminal since the last batch closing.

PRINT SUMMARY REPORT

This option prints a report that shows a summary of sales, refunds, tips and grand total for each card brand.

The Receipt section will be displayed if the option is enabled in the SecurePay Application Settings.

REPRINT RECEIPT

This option allows receipts to to be reprinted based on invoice number, sequence number or the last transaction processed at the terminal.

CONFIGURATION

This option brings up the SecurePay application settings.

The full functions menu contains all the options from the No Password Menu, plus a few more administrative options. To access the full functions menu:

The FUNCTIONS menu (no password menu) will be displayed. Touch the CONFIGURATION option.

You will be prompted to enter a password before you can access settings. Enter the password and press the OK key.

The SETTINGS screen will be displayed. Touch the blue Functions Menu link.

NOTE: The default password after a new installation is 1234.

The Functions menu will be displayed. Contrary to the No Password Menu discussed above, all the options shown below are always available, regardless of the status of the advanced settings.

SETTLE BATCH

This option will manually close the current batch.

IMPORTANT! Transactions that are part of a batch that is closed can no longer be voided, reprinted or otherwise modified.

This option prints a report with the details of every card payment processed at the terminal since the last batch closing.

PRINT SUMMARY REPORT

This option prints a report that shows a summary of sales, refunds, tips and grand total for each card brand.

BACKUP SETTINGS

This option will save all of the current settings to an S3 Bucket cloud location. Backing up the settings allows for quick recovery of the configuration in case the settings get reset to default after a major application update or Android update.

RESTORE SETTINGS

Use this option to restore saved settings. Using this option will override all settings with the ones found in the backup, except for the terminal ID.

This option allows receipts to to be reprinted based on invoice number, sequence number or the last transaction processed at the terminal.

In order to get accurate reporting data with SecureTable or SecurePay, media types known as mappings need to be created for each card brand that will be accepted by the merchant. Before beginning, gather information on all the card brands and payment types that are accepted at the restaurant. Obtain this information from the restaurant owner and managers, and from the restaurant’s credit card processor.

NOTE: SecureTable and SecurePay can be used at the same time on the same POS system. Therefore, the merchant can have any combination of stationary terminals using SecurePay and mobile terminals using SecureTable. Both types of terminals will share the same media type mappings.

Logon to the Maitre’D Back-Office with appropriate credentials. (Distributor or System Owner)

Start the Point of Sale Control Module.

Click the Payments menu, and select the Media Types… option.

The list of all current media types will be displayed. Click the Add button.

A blank Media Type window will open directly on the Media Type branch. Configure according to the information below:

Media Type ID #

The Media Type ID number is automatically determined by Maitre’D when the Media Type is created. Maitre’D will always use the lowest available number between #2 and #23 inclusively.

Description

Enter a meaningful description for this media type. This should generally be a card brand name such as Visa, MasterCard, AMEX, etc. This description will be shown on customer receipts and media reports.

Payment Type

Select the Charge option from the drop-down list.

Payment Surplus

Select Tip Entry if the merchant accepts tips for servers.

Select NULL if the merchant does not accept tips.

Configure remaining options per the merchant’s needs and preferences.

Click on the Option branch.

Print Receipt (Optional)

Enable this option to allow for a receipt to be printed after the transaction has been processed.

Check on Receipt (Optional)

Enable this option to have the detailed check print on the receipt.

Folio

Disabled. This option needs to be disabled for cards to be read properly.

Keyboard Input

Disabled. This option cannot be used since the Folio option above also needs to be disabled.

Included in Report

Enable this option so that this media type is shown in Back-Office reports (Recommended). Disabling this option will cause this media type to be hidden in the reports (NOT recommended).

Open Drawer (Optional)

Enable this option to make the cash drawer open when this media type is used.

NOTE: Print Receipt, Check on Receipt and Open Drawer options have no effect on wireless payment terminals using SecureTable. However, payment terminals with SecurePay will be affected.

Configure remaining options per the merchant’s needs and preferences.

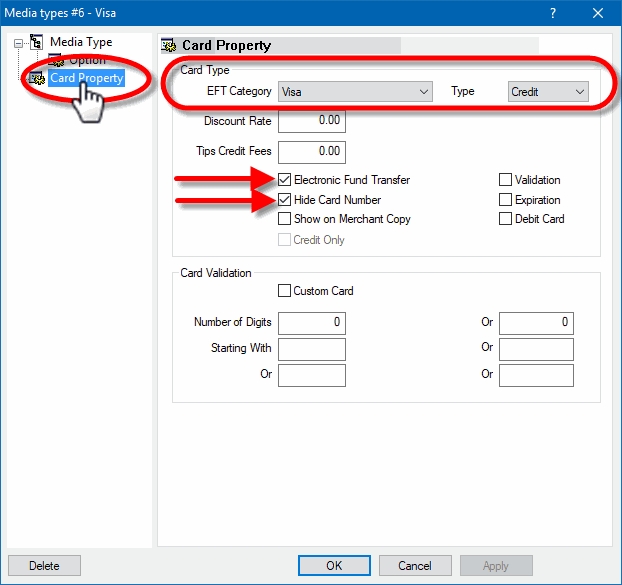

Click on the Card Property branch.

EFT Category

Set this drop-down list to whichever card brand that needs to be mapped to this media type.

Type

This drop-down list is used to determine the type of payment for the purpose of Sales Recording Modules and fiscal printers. The available settings are described below.

Cash

Select the Cash option for the default cash payment and any other payment involving cash, such as foreign currencies.

Credit

Select this option for all credit card payments.

Debit

Select this option for U.S. Debit and Canadian debit (Interac) payments.

Other

Select this option for all payments which do not fall in any of the above categories. Gift card purchases and Gift Card redeem are common examples of media types where Other needs to be selected.

Discount Rate

This option is not supported with EMV protocols and semi-integrated protocols like SecureTable or SecurePay. Leave this value at 0.00.

Tips Credit Fees

Enter the percentage of tips paid to the waiters that will be withheld to cover for fees charged by payment processors. If you do not wish to use this feature, leave it at 0.00.

NOTE: Some jurisdictions don't allow transaction or credit card processing fees to be passed down to employees. Please verify your local regulations before using this feature.

Electronic Funds Transfer

Enable this option. This option needs to be enabled to block operations that are not compatible with EMV payments, such as Cancel/Reopen Check.

Hide Card Number

This option automatically becomes enabled when Electronic Funds Transfer is enabled. Leave it enabled.

Show on Merchant Copy

Disable this option. This option was used by older, non-integrated protocols and caused the credit card number to be printed on the merchant copy of EFT transaction records. This option has no effect with any Electronic Funds Transfer protocol, semi-integrated protocols, SecureTable or SecurePay.

Credit Only

This option is not usable (grayed-out) with most EFT protocols. It is only used with the Datacap - DSIEMVUS semi-integrated protocols to allow Pre-Authorization and PreAuth Capture with select processors that support this feature.

Validation

Disable this option. Validation is only used with fully integrated EFT protocols and has no effect with semi-integrated protocols such as SecureTable or SecurePay.

Expiration

Disable this option. This option automatically becomes enabled when Electronic Funds Transfer is enabled. Make sure to DISABLE it. Otherwise, the POS will request the credit card’s expiration date, which will slow down your operations. This information is already checked by the payment terminal and does not need to be re-validated by the POS.

Debit Card

Enable this option if you are creating a mapping for U.S. Debit or Canadian Debit (Interac).

Disable this option for credit card brand mappings (Visa, Mastercard, American Express, Discover, etc.).

Card Validation

All the options in this section must be cleared. Make sure to clear the Custom Card checkbox as well as all the fields in the Card Validation section.

Click OK to save changes. The new media type will appear in the list.

Repeat the previous steps until all required mappings are created. At the end of the process, you should have one mapping for each card brand that is accepted by the merchant.

In this section, the tip presets configured in the in SecurePay's advanced settings are displayed. Each percentage box also indicates the corresponding dollar amount.

Enable this option to allow users to access a simplified version of the Functions menu without entering a password. This menu is accessed by touching the cog wheel icon ( ) at the top-right of the home screen. Enabling this option will also unlock access to the Allow Reports Printing and Allow Receipt Reprinting options below.

.

One tip preset Two tip presets

Three tip presets No tip presets

Manager code is requested after touching the CONFIRM button

With the tip confirmation option enabled, the customer is presented with the detailed calculation of the tip. This screen also allows the customer to quickly back track and make corrections using the Back ( ) button.

From the SecurePay home screen, touch the cog wheel icon ( ) at the top-right of the screen.

SecurePay Installation on Android Payment Terminals

SecurePay Application - Basic Navigation

SecurePay Application Configuration

SecurePay Functions