Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

This document will introduce you to your payment terminal as well as guide you through the process of preparing and configuring your it in order to quickly begin processing payments.

Your PAX A920 payment processing terminal comes with the following:

Payment terminal

AC power outlet

Roll of printer paper

You may also have an optional charger and external printer included, but this document addresses the most basic delivery configuration.

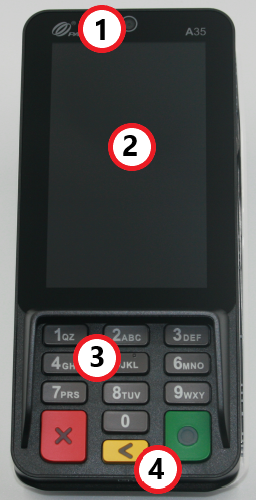

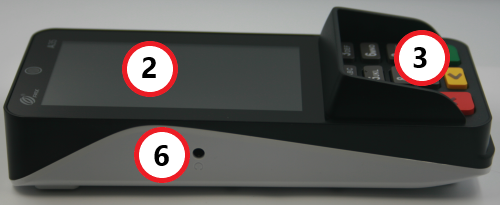

The following illustrations show the location of the main terminal features and hardware:

Mobile

Countertop

Unattended

PAX A920

PAX A920 Pro

A920 / A920 Pro Accessories

Magnetic stripe reader

Front-facing camera (not used)

Color touchscreen

Chip card reader

Volume up button

Power button

Volume down button

Micro USB charging port

Contactless payment reader

Printer

Printer latch

Rear camera/scanner

Battery cover

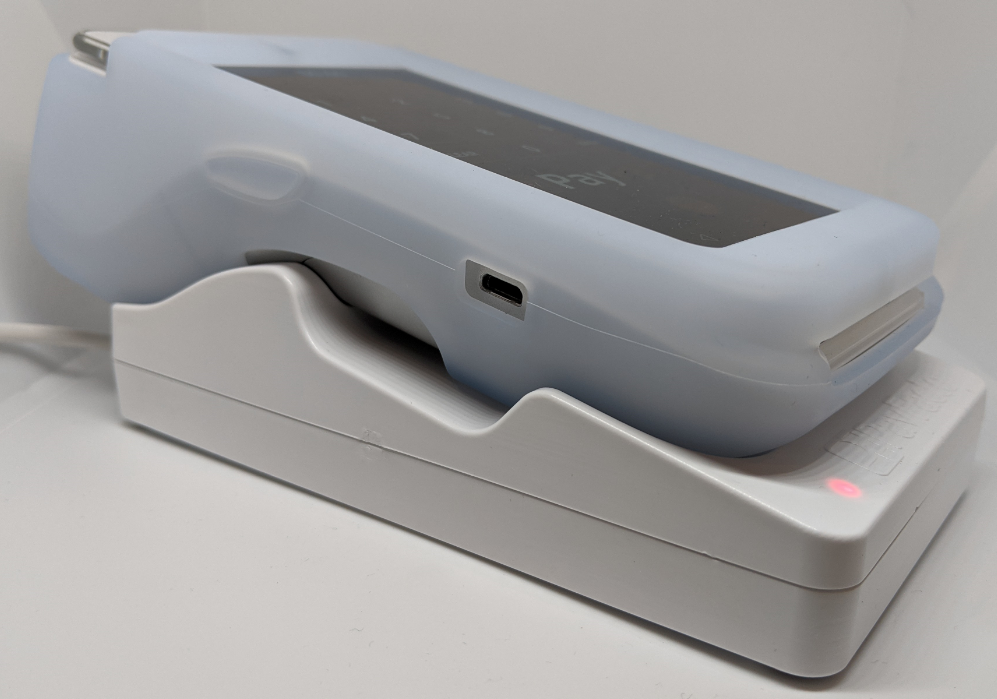

This document explains how to install the charging base for the PAX A920 or A920 Pro terminal and included silicone sleeve. The charging base makes it easy to recharge the terminal without having to remove the silicone sleeve to ensure that the USB power connector is properly seated in the terminal’s charging port.

NOTE: The terminal must be fitted with the PayFacto-branded silicone sleeve for the best results. The PayFacto silicone sleeve displays the PayFacto logo on the back. You should not use the charging base for any terminal not protected by the silicone sleeve.

The terminal requires a network connection to communicate with the payment processor server to process transactions.

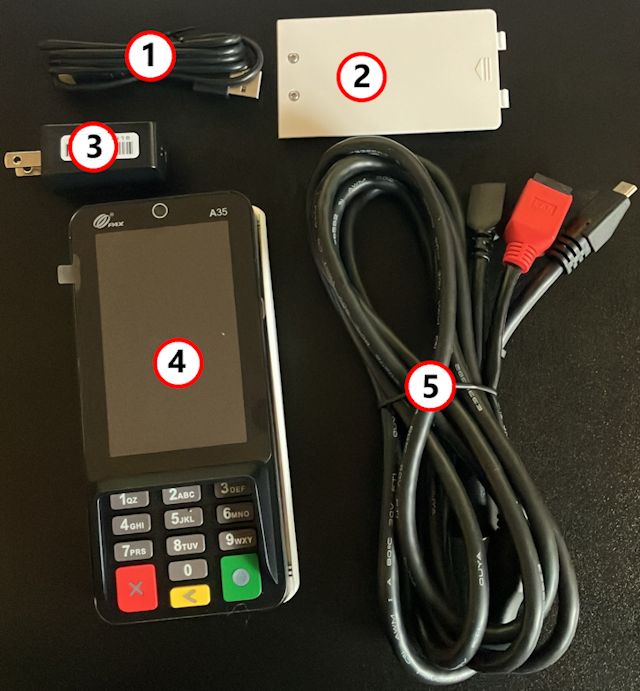

The PAX A35 is a countertop payment terminal that can connect to wired (Ethernet) and wireless (Wi-Fi) networks.

Configuring the Terminal Ethernet Connection

Configuring the Terminal Wi-Fi Connection

The terminal powers on automatically when you connect it to an AC power supply. To power off the terminal, disconnect the AC power supply.

IMPORTANT! Disconnecting the AC power immediately powers off the terminal and any transaction that was in progress is cancelled.

PayFacto uses a self-service terminal activation procedure designed to save time while also providing better security. The new activation procedure applies only to countertop and mobile PAX payment terminals using the Android operating system. The new procedure applies to:

All new merchants activating their terminals for the first time

Any existing merchants adding new payment terminals

Any existing merchants receiving replacement terminals

After you configure the terminal's network connection(s) and power on the terminal, the procedure comprises of 2 parts:

NOTE: If you have multiple new payment terminals, you need to perform the activation procedure on each terminal individually.

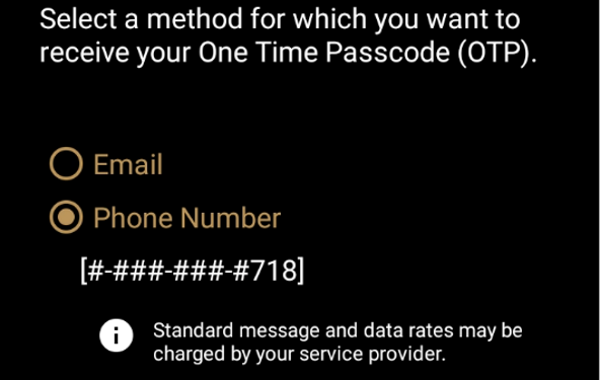

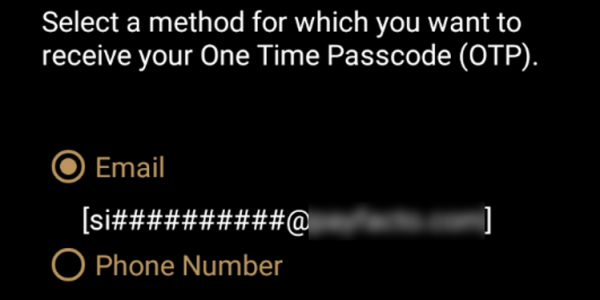

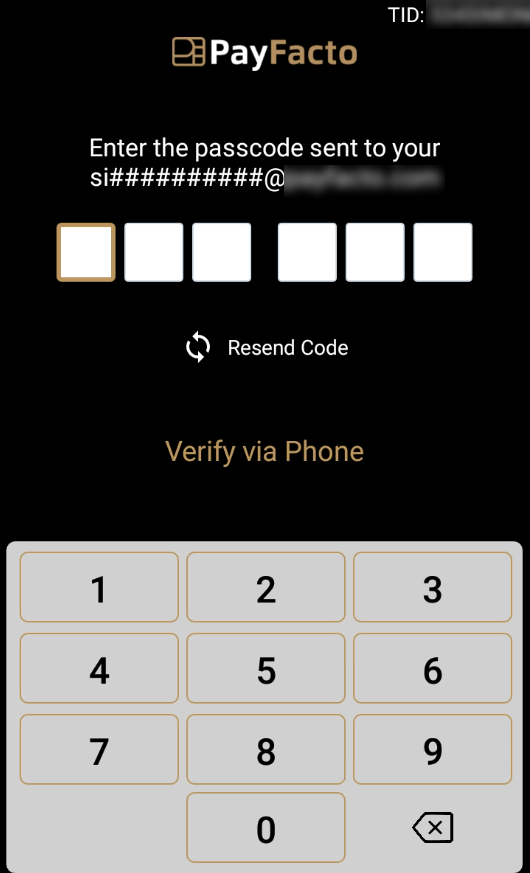

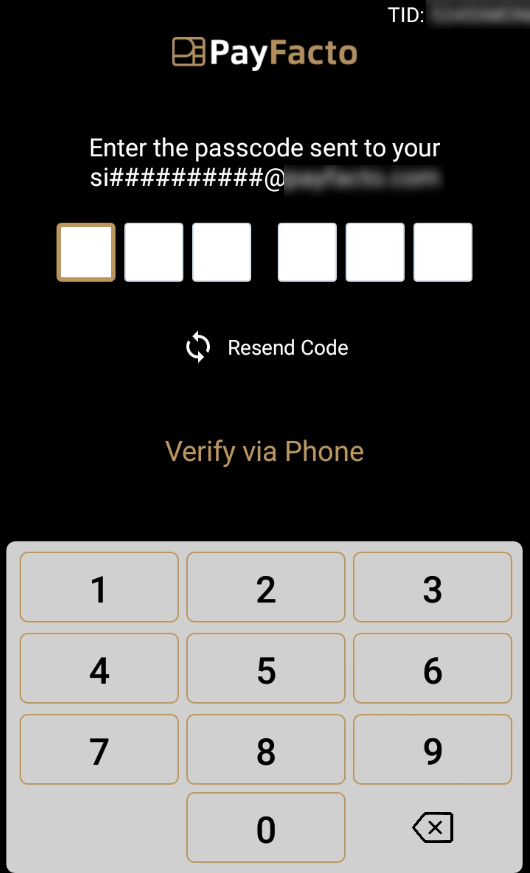

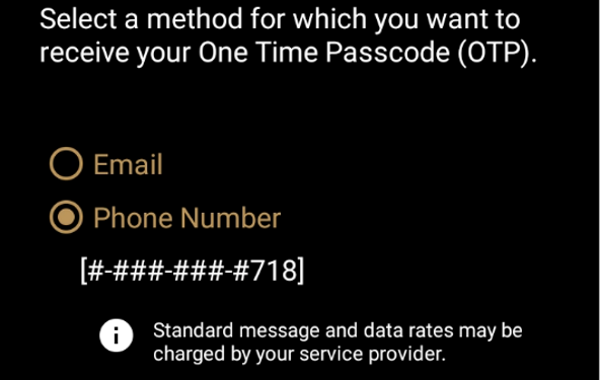

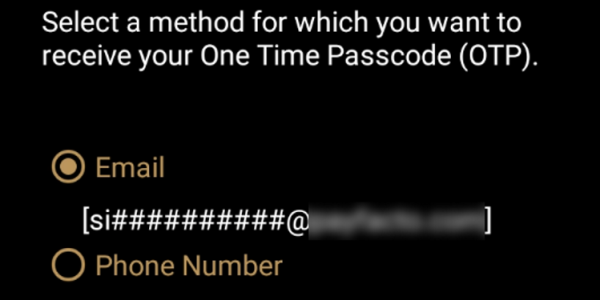

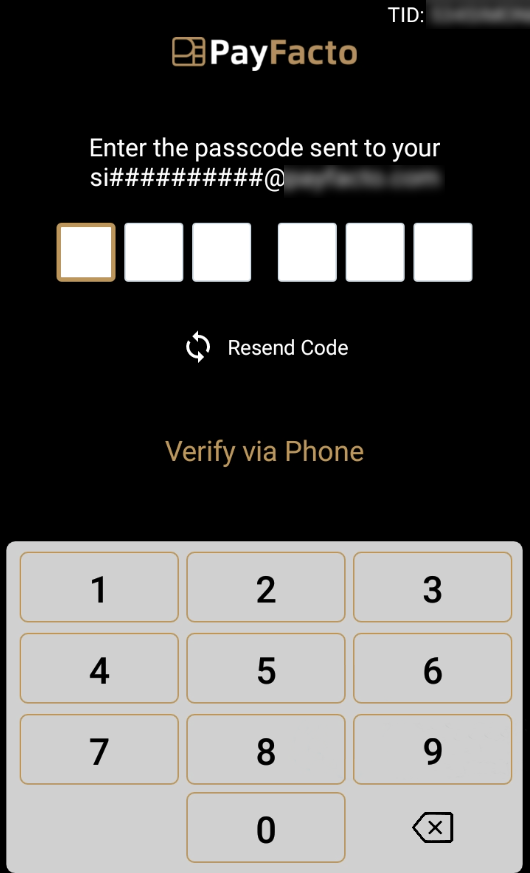

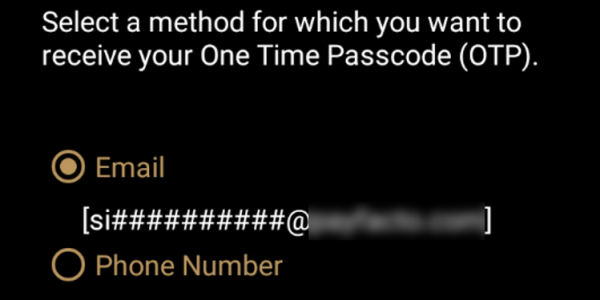

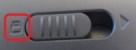

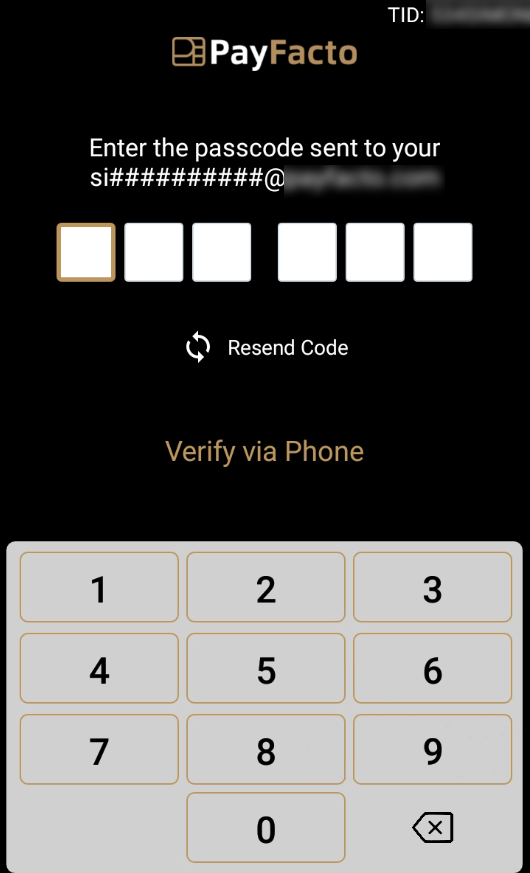

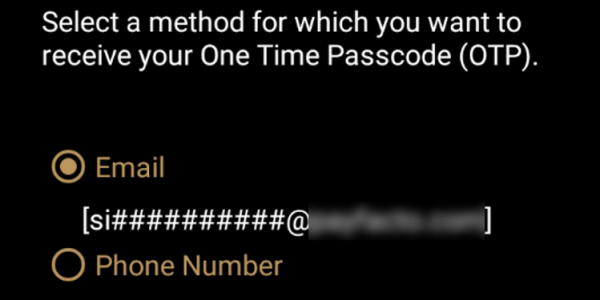

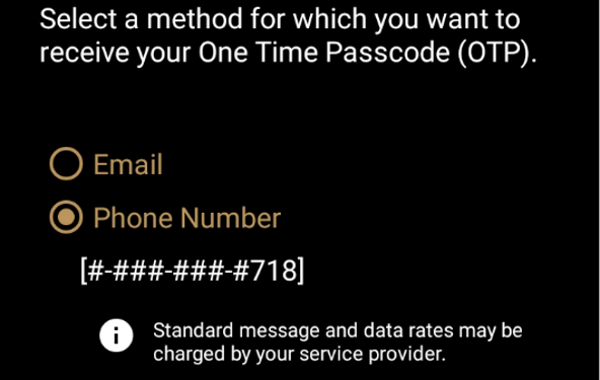

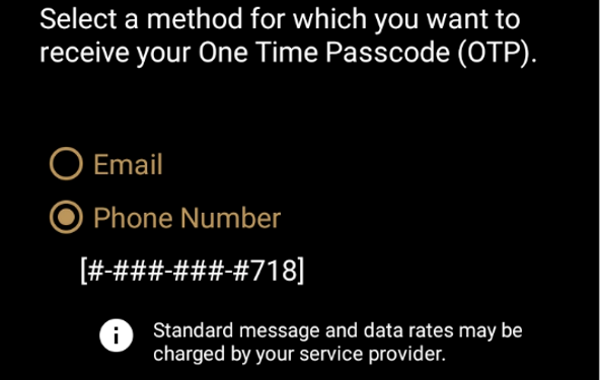

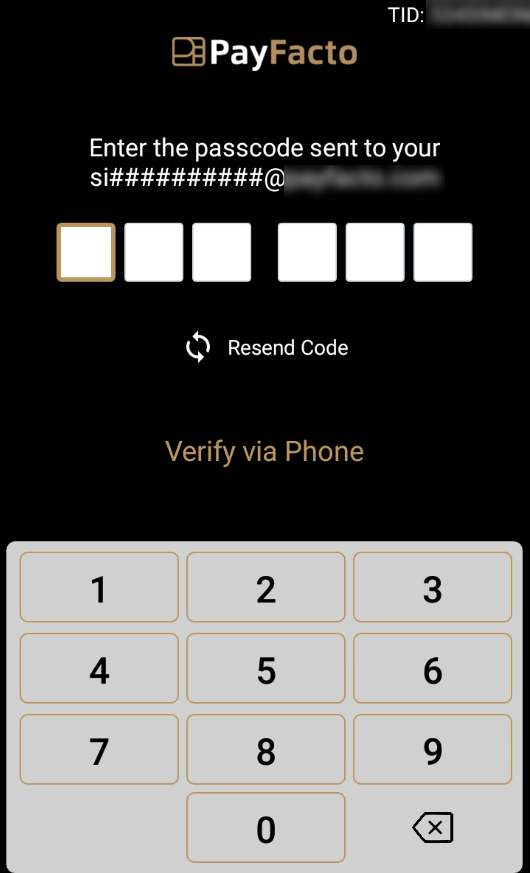

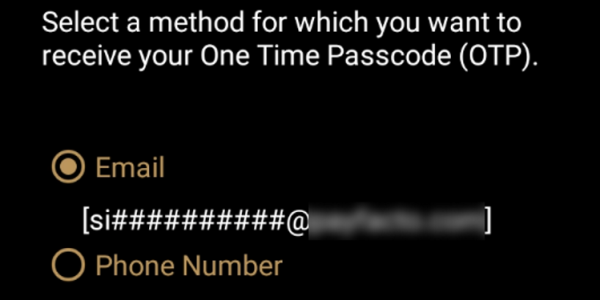

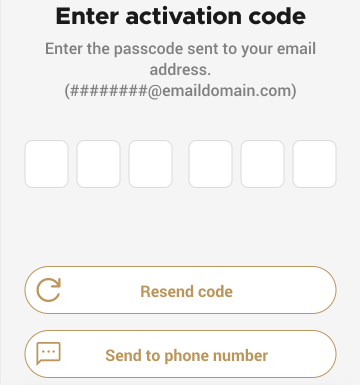

After configuring the terminal’s network connection, you need to start the PayFacto payment application to complete the remaining steps. Terminal activation requires you to input a One Time Passcode (OTP) that PayFacto sends to the email address or telephone number registered to your account.

IMPORTANT! To receive the OTP on your phone, your registered phone number must be able to receive text messages (SMS). If you cannot receive text messages, select the email option to get the OTP.

Touch the PAYMENT icon on the main screen. The Welcome To Your Payment Terminal screen appears.

NOTE: The terminal may need to download host and security parameters; this can take a few moments.

In the top right corner of the screen, your terminal ID (TID) appears; confirm that the number on the screen matches the TID on the label on the back of your terminal. The TID will not appear on your terminal screen after you complete the activation process.

IMPORTANT! If the TID does not match, call PayFacto immediately.

Touch anywhere on the screen to begin the activation process.

Touch the desired option to receive the OTP.

Phone Number

Touch the Send Code button.

IMPORTANT! The OTP code is valid for 15 minutes after you receive it. If you wait more than 15 minutes to enter the OTP, the terminal will display an error and you will have to request a new OTP.

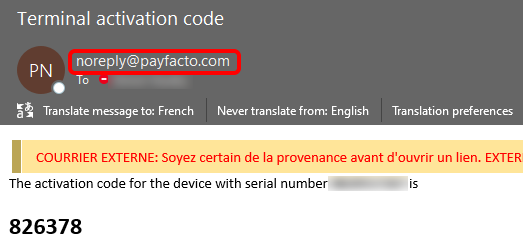

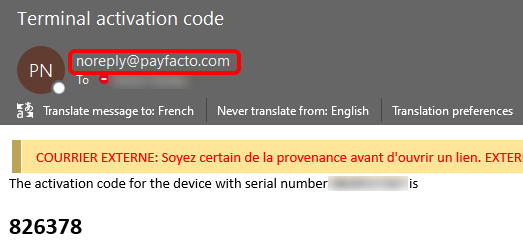

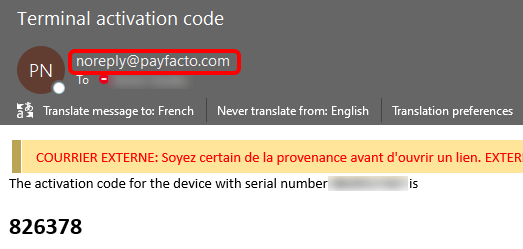

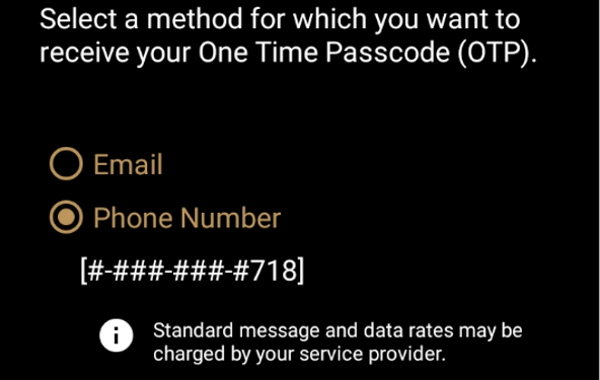

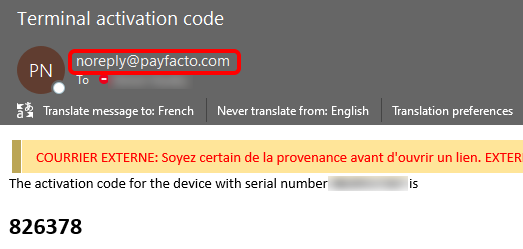

If you select Email, look for a message from [email protected].

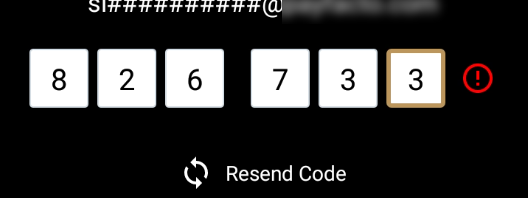

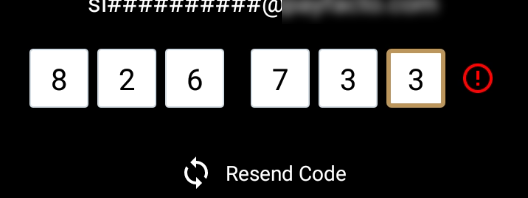

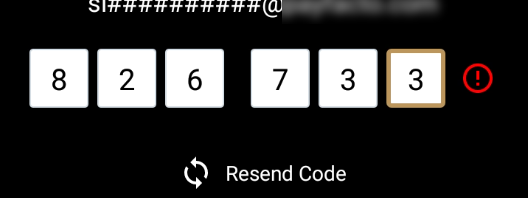

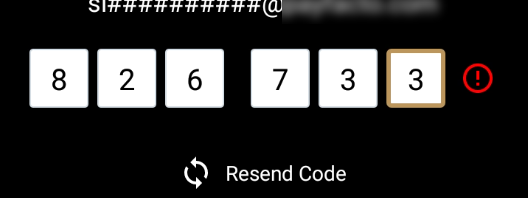

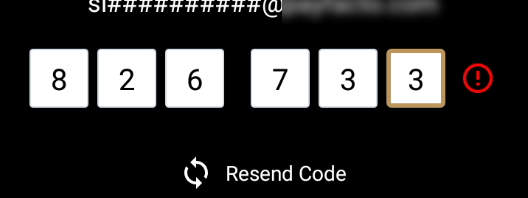

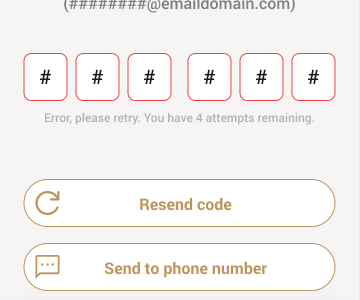

After you receive the 6-digit activation code, use the on-screen keypad to enter the code on the terminal screen.

If you enter the code incorrectly, a red exclamation appears to indicate that the code is incorrect.

Re-enter the code, or touch Resend Code to obtain a new OTP.

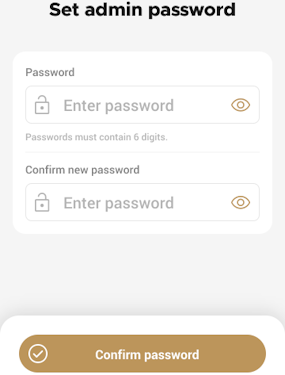

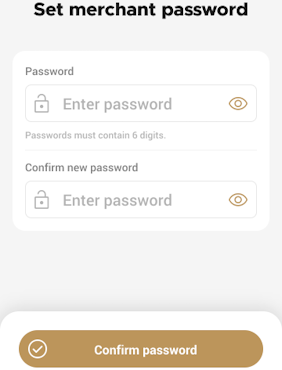

After you enter the OTP correctly, the payment application displays the Set Administrative Password screen to

To prevent unauthorized individuals from changing the terminal’s configuration, you need to set the Administrator and Merchant passwords. These passwords restrict access to certain functions on the terminal.

When setting your passwords, you must respect the following parameters:

Passwords must be 6 characters long

The Administrator and Merchant passwords cannot be the same (can’t match)

You cannot use the same digit 6 times consecutively (for example: 111111 or 777777)

On the Set Administrative Password screen, use the on-screen keypad to enter a 6-digit password in the Admin Password field and touch the Next icon on the keypad.

On the Confirm Administrative Password screen, re-enter the password in the Admin Password field and touch the Next icon on the keypad.

On the Set Merchant Password screen, use the on-screen keypad to enter a 6-digit password in the

Your payment terminal is now ready for use.

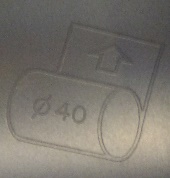

The terminal uses 2 ¼” or 58mm thermal paper rolls to print transaction receipts.

On the back of the terminal at the top, lift the lever with the contactless logo to unlock and open the printer cover.

NOTE: The printer cover opens on a hinge, it does not come off the terminal.

Place the roll of printer paper in the paper tray, leaving about 2 inches (5 cm) of paper beyond the printer's cutter as shown in the following example:

IMPORTANT! Make sure the paper unrolls from the back of the roll, otherwise the printer will be unable to print the transaction receipt.

Close the printer cover until it snaps into place and remove any excess paper.

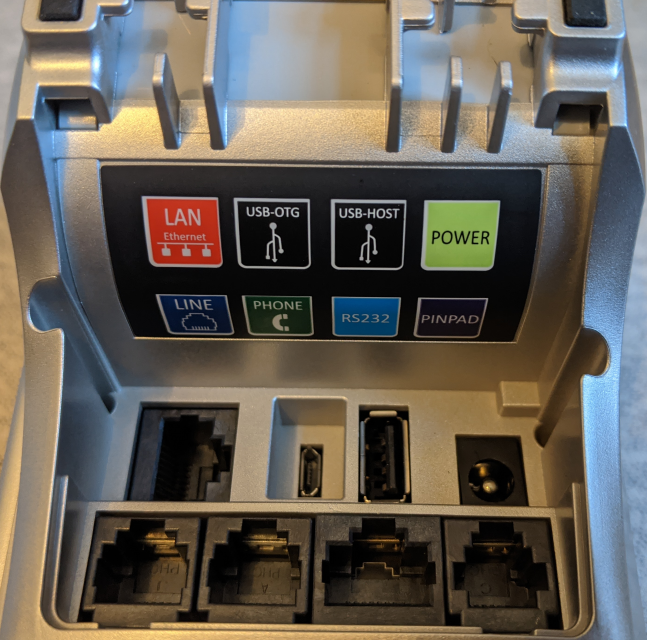

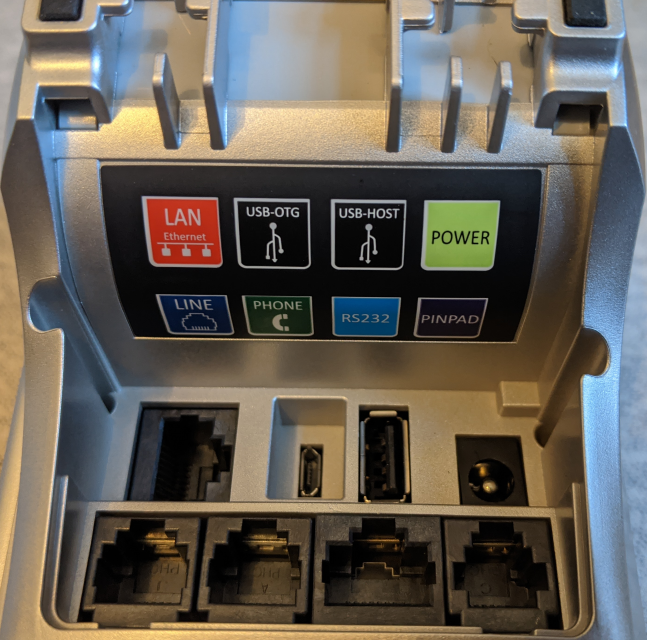

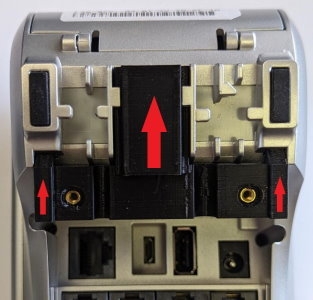

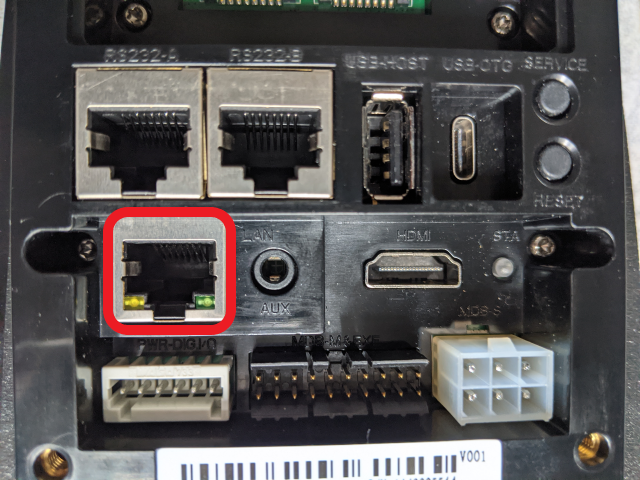

There are multiple connection ports on the back of the terminal. Countertop terminals generally require AC power and Ethernet connections.

Your configuration may also include a connection to a POS system or an additional PIN pad.

Use the diagram on the back of the terminal to determine where to connect the cables that apply to your configuration. The terminal’s connection ports are shown below:

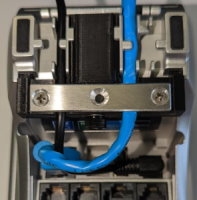

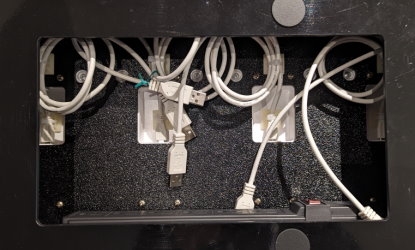

There are multiple communication ports on the back of the terminal with cable guides. The diagram on the back of the terminal shows where to connect the communication cables, in addition to AC power.

Cable guides

Ports diagram

Ethernet port

PayFacto uses a self-service terminal activation procedure designed to save time while also providing better security. The new activation procedure applies only to countertop and mobile PAX payment terminals using the Android operating system. The new procedure applies to:

All new merchants activating their terminals for the first time

Any existing merchants adding new payment terminals

Any existing merchants receiving replacement terminals

After you configure the terminal's network connection(s) and power on the terminal, the procedure comprises of 2 parts:

NOTE: If you have multiple new payment terminals, you need to perform the activation procedure on each terminal individually.

PayFacto uses a self-service terminal activation procedure designed to save time while also providing better security. The new activation procedure applies only to countertop and mobile PAX payment terminals using the Android operating system. The new procedure applies to:

All new merchants activating their terminals for the first time

Any existing merchants adding new payment terminals

The following illustrations show the location of the main terminal features and hardware:

This document will introduce you to your payment terminal as well as guide you through the process of preparing and configuring it in order to quickly begin processing payments.

Your PAX A35 payment processing terminal comes with the following:

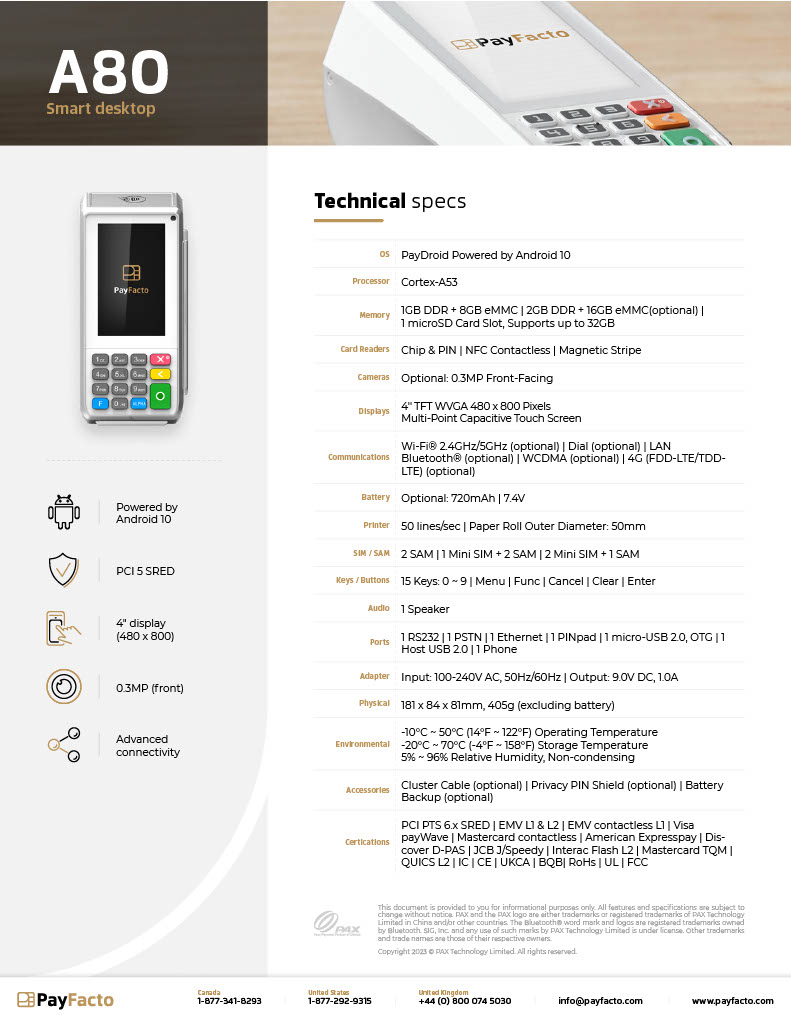

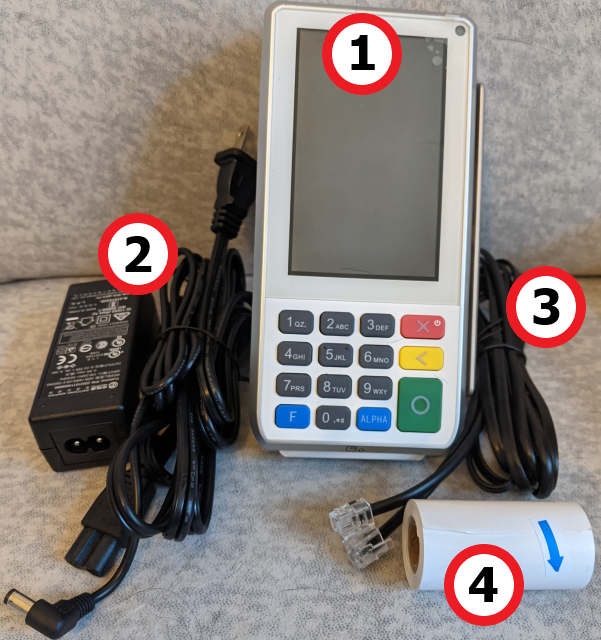

The PAX A80 terminal offers an on-screen keypad as well as a physical keypad to enter transaction amounts. Your terminal operators and customers enter information and respond to prompts using either the terminal’s touch screen or physical keypad.

There are three (3) colored function keys on the physical keypad that you can use to confirm, correct, or cancel an operation:

The terminal does not have a dedicated power on/off button; it turns on automatically when you connect it to an AC power source and turns off when disconnected from a power source.

After you connect the multi-function cable to the terminal and secure the back cover, turn the terminal over.

There are three (3) ways for a customer to use their payment card with the terminal:

To prevent unauthorized individuals from changing the terminal’s configuration, you need to set the Administrator and Merchant passwords. These passwords restrict access to certain functions on the terminal.

When setting your passwords, you must respect the following parameters:

Passwords must be 6 characters long

The Administrator and Merchant passwords cannot be the same (can’t match)

After you configure the terminal's network connection(s) and power on the terminal, the procedure comprises of 2 parts:

Activate the terminal with a One Time Passcode (OTP)

Set the Administrator and Merchant passwords

NOTE: If you have multiple new payment terminals, you need to perform the activation procedure on each terminal individually.

On the Confirm Merchant Password screen, re-enter the password in the Merchant Password field and touch the Next icon on the keypad.

Turn the charging base over and locate the USB connection port.

A920

A920 Pro

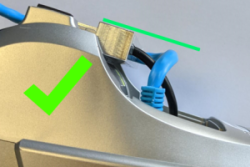

Insert the cable’s micro-USB (A920) or USB Type-C (A920 Pro) plug into the base’s connection port.

A920

A920 Pro

Secure the cable in the guide at the top of the charging base and turn the charging base over.

A920

A920 Pro

Connect the cable’s USB plug into the AC adapter’s USB port.

A920

A920 Pro

Plug the adapter into an AC outlet. The LED at the bottom edge of the base lights up.

To protect your PAX A920 or A920 Pro terminal from minor impact damage, you should install the silicone sleeve provided with the terminal charging base as the charging base is designed specifically for terminals with the sleeve.

Insert the top of the terminal into the sleeve's printer protection until the sleeve fits snugly onto the terminal’s top.

Pull the bottom of the sleeve over the bottom edge of the terminal.

Repeat for any additional terminals you intend to place on the charging base.

NOTE: To add or change a SIM card, you need to remove the sleeve from the terminal.

The topics covered in this guide include:

Before you can install the cable attachment to the PAX A80 terminal, you must prepare the terminal by doing the following:

Power off the terminal by pressing and holding the red X key on the physical keypad.

Turn the terminal over and remove all cables from the terminal's communication ports.

Beginning with the AC adapter, inserting it in the terminal's cable guide on the left and connect the adapter to the Power port.

Insert the Ethernet cable in the terminal's cable guide on the right and connect it to the LAN port.

When the cables are properly seated in their ports, gently pull on the cables to remove any excess cable that is higher than the plane of the T bracket.

Place the 3-hole metal bracket over the cables, aligned with the screw holes in the T bracket and secure it in place using a Phillips head screwdriver to insert the two short screws.

Turn the terminal over and power on the terminal. The completed assembly should resemble the following:

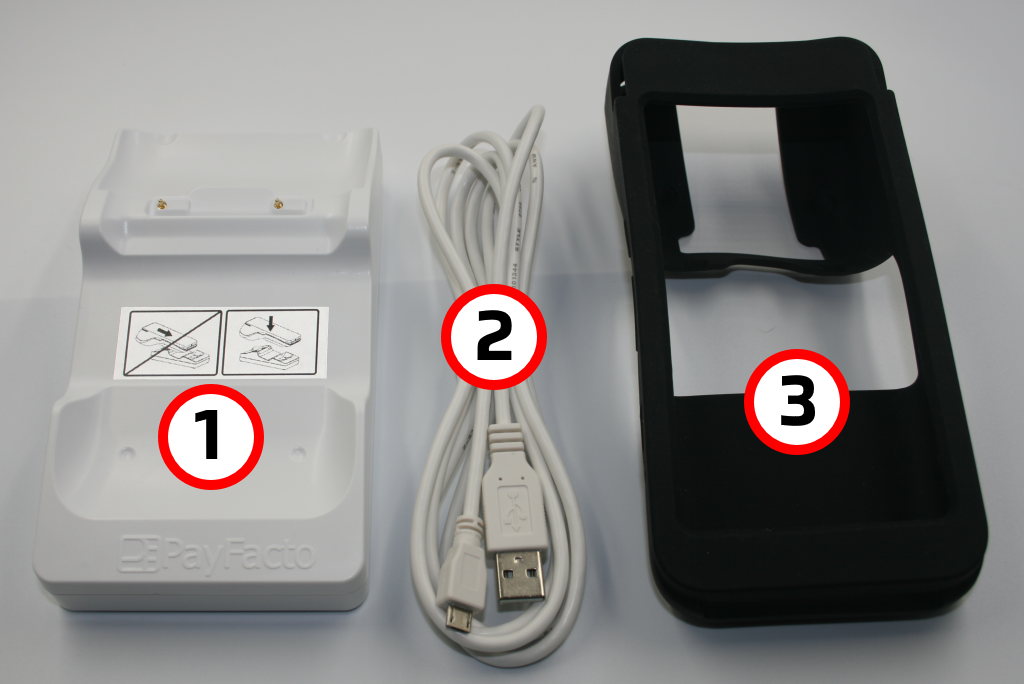

Your PAX A920 or A920 Pro terminal charging base includes the following components:

A920

Charging base

6-foot (180cm) USB to micro-USB cable

Protective silicone sleeve

A920 Pro

Charging base

5-foot (152cm) USB to USB Type-C cable

Protective silicone sleeve

On the terminal’s main screen, touch the Settings icon.

On the Settings screen, touch the Please Input Password field and use the keypad to type the password: either 9876 or pax9876@@.

Touch the checkmark icon on the keypad when you are done and touch OK.

Scroll to the Personal section and touch Language & input.

Touch Language.

Scroll to and touch the desired language.

Touch the Back icon twice to return to the main screen.

Insert the chip card and enter a PIN

Swipe the card’s magnetic strip

Tap the card for contactless payment

To correct an entry, touch BACK on the screen or press the yellow < key

To cancel a function, touch CLEAR on the screen or press the red X key

Insert the power cord’s male USB Type-C plug in the open (female) USB Type-C power connector on the multi-function cable.

Connect the cable’s USB plug into the AC adapter’s USB port.

Plug the adapter into an AC outlet. The terminal powers on automatically and makes a sound to indicate it is starting.

You cannot use the same digit 6 times consecutively (for example: 111111 or 777777)

You cannot use 6 consecutive numbers, either ascending or descending (for example: 123456 or 987654)

On the Set Administrative Password screen, use the on-screen keypad to enter a 6-digit password in the Admin Password field and touch the Next icon on the keypad.

On the Confirm Administrative Password screen, re-enter the password in the Admin Password field and touch the Next icon on the keypad.

On the Set Merchant Password screen, use the on-screen keypad to enter a 6-digit password in the Merchant Password field and touch the Next icon on the keypad.

On the Confirm Merchant Password screen, re-enter the password in the Merchant Password field and touch the Next icon on the keypad.

Your payment terminal is now ready for use.

Payment terminal

AC power adapter and terminal power cord (2 pieces)

RJ-11 (telephone) cable *

Roll of printer paper

Front-facing camera (not used)

Color touchscreen /Contactless payment reader

Physical keypad

Chip card reader

Magnetic stripe reader

3.5mm audio jack

USB Type-C power cord

Back cover

AC power adapter

Payment terminal

Multi-function cable

Insert the chip card and enter a PIN

Swipe the card’s magnetic strip

Tap the card for contactless payment

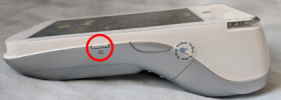

After you remove the terminal and accessories from the box, you need to charge the terminal before you can use it. The pre-installed battery has a protective cover on the contacts to prevent the possibility of a short circuit during transport.

Turn the terminal over.

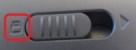

On the back of the terminal at the bottom, slide the battery cover locking switch to the right.

Lift the battery cover off the terminal. You should notice a plastic tab at the top of the battery.

Insert the USB cable in the AC outlet and connect the outlet to an AC plug.

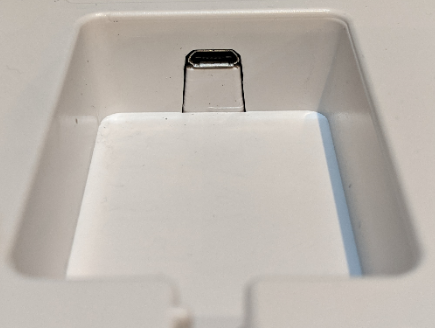

Insert the micro USB connector in the terminal’s charging port, located on the left side, below the Volume Down button. The terminal begins charging.

NOTE: The terminal’s charging port may have a protective cover; you will need to remove it before inserting the micro USB port.

If the supplied roll of printer paper was not already installed in the terminal when you received it, you will need to install it before you can print any transaction receipts.

TIP: This procedure also applies to replacing a roll of printer paper.

On the back of the terminal at the top, lift the lever to unlock and open the printer cover.

NOTE: The printer cover opens on a hinge, it does not come off the terminal.

The paper tray contains an illustration of how to install the roll of paper.

Place the roll of printer paper in the paper tray, leaving about 2 inches (5 cm) of paper beyond the printer's cutter.

IMPORTANT! Make sure the paper unrolls from the back of the roll, otherwise the printer will be unable to print the transaction receipt.

Close the printer cover until it snaps into place and remove any excess paper.

The terminal requires a network connection to communicate with the payment processor server to process transactions.

The PAX A920 is a mobile payment terminal that can connect to mobile (LTE) and wireless (Wi-Fi) networks.

Mobile network access is required for delivery and transportation use, but it can also serve as a backup connection if your Wi-Fi network reception is unreliable in certain areas.

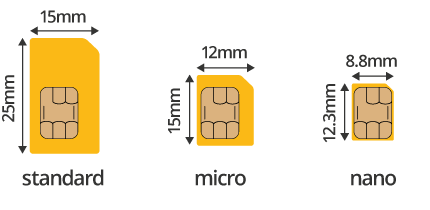

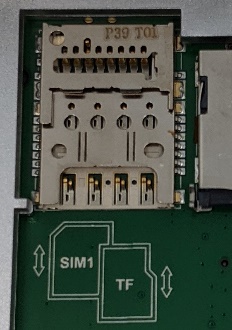

If you plan to use your terminal outside of your usual wi-fi network, you need to install the mobile SIM card, provided by PayFacto or your mobile communications provider. The SIM card will connect you to a mobile network, allowing you to process payments anywhere the terminal has reception. The terminal uses the regular (full) SIM card size.

NOTE: If you plan to use your terminal only on your wi-fi network, you can skip this procedure and proceed directly to .

On the back of the terminal at the bottom, slide the battery cover locking switch to the right.

Lift the battery cover off the terminal.

Lift the battery from the terminal to remove and set aside.

IMPORTANT! The SIM card goes into the leftmost space and should not require great force to insert.

Re-install the battery by sliding the thin segment into the terminal, near the charging connectors, and pushing on the bottom of the battery to seat it correctly.

Re-install the battery cover on the terminal and slide the lock switch to the lock position on the left.

Power on the terminal by pressing and holding the Power button for 3 seconds.

The terminal should identify the SIM card and configure the mobile network settings automatically.

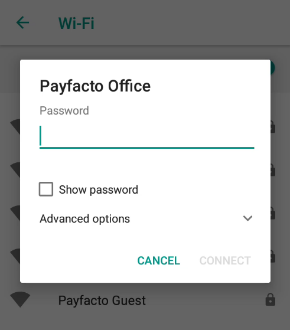

This section explains how to turn wi-fi on and connect to your network.

To connect to your wireless network:

On the terminal’s main screen, touch the Settings icon.

On the Settings screen, touch the Please Input Password field and use the keypad to type the password: either 9876 or pax9876@@.

Touch the checkmark icon on the keypad when you are done and touch OK.

In the Wireless & networks section, touch Wi-Fi.

If Wi-Fi is Off, touch the toggle to turn it on. If Wi-Fi is already on, a list of available networks appears.

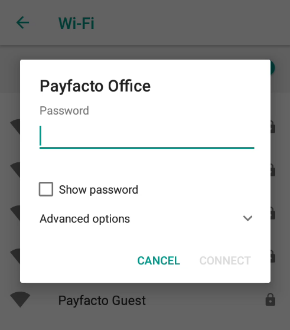

From the list of available networks, touch the name of the network you want to connect to.

TIP: You can touch Show password before typing to ensure you are entering the password correctly.

After the terminal displays Connected for the selected network, touch the Back icon to return to the Settings screen.

Touch the Back icon again to return to the main screen.

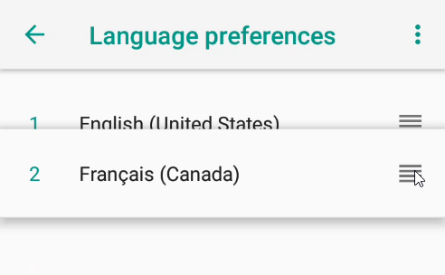

By default, the terminal displays all information in English. This procedure explains how to change the terminal’s display language if necessary.

IMPORTANT! Selecting a different language changes all text that appears on the terminal.

To change the terminal display language:

On the terminal’s main screen, touch the Settings icon.

On the Settings screen, touch the Please Input Password field and use the keypad to type the password: either 9876 or pax9876@@.

Touch the checkmark icon on the keypad when you are done and touch OK.

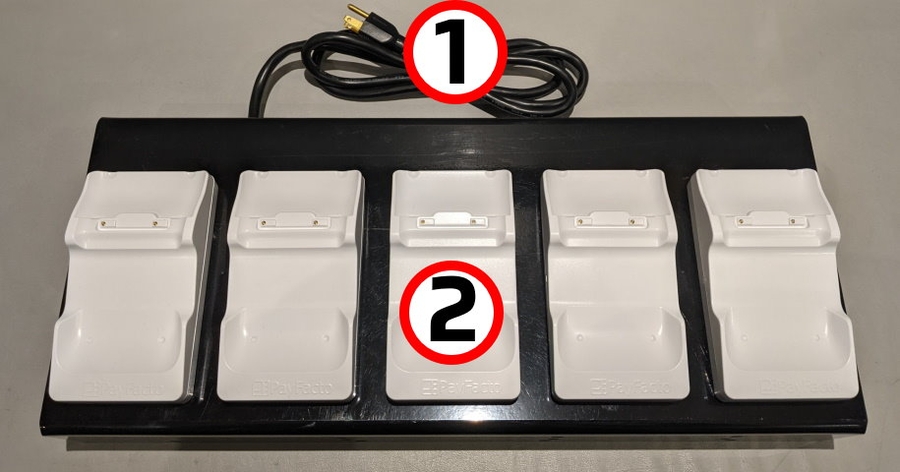

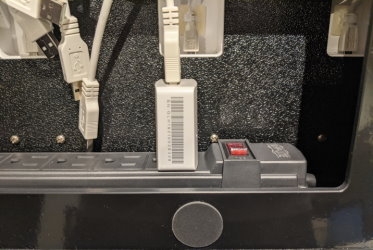

The multi-terminal charging base has a power switch on the attached power bar, shown below:

• To power on the terminal charging base, make sure the power cord is plugged into a grounded AC outlet and that the power switch is in the On/RESETposition; the switch lights up with a red indicator, as shown below:

• To power off the terminal charging base, you can either push the power switch to the OFF position or unplug the power cord from the grounded AC outlet.

To use the charging base, you need only place the terminal(s) vertically on the base so the printer rests in the cradle at the top of the charging base.

NOTE: The charging base should only be used to charge your terminal(s); it is not designed to be a storage location for the terminal(s).

If the status light remains blue after you place the terminal on the base, the terminal is not seated correctly, and not connecting to the base’s gold charging contacts.

IMPORTANT! Do not slide a terminal onto the base, as it can damage the gold charging contacts. Always place the terminal onto the base vertically, as shown below:

The LED at the bottom edge of the charging base indicates the terminal’s charging status:

To use the charging base, you need only place the terminal(s) vertically on the base so the printer rests in the cradle at the top of the charging base.

NOTE: The charging base should only be used to charge your terminal(s); it is not designed to be a storage location for the terminal(s).

If the status light remains blue after you place the terminal on the base, the terminal is not seated correctly, and not connecting to the base’s gold charging contacts.

IMPORTANT! Do not slide a terminal onto the base, as it can damage the gold charging contacts. Always place the terminal onto the base vertically, as shown below

The LED at the bottom edge of the charging base indicates the terminal’s charging status:

This section explains how to enable an Ethernet connection and connect to your network.

Ensure your network cable is connected in the red Ethernet adapter on the multi-function cable and make sure the other end of the network cable is connected to a network jack or hub.

On the terminal’s main screen, touch the Settings icon.

On the Settings screen, touch the Please Input Password field and use the keypad to type the password: or pax9876@@.

Touch the checkmark icon on the keypad when you are done and touch OK.

On the Settings page, touch Network & Internet.

On the Network & internet page, touch Ethernet.

If Ethernet is Off, touch the toggle to turn it on.

After you toggle Ethernet to On (or if Ethernet is already on), the connected network settings appear.

If necessary, you can change the network connection parameters manually by scrolling to the bottom and touching Ethernet Configuration to select and configure the Connection Type.

IMPORTANT! Changing the network connection parameters incorrectly will prevent the terminal from communicating with the payment processing server.

Touch the Back icon to return to the Network & Internet page.

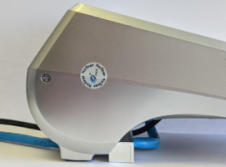

To ensure the best charging results, you must use the original AC power adapter that came with your PAX A920 or A920 Pro terminals. The AC power adapter should have the PAX logo printed on one side as shown below:

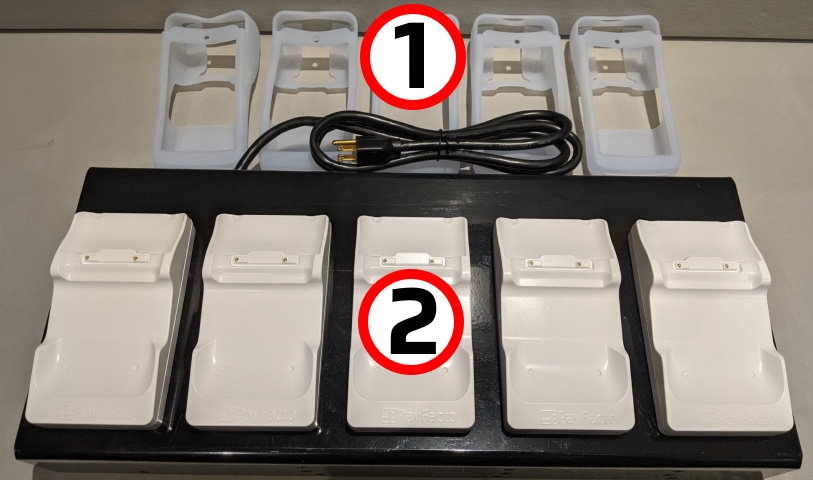

Your multi-terminal charging base comes with the following:

The following images show the location of the main charging base components:

AC power cord

Multi-terminal charging bases (x5)

USB charging cables (x5)

Six (6) outlet power bar

There are multiple communication ports available through the multi-function cable. The cable allows you to connect the terminal to:

USB Type-C (female) power connector (for AC supplly)

Wired network using the Ethernet connector

Multi-function connector (USB Type-C male)

The PAX A80 countertop payment terminal is perfect for retail and bar/restaurant applications. This setup guide describes the following topics:

Initial terminal configuration

Activating the terminal

Working with the terminal

To prevent unauthorized individuals from changing the terminal’s configuration, you need to set the Administrator and Merchant passwords. These passwords restrict access to certain functions on the terminal.

When setting your passwords, you must respect the following parameters:

Passwords must be 6 characters long

The Administrator and Merchant passwords cannot be the same (can’t match)

You cannot use the same digit 6 times consecutively (for example: 111111 or 777777)

You cannot use 6 consecutive numbers, either ascending or descending (for example: 123456 or 987654)

On the Set Administrative Password screen, use the on-screen keypad to enter a 6-digit password in the Admin Password field and touch the Next icon on the keypad.

On the Confirm Administrative Password screen, re-enter the password in the Admin Password field and touch the Next icon on the keypad.

On the Set Merchant Password screen, use the on-screen keypad to enter a 6-digit password in the

Your payment terminal is now ready for use.

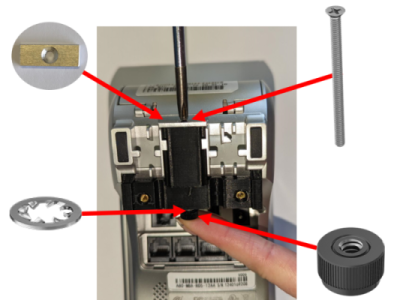

The A80 cable attachment is anchored by a T bracket that keeps the attached cables from being accidentally disconnected .

With the terminal turned over, insert the T bracket into the guides on the underside of the A80 terminal.

Slide the T bracket up by pushing it from the bottom towards the top of the terminal.

To prevent the T bracket and cables from sliding off the terminal, you must next secure the T bracket to the terminal.

Place the short metal bracket at the top of the T bracket and insert the long screw at the opening near the top of the terminal.

When the end of the long screw comes out of the bottom of the T bracket, place the metal washer over the screw and then thread the thumb nut onto the end of the screw.

Using a Phillips head screwdriver, tighten the screw securely (but not excessively) into the thumb nut.

This section explains how to turn Wi-Fi on and connect to your network.

On the terminal’s main screen, touch the Settings icon.

On the Settings screen, touch the Please Input Password field and use the keypad to type the password: pax9876@@.

Touch the checkmark icon on the keypad when you are done and touch OK.

On the Settings page, touch Network & Internet.

On the Network & Internet page, touch Wi-Fi.

If Wi-Fi is Off, touch the toggle to turn it on. If Wi-Fi is already on, a list of available networks appears.

From the list of available networks, touch the name of the network you want to connect to.

Enter the password for the selected network and touch CONNECT.

TIP: You can touch Show password before typing to ensure you are entering the password correctly.

After the terminal displays Connected for the selected network, touch the Back icon to return to the Network & Internet page.

The terminal powers on automatically when you connect it to a vending device’s MDB plug and the vending device is connected to an AC power supply. To power off the terminal, disconnect the MDB plug or the vending device’s AC power supply.

IMPORTANT! If you disconnect the AC power from the vending device, any transaction that was in progress is cancelled.

Your terminal operators and your customers enter information and respond to prompts using the terminal’s touch screen. The application prompts you and your customers on the next action to perform.

There are three (3) ways for a customer to use their payment card with the terminal:

The following illustrations show the location of the main terminal features and hardware:

Contactless payment reader

Color touchscreen

Magnetic stripe reader

By default, the terminal displays all information in English. This procedure explains how to change the terminal’s display language if necessary.

IMPORTANT! Selecting a different language changes all text that appears on the terminal.

On the terminal’s main screen, touch the Settings icon.

On the Settings screen, touch the Please Input Password field and use the keypad to type the password: pax9876@@.

Touch the checkmark icon on the keypad when you are done and touch OK.

NOTE: If the language has localized variants, select the appropriate regional option for your country.

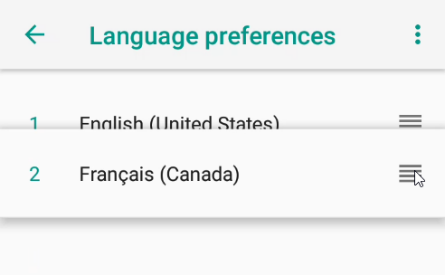

If the selected language does not appear automatically, you can drag the language to the top of the list, as shown below:

If the supplied roll of printer paper was not already installed in the terminal when you received it, you will need to install it before you can print any transaction receipts.

TIP: This procedure also applies to replacing a roll of printer paper.

On the back of the terminal at the top, lift the lever with the contactless logo to unlock and open the printer cover.

NOTE: The printer cover opens on a hinge, it does not come off the terminal.

Place the roll of printer paper in the paper tray, leaving about 2 inches (5 cm) of paper beyond the printer's cutter as shown in the following example:

IMPORTANT! Make sure the paper unrolls from the back of the roll, otherwise the printer will be unable to print the transaction receipt.

Close the printer cover until it snaps into place and remove any excess paper.

Overview

Safeguard Your Transactions with the PayFacto Secure App

This section explains how to enable Ethernet and connect to your network.

Ensure your network cable is connected in the appropriate connector located on the back of the terminal and make sure the other end of the network cable is connected to a network jack or hub.

On the terminal’s main screen, touch the Settings icon.

On the Settings screen, touch the Please Input Password field and use the keypad to type the password: either 9876 or pax9876@@.

IMPORTANT! Changing the network connection parameters incorrectly will prevent the terminal from communicating with the payment processing server.

Touch the Back icon twice to return to the main screen.

The PAX A35 terminal offers an on-screen keypad as well as a physical keypad to enter transaction amounts. Your terminal operators and customers enter information and respond to prompts using either the terminal’s touch screen or physical keypad.

To enter an amount or a PIN, you can use either the on-screen or physical keypad.

There are three (3) colored function keys on the physical keypad that you can use to confirm, correct, or cancel an operation:

To confirm an entry, touch OK on the screen or press the green O key

To correct an entry, touch BACK on the screen or press the yellow < key

To cancel a function, touch CLEAR on the screen or press the red X key

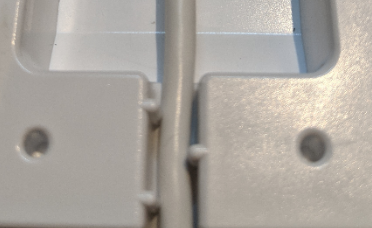

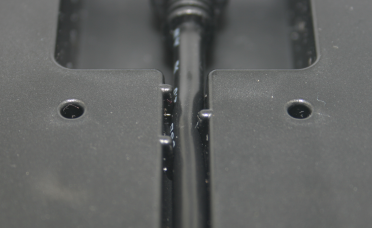

The terminal uses a multi-function cable to provide access to the supported connections. Countertop terminals generally require AC power and Ethernet connections. Your configuration may also include a connection to a POS system.

On the back of the terminal at the top, use a #1 Phillips screwdriver to loosen the two screws securing the cover.

The Secure Payment application's App to app module has multiple configurable features and functions. The features and functions apply to all Secure Payment modules you may use, including standalone Payment, SecurePay, SecureTable, Gateway, and Gift Cards.

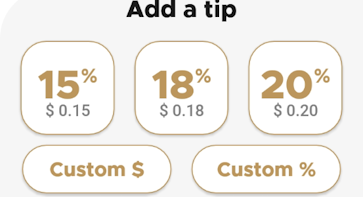

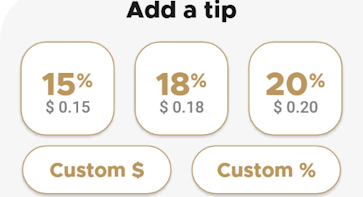

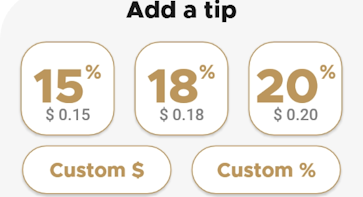

For the App to app module, the feature you will most likely need to configure is tipping (if that applies to your business), but you can access the following :

After configuring the terminal’s network connection, you need to start the PayFacto payment application to complete the remaining steps. Terminal activation requires you to input a One Time Passcode (OTP) that PayFacto sends to the email address or telephone number registered to your account.

After configuring the terminal’s network connection, you need to start the PayFacto payment application to complete the remaining steps. Terminal activation requires you to input a One Time Passcode (OTP) that PayFacto sends to the email address or telephone number registered to your account.

IMPORTANT! To receive the OTP on your phone, your registered phone number must be able to receive text messages (SMS). If you cannot receive text messages, select the email option to get the OTP.

The Secure Payment App to app module provides payment processing to merchants who use a non-PayFacto terminal payment application. The App to app module is different from the SecurePay, SecureTable, and Gateway modules as there is no communication between the Point of Sale (POS) system and the payment terminal.

Operation of the App to app module more closely resembles the Payment module in standalone mode. The merchant enters the amount of the sale on a third-party terminal application and then the App to app module receives the sale information and processes the sale using the PayFacto servers.

The Gateway module allows you to view the connection settings to your POS system. The connection settings should not be modified unless specifically instructed to do so by PayFacto support. Changing the settings may affect the terminal's ability to communicate with the POS.

The topics covered in this page include:

This document addresses the configuration and use of the Secure Payment application's Gateway module. The Gateway module allows a Point of Sale (POS) system to communicate with a payment terminal to complete a sales transaction.

The typical information flow between the POS system and the payment terminal has the POS send the sale amount to the payment terminal. On the terminal, the customer confirms the sale amount and presents their card for reading. The terminal communicates with the authorization server and displays the result. The approved (or declined) transaction information is then communicated back to the POS system to conclude the transaction.

Secure Payment

PayFacto Gift powered by Freebees

PayFacto Gift - DataCandy

Overview - Gateway Module

Gateway Application

Tasks and How-Tos

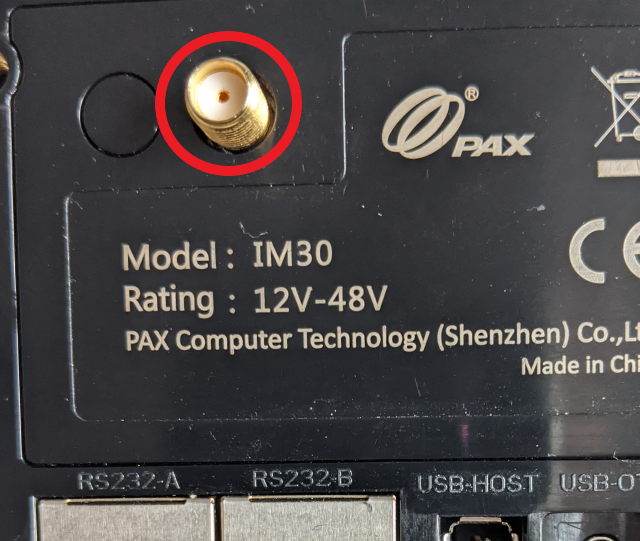

PAX IM30 (Canada Only)

Re-install the battery by sliding the thin segment into the terminal, near the charging connectors, and pushing on the bottom of the battery to seat it correctly.

Re-install the battery cover on the terminal and slide the lock switch to the lock position on the left and turn the terminal over.

Enter the password for the selected network and touch CONNECT.

Scroll to the Personal section and touch Language & input.

Touch Language.

Scroll to and touch the desired language.

Touch the Back icon twice to return to the main screen.

Anti-slip rubber pads

Protective silicone sleeves (x5)

Multi-terminal charging base

On the Confirm Merchant Password screen, re-enter the password in the Merchant Password field and touch the Next icon on the keypad.

On the Settings page, scroll to the bottom and touch System.

On the System page, touch Languages & input.

On the Languages & input page, touch Languages.

On the Language preferences page, touch Add a language.

On the Add a language page, scroll to and touch the desired language.

Touch the checkmark icon on the keypad when you are done and touch OK.

In the Wireless & networks section, touch Ethernet.

If Ethernet is Off, touch the toggle to turn it on.

After you toggle Ethernet to On (or if Ethernet is already on), the connected network settings appear.

If necessary, you can change the network connection parameters manually by scrolling to the bottom and touching Ethernet Configuration to select and configure the Connection Type.

Chip card reader

Touch the Power off icon and then touch Power off again.

NOTE: Avoid allowing the terminal’s battery to run down to 0%. The terminal requires the battery to be at least at 8% capacity to process a transaction. It is strongly recommended that you charge the terminal overnight or during non-business hours.

Your terminal operators and your customers enter information and respond to prompts using the terminal’s touch screen. The application prompts you and your customers on the next action to perform.

There are three (3) ways for a customer to use their payment card with the terminal:

Insert the chip card and enter a PIN

Swipe the card’s magnetic strip

Tap the card for contactless payment

The terminal uses 2 ¼” or 58mm thermal paper rolls to print transaction receipts.

On the back of the terminal at the top, lift the lever to unlock and open the printer cover.

NOTE: The printer cover opens on a hinge, it does not come off the terminal.

Place the roll of printer paper in the paper tray, leaving about 2 inches (5 cm) of paper beyond the printer's cutter.

IMPORTANT! Make sure the paper unrolls from the back of the roll, otherwise the printer will be unable to print the transaction receipt.

Close the printer cover until it snaps into place and remove any excess paper.

NOTE: You do not need to remove the screws from the cover; they are designed to remain attached.

Remove the cover from the back of the terminal and locate the USB Type-C plug between the slots for the MicroSD and SAM cards.

Insert the multi-function cable’s USB Type-C connector into the terminal’s corresponding plug.

After you connect the multi-function cable to the terminal, make sure that the strain relief sleeve is seated in the slot at the top of the terminal.

NOTE: You can move the strain relief sleeve along the multi-function cable to position it correctly.

Re-install the cover and tighten the two screws to complete the cable installation.

Application Configuration

Close (or exit from) the third party payment application.

If the App to app main screen does not appear automatically, touch the Secure Payment icon on the terminal's main screen.

From the App to app main screen, touch the menu icon at the top-left corner of the screen.

Enter the merchant password and touch the Confirm button. The Settings page appears.

Touch the PAYMENT icon on the main screen. The Welcome To Your Payment Terminal screen appears.

NOTE: The terminal may need to download host and security parameters; this can take a few moments.

In the top right corner of the screen, your terminal ID (TID) appears; confirm that the number on the screen matches the TID on the label on the back of your terminal. The TID will not appear on your terminal screen after you complete the activation process.

IMPORTANT! If the TID does not match, call PayFacto immediately.

Touch anywhere on the screen to begin the activation process.

Touch the desired option to receive the OTP.

Phone Number

Touch the Send Code button.

IMPORTANT! The OTP code is valid for 15 minutes after you receive it. If you wait more than 15 minutes to enter the OTP, the terminal will display an error and you will have to request a new OTP.

If you select Email, look for a message from [email protected].

After you receive the 6-digit activation code, use the on-screen keypad to enter the code on the terminal screen.

If you enter the code incorrectly, a red exclamation appears to indicate that the code is incorrect.

Re-enter the code, or touch Resend Code to obtain a new OTP.

After you enter the OTP correctly, the payment application displays the Set Administrative Password screen to configure your terminal passwords.

Touch the PAYMENT icon on the main screen. The Welcome To Your Payment Terminal screen appears.

NOTE: The terminal may need to download host and security parameters; this can take a few moments.

In the top right corner of the screen, your terminal ID (TID) appears; confirm that the number on the screen matches the TID on the label on the back of your terminal. The TID will not appear on your terminal screen after you complete the activation process.

IMPORTANT! If the TID does not match, call PayFacto immediately.

Touch anywhere on the screen to begin the activation process.

Touch the desired option to receive the OTP.

Phone Number

Touch the Send Code button

IMPORTANT! The OTP code is valid for 15 minutes after you receive it. If you wait more than 15 minutes to enter the OTP, the terminal will display an error and you will have to request a new OTP.

If you select Email, look for a message from [email protected].

After you receive the 6-digit activation code, use the on-screen keypad to enter the code on the terminal screen.

If you enter the code incorrectly, a red exclamation appears to indicate that the code is incorrect.

Re-enter the code, or touch Resend Code to obtain a new OTP.

After you enter the OTP correctly, the payment application displays the Set Administrative Password screen to configure your terminal passwords.

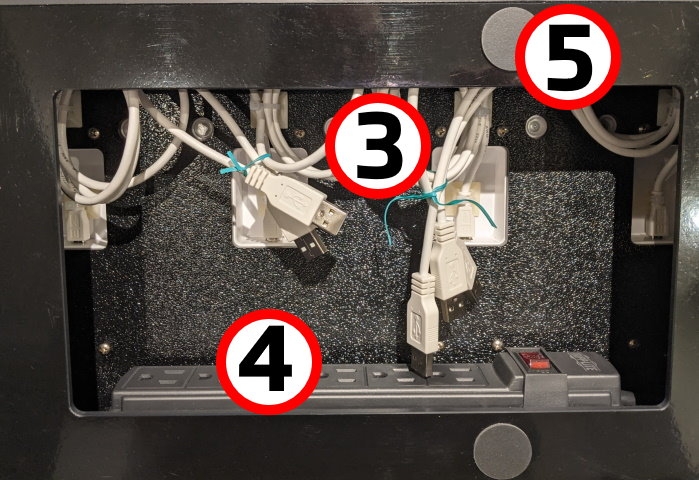

Collect the original AC power adapters that were shipped with your PAX A920 or A920 Pro terminals (maximum of 5 per multi-terminal charging base).

Turn the multi-terminal charging base over to access the opening on the bottom.

Remove any twist ties that secure the charging cables together. Do not remove any of the nylon zip ties as each cable should be long enough to reach an outlet on the power bar.

Working one cable at a time, connect the cable’s USB plug into the AC adapter’s USB port.

Plug the adapter into an outlet on the power bar.

Repeat steps 4 and 5 for each additional charging cable.

After you connect all 5 cables to the power bar, plug in the power bar's cable to an available AC outlet.

If it is not already, switch the power bar's power button to the On/RESETposition; the switch lights up with a red indicator and the LEDs at the bottom edge of the charging bases light up.

Turn the multi-terminal charging base over to place it securely in its desired location. The base is ready to begin charging your terminals.

IMPORTANT! To minimize the risk of short-circuits and reduce the risk of fire, DO NOT connect any additional devices to the charging base's power bar.

To protect your PAX A920 or A920 Pro terminals from minor impact damage, you should install the silicone sleeves provided with the multi-terminal charging base as the charging bases are designed specifically for terminals with the sleeve.

Insert the top of the terminal into the sleeve's printer protection until the sleeve fits snugly onto the terminal’s top.

Pull the bottom of the sleeve over the bottom edge of the terminal.

Repeat for every terminal you intend to place on the charging bases.

NOTE: To add or change a SIM card, you need to remove the sleeve from the terminal.

To power off the terminal:

Press and hold the power key on the right side of the terminal for 2-3 seconds.

Touch the Power off icon and then touch Power off again.

NOTE: Avoid allowing the terminal’s battery to run down to 0%. The terminal requires the battery to be at least at 8% capacity to process a transaction. It is strongly recommended that you charge the terminal overnight or during non-business hours.

Your terminal operators and your customers enter information and respond to prompts using the terminal’s touch screen. The application prompts you and your customers on the next action to perform.

There are three (3) ways for a customer to use their payment card with the terminal:

Insert the chip card and enter a PIN

Swipe the card’s magnetic strip

Tap the card for contactless payment

The terminal uses 2 ¼” or 58mm thermal paper rolls to print transaction receipts.

On the back of the terminal at the top, lift the lever to unlock and open the printer cover.

NOTE: The printer cover opens on a hinge, it does not come off the terminal.

Place the roll of printer paper in the paper tray, leaving about 2 inches (5 cm) of paper beyond the printer's cutter.

IMPORTANT! Make sure the paper unrolls from the back of the roll, otherwise the printer will be unable to print the transaction receipt.

Close the printer cover until it snaps into place and remove any excess paper.

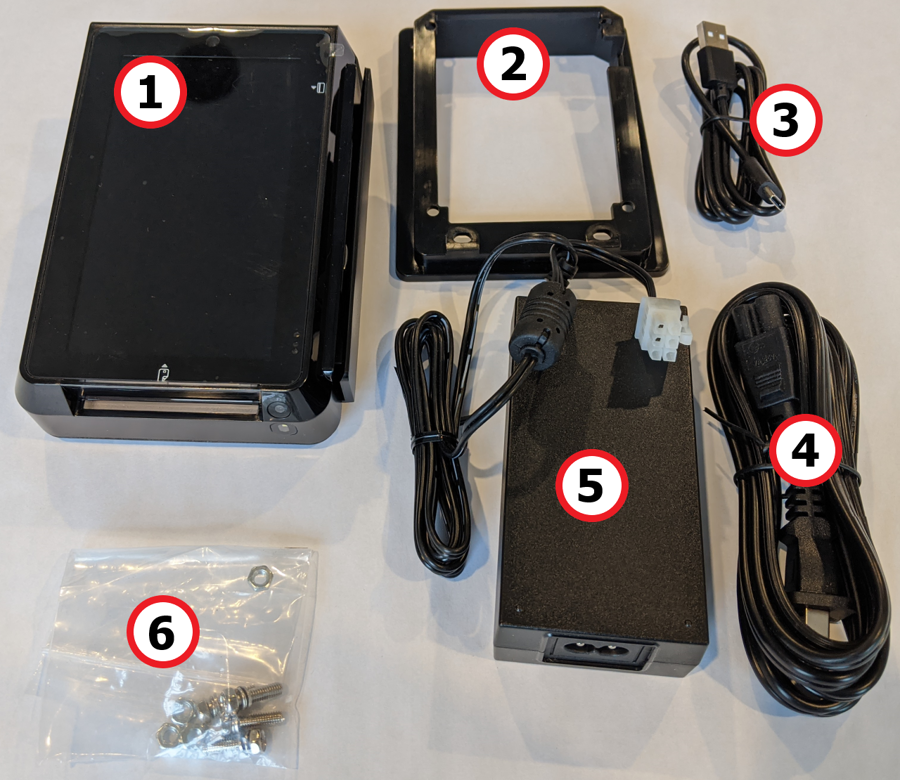

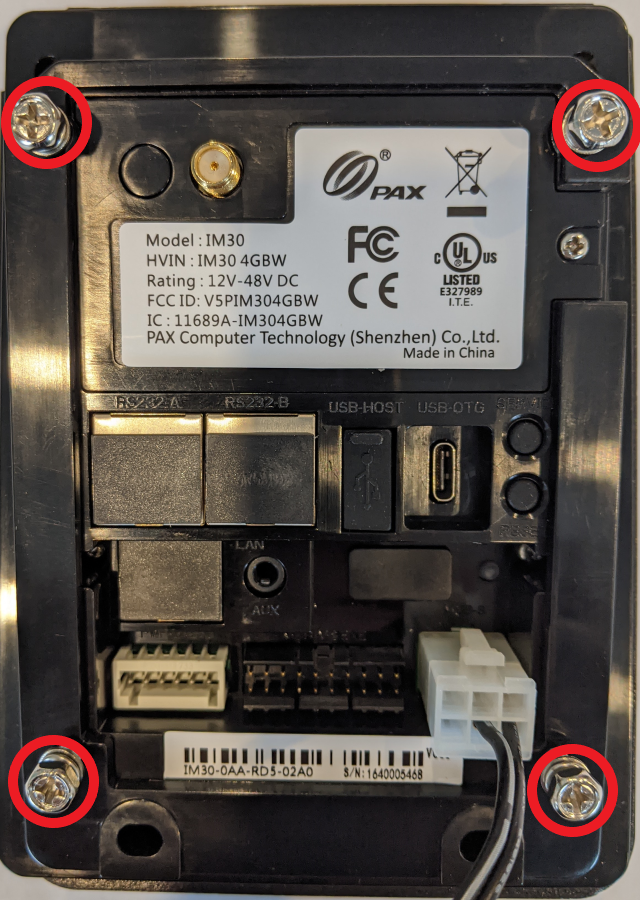

IMPORTANT! The IM30 contains anti-tampering features that disable the terminal if triggered. If the terminal requires maintenance, be sure to contact an experienced professional who can remove and repair the terminal without rendering it inoperable.

The following illustrations show the location of the main terminal features and hardware:

Front-facing camera (not used)

Color touchscreen / Contactless payment reader

Magnetic stripe reader

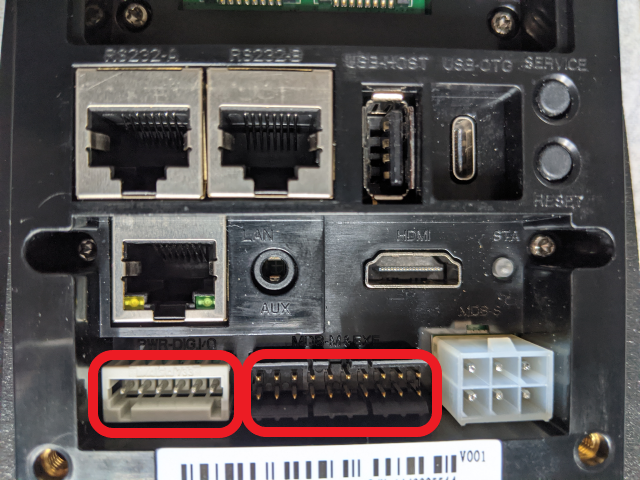

There are multiple communication ports on the back of the terminal. The port you use depend on the type of vending device you are connecting the terminal to. At a minimum, you will need to connect the MDB-S connector to provide AC power to the terminal. All other connections will be situation-specific. The available communication ports include:

RS232-A

RS232-B

USB Host

NOTE: Some of the communication ports may be protected by a cover; remove the covers for the ports you require.

Payment terminal

Mounting bracket

USB Type-C cable

AC power cord

AC adapter with MDB connector

M4 screws & nuts

Close the third party payment application if it is still open.

If the App to app main screen does not appear, touch the Secure Payment icon on the terminal's main screen.

From the App to app main screen, touch the Menu button.

Enter the merchant password and touch Confirm.

Scroll to the Semi-integrated configuration section and touch Switch to Standalone.

The Settings page closes and the terminal displays the standalone payment module.

If you have more than one terminal, repeat steps 1 to 5 for each additional terminal where you want to switch the terminal to standalone payment mode.

If you switched from using the App to app module to Secure Payment's standalone payment mode, you need to switch back when the communication issue with the 3rd party payment application is resolved.

From the standalone payment main screen, touch the Settings button.

Enter the merchant password and touch Confirm.

Scroll to the Semi-integrated configuration section and touch Switch to app to app mode.

The terminal returns to the App to app main screen.

Start third party payment application.

If you have more than one terminal, repeat steps 1 to 4 for each additional terminal where you want to switch back from standalone payment mode.

On the terminal’s main screen, touch the Settings icon.

On the Settings screen, touch the Please Input Password field and use the keypad to type the password: either 9876 or pax9876@@.

Touch the checkmark icon on the keypad when you are done and touch OK.

In the Wireless & networks section, touch Wi-Fi.

If Wi-Fi is Off, touch the toggle to turn it on. If Wi-Fi is already on, a list of available networks appears.

From the list of available networks, touch the name of the network you want to connect to.

Enter the password for the selected network and touch CONNECT.

TIP: You can touch Show password before typing to ensure you are entering the password correctly.

After the terminal displays Connected for the selected network, touch the Back icon to return to the Settings screen.

Touch the Back icon again to return to the main screen.

Enter the merchant password and touch Confirm.

Scroll to the Semi-integrated configuration section and touch Gateway settings.

In the Connection section, review the information that appears.

TPV Client: Read-only field, this lists the terminal's unique identifier (TID).

Connection address: Displays the URL to the authorization server. Do not change unless instructed to do so by PayFacto support.

Port: Read-only field, this lists the port the terminal uses to connect to the authorization server.

If you have more than one terminal, repeat steps 1 to 4 for each additional terminal to review the terminal's connection settings.

The Gateway module is a universal middleware platform that provides an EMV-Compliant, Pay at the Counter (PATC) processing solution that can be connected to a POS (Point of Sale) system.

The Android-based Gateway module is a bi-directional interface which links the PayFacto payment application to a POS system. The Gateway module automates some operations which previously had to be carried out by the clerk, such as the entry of the sales amount and card brand selection. The Gateway module is especially well-suited to quick service environments and drive-through windows, with or without tip management.

The integration of the Gateway module with various POS systems allows the payment terminal to retrieve guest check data from the POS System. After the payment terminal processes a payment, the Gateway module sends the payment data back to the POS System for reporting purposes. Payment amounts, tip amounts and card brand used are all automatically transmitted to the POS system to allow for accurate reporting.

LED Color

A920

A920 Pro

Blue: Charging base is plugged in, no terminal connected.

Red/Yellow: Terminal is charging.

Green: Terminal is fully charged.

LED Color

A920

A920 Pro

Blue: Charging base is plugged in, no terminal connected.

Red/Yellow: Terminal is charging.

Green: Terminal is fully charged.

Insert the chip card and enter a PIN

Swipe the card’s magnetic strip

Tap the card for contactless payment

PayFacto uses a self-service terminal activation procedure designed to save time while also providing better security. The new activation procedure applies only to countertop and mobile PAX payment terminals using the Android operating system. The new procedure applies to:

All new merchants activating their terminals for the first time

Any existing merchants adding new payment terminals

Any existing merchants receiving replacement terminals

After you configure the terminal's network connection(s) and power on the terminal, the procedure comprises of 2 parts:

NOTE: If you have multiple new payment terminals, you need to perform the activation procedure on each terminal individually.

After configuring the terminal’s network connection, you need to start the PayFacto payment application to complete the remaining steps. Terminal activation requires you to input a One Time Passcode (OTP) that PayFacto sends to the email address or telephone number registered to your account.

IMPORTANT! To receive the OTP on your phone, your registered phone number must be able to receive text messages (SMS). If you cannot receive text messages, select the email option to get the OTP.

Touch the PAYMENT icon on the main screen. The Welcome To Your Payment Terminal screen appears.

NOTE: The terminal may need to download host and security parameters; this can take a few moments.

In the top right corner of the screen, your terminal ID (TID) appears; confirm that the number on the screen matches the TID on the label on the back of your terminal. The TID will not appear on your terminal screen after you complete the activation process.

IMPORTANT! If the TID does not match, call PayFacto immediately.

Touch anywhere on the screen to begin the activation process.

Touch the desired option to receive the OTP.

Phone Number

Touch the Send Code button.

IMPORTANT! The OTP code is valid for 15 minutes after you receive it. If you wait more than 15 minutes to enter the OTP, the terminal will display an error and you will have to request a new OTP.

If you select Email, look for a message from [email protected].

After you receive the 6-digit activation code, use the on-screen keypad to enter the code on the terminal screen.

If you enter the code incorrectly, a red exclamation appears to indicate that the code is incorrect.

Re-enter the code, or touch Resend Code to obtain a new OTP.

After you enter the OTP correctly, the payment application displays the Set Administrative Password screen to .

To prevent unauthorized individuals from changing the terminal’s configuration, you need to set the Administrator and Merchant passwords. These passwords restrict access to certain functions on the terminal.

When setting your passwords, you must respect the following parameters:

Passwords must be 6 characters long

The Administrator and Merchant passwords cannot be the same (can’t match)

You cannot use the same digit 6 times consecutively (for example: 111111 or 777777)

On the Set Administrative Password screen, use the on-screen keypad to enter a 6-digit password in the Admin Password field and touch the Next icon on the keypad.

On the Confirm Administrative Password screen, re-enter the password in the Admin Password field and touch the Next icon on the keypad.

On the Set Merchant Password screen, use the on-screen keypad to enter a 6-digit password in the

Your payment terminal is now ready for use.

PayFacto uses a self-service terminal activation procedure designed to save time while also providing better security. The new activation procedure applies only to PAX payment terminals using the Android operating system. The new procedure applies to:

All new merchants activating their terminals for the first time

Any existing merchants adding new payment terminals

The Secure Payment application's Gateway module has multiple configurable features and functions. The features and functions apply to all Secure Payment modules you may use, including standalone Payment, SecurePay, SecureTable, and Gift Cards.

For the Gateway module, the feature you will most likely need to configure is tipping, but you can access the following configuration menus:

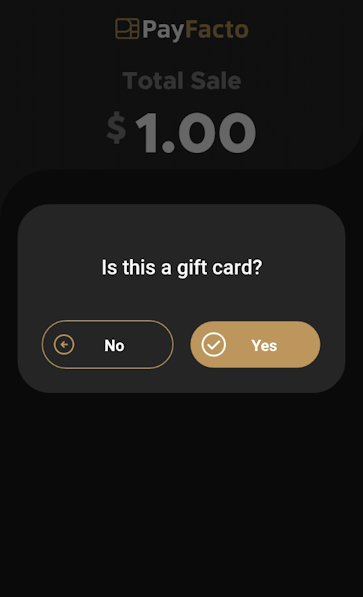

This section describes the general transaction workflow and user experience when making a purchase with a merchant using the Secure Payment application's App to app module.

The merchant will calculate the total amount using a Point of Sale (POS) system or a cash register and enter the total amount on the payment terminal using the third-party application. The third-party application then communicates the total amount to the Secure Payment application's App to app module.

Configuration Settings

Accessing Configuration Settings

Transaction Management

Configure Tipping Options

Configure Cashback Options

Configure Printing Options

Configure Password Options

Help and Training Tools

Accessing Configuration Settings

App to App Application

Tasks and How-tos

On the Confirm Merchant Password screen, re-enter the password in the Merchant Password field and touch the Next icon on the keypad.

Barcode scanner (not used)

SIM card module

Communication ports

Ethernet

3.5mm Auxiliary audio

HDMI

Power-Digital I/O

MDB-M & EXE

MDB-S

Initial terminal configuration

Charging the Terminal

Activating the terminal

Working with the terminal

This document will introduce you to your payment terminal as well as guide you through the process of preparing and configuring it in order to quickly begin processing payments.

Your PAX A920 Pro payment processing terminal comes with the following:

Payment terminal

Roll of printer paper

AC power outlet

You may also have an optional charger and external printer included, but this document addresses the most basic delivery configuration.

The following illustrations show the location of the main terminal features and hardware:

1. Magnetic stripe reader 2. Color touchscreen 3. Chip card reader 4. Scanner button

5. Volume control button 6. USB Type-C charging port 7. Power button 8. Scanner 9. Contactless payment reader

10. Printer 11. Printer latch 12. Rear camera 13. Battery cover 14. Battery cover latch

After you configure the terminal's network connection(s) and power on the terminal, the procedure comprises of 2 parts:

NOTE: If you have multiple new payment terminals, you need to perform the activation procedure on each terminal individually.

After configuring the terminal’s network connection, you need to start the PayFacto payment application to complete the remaining steps. Terminal activation requires you to input a One Time Passcode (OTP) that PayFacto sends to the email address or telephone number registered to your account.

IMPORTANT! To receive the OTP on your phone, your registered phone number must be able to receive text messages (SMS). If you cannot receive text messages, select the email option to get the OTP.

To activate the payment terminal:

Touch the PAYMENT icon on the main screen. The Welcome To Your Payment Terminal screen appears.

NOTE: The terminal may need to download host and security parameters; this can take a few moments.

In the top right corner of the screen, your terminal ID (TID) appears; confirm that the number on the screen matches the TID on the label on the back of your terminal. The TID will not appear on your terminal screen after you complete the activation process.

IMPORTANT! If the TID does not match, call PayFacto immediately.

Touch anywhere on the screen to begin the activation process.

Touch the desired option to receive the OTP.

Phone Number

Touch the Send Code button.

IMPORTANT! The OTP code is valid for 15 minutes after you receive it. If you wait more than 15 minutes to enter the OTP, the terminal will display an error and you will have to request a new OTP.

If you select Email, look for a message from [email protected].

After you receive the 6-digit activation code, use the on-screen keypad to enter the code on the terminal screen.

If you enter the code incorrectly, a red exclamation appears to indicate that the code is incorrect.

Re-enter the code, or touch Resend Code to obtain a new OTP.

After you enter the OTP correctly, the payment application displays the Set Administrative Password screen to configure your terminal passwords.

To prevent unauthorized individuals from changing the terminal’s configuration, you need to set the Administrator and Merchant passwords. These passwords restrict access to certain functions on the terminal.

When setting your passwords, you must respect the following parameters:

Passwords must be 6 characters long

The Administrator and Merchant passwords cannot be the same (can’t match)

You cannot use the same digit 6 times consecutively (for example: 111111 or 777777)

You cannot use 6 consecutive numbers, either ascending or descending (for example: 123456 or 987654)

To set your Administrator and Merchant passwords:

On the Set Administrative Password screen, use the on-screen keypad to enter a 6-digit password in the Admin Password field and touch the Next icon on the keypad.

On the Confirm Administrative Password screen, re-enter the password in the Admin Password field and touch the Next icon on the keypad.

On the Set Merchant Password screen, use the on-screen keypad to enter a 6-digit password in the Merchant Password field and touch the Next icon on the keypad.

On the Confirm Merchant Password screen, re-enter the password in the Merchant Password field and touch the Next icon on the keypad.

Your payment terminal is now ready for use.

Application Configuration

From the Gateway home screen, touch the menu icon at the top-left corner of the screen.

Enter the merchant password and touch the Confirm button. The Settings page appears.

NOTE: Due to the variety of third-party payment applications, no image of this step in the workflow process is included in the documentation.

The next step in the process depends on the type of sale. If the merchant adds any surcharge for debit card transactions (for Canadian merchants only, excluding Quebec), the App to app module applies the associated surcharge to the total amount and requires the customer to confirm the total.

The following sections will describe the workflow without surcharges; the available sale types are:

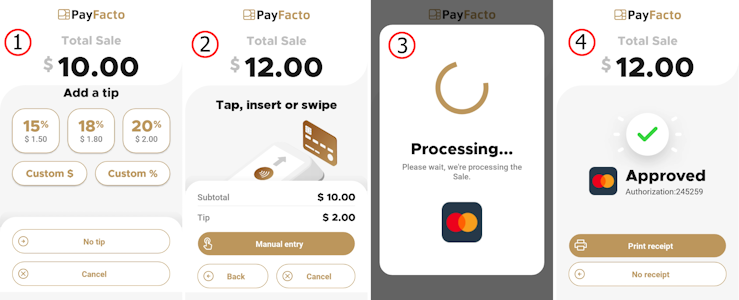

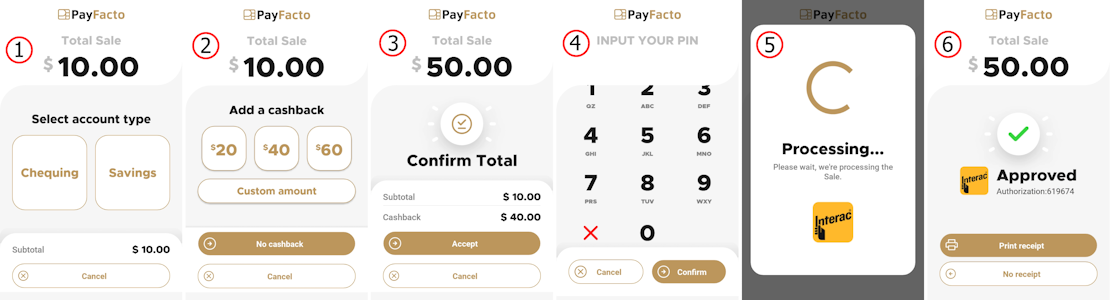

After the merchant enters the amount on the third-party application, the Secure Payment App to app module displays the total sale amount, at which point the merchant hands the terminal to (or turns it towards) the customer.

The customer inserts, swipes, or taps their payment card.

The terminal displays a processing screen with the payment card brand logo.

After approving (or declining) the payment request, the terminal prints the merchant copy of the transaction receipt and the merchant touches Print receipt to print the customer copy or No receipt if the customer does not want their copy of the transaction receipt.

After the merchant enters the amount on the third-party application, the Secure Payment App to app module displays the Add a tip screen, at which point the merchant hands the terminal to (or turns it towards) the customer.

The customer selects one of the preset tip percentages, a custom dollar amount, or a custom percentage (if enabled) or they can touch the No tip button.

After the customer selects the tip amount, the Total Sale screen appears where the customer then inserts, swipes, or taps their payment card.

The terminal displays a processing screen with the payment card brand logo.

After approving (or declining) the payment request, the terminal prints the merchant copy of the transaction receipt and the merchant touches Print receipt to print the customer copy or No receipt if the customer does not want their copy of the transaction receipt.

IMPORTANT! Cashback is only available for debit transactions where clients insert their card into the terminal and enter their PIN. If a client taps a contactless card, the cashback option will not appear.

After the merchant enters the amount on the third-party application, the Secure Payment App to app module displays the total sale amount, at which point the merchant hands the terminal to (or turns it towards) the customer. If the sale includes a tip, the terminal displays the Add a tip screen, where the customer selects the tip to add (or not) before inserting the card into the terminal's chip reader.

The customer selects the account to debit the sale amount from (Chequing or Savings).

The customer selects the amount for cashback.

The customer confirms the total amount (sale plus cashback).

The customer enters their PIN and touches the Confirm button.

The terminal displays a processing screen with the payment card brand logo.

After approving (or declining) the payment request, the terminal prints the merchant copy of the transaction receipt and the merchant touches Print receipt to print the customer copy or No receipt if the customer does not want their copy of the transaction receipt.

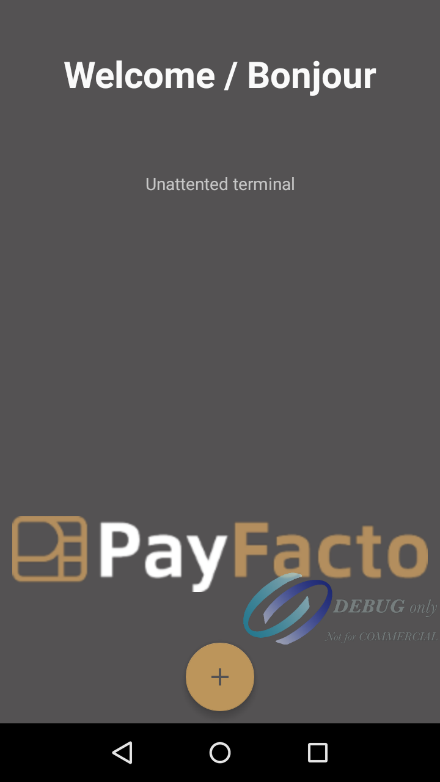

Before you install the terminal in the vending device, you should confirm that the terminal has been properly configured to operate in unattended mode—that a user is unable to initiate a transaction on the terminal.

IMPORTANT! To perform this procedure, the terminal must have an Internet connection.

To confirm that the terminal is operating in unattended mode:

Close any open applications:

To close the PayFacto payment application, touch the Exit icon.

To close the Gateway PayFacto application, press and hold the Welcome / Bonjour text for five (5) seconds, enter the Merchant password, touch OK, and then touch Exit Application.

Due to the many different vending devices available, this guide does not include specific physical installation instructions.

The following points are some general installation guidelines to consider:

Use the supplied M4 nuts to secure the mounting bracket’s outermost openings to M4 screws on the inside wall of the vending device.

Prior to fitting the terminal in the vending device, securely connect the vending device’s digital I/O and MDB cables to the appropriate ports on the rear of the terminal.

If you are using an Ethernet cable to connect the terminal to a network, ensure that the cable is properly seated in the port.

Secure the terminal to the mounting bracket using the supplied M4 screws.

Insert the AC adapter’s MDB connector in the MDB-S port.

If it does not start automatically after you connect the AC power, touch the Gateway PayFacto icon on the main screen to start the application.

Refer to the PAX IM30 Quick Setup Guide (included in the box with the terminal) for general precautions and operational specifications.

Although the IM30 unattended payment processing terminal is configured to receive updates automatically, you may need to perform some maintenance after you install the terminal to the vending device.

The primary maintenance tasks that may be required after initial installation include:

To perform any of these tasks, you must:

Disconnect the power to the terminal; either by disconnecting the MDB-S connector from the back of the terminal or by disconnecting the AC adapter cord.

Disconnect any cables from the terminal.

When using the Secure Payment application, it is helpful to have a list of processed transactions to ensure your bookkeeping is aligned with your business' sales. The terminal can print transaction reports, allowing you to view either detailed or summary information on the transactions and transaction types for the terminal's current batch; if your business uses multiple terminals, you need to print reports on those terminals to view their reports.

Detailed reports display a list of every transaction in the current batch, including date, time, transaction type, payment method, invoice number, and amount. Summary reports group the transactions by card type, displaying the total sales, and the number of transactions.

The terminal’s printer (built-in or external) can print transaction reports for the current batch. For reconciliation purposes, you may want to print a report prior to the automated settlement, but it is not a requirement. Printing reports is meant to assist with your bookkeeping.

The available transaction reports are:

When using the Secure Payment application, it is helpful to have a list of processed transactions to ensure your bookkeeping is aligned with your business' sales. The terminal can print transaction reports, allowing you to view either detailed or summary information on the transactions and transaction types in the current batch, if your business uses multiple terminals, you need to print reports on those terminals to view their reports.

Detailed reports display a list of every transaction in the current batch, including date, time, transaction type, payment method, invoice number, and amount. Summary reports group the transactions by card type, displaying the total sales, and the number of transactions.

Replacing the Printer Paper

On the terminal’s main screen, touch the PayFacto icon to start the payment application.

Touch the Action button on the main screen.

Touch Settings.

Enter the Merchant password and touch OK.

Touch Host Options.

Touch Process parameters download.

Touch OK to confirm the host download.

After the download completes successfully, there are two possible results:

The application’s screen displays Welcome/Bonjour and Unattended terminal, indicating the terminal is correctly configured in unattended mode.

The application’s number pad appears, which indicates that the terminal is not configured for unattended mode.

Correctly Configured Unattended Mode

Incorrectly Configured Unattended Mode

To charge the terminal:

Turn the terminal over.

On the back of the terminal at the bottom, slide the battery cover locking switch to the right.

Lift the battery cover off the terminal. You should notice a plastic tab at the top of the battery.

Lift the battery from the terminal and remove the plastic tab.

Re-install the battery and push on the bottom of the battery to seat it correctly.

Re-install the battery cover on the terminal and slide the lock switch to the lock position on the left and turn the terminal over.

Insert the USB cable in the AC outlet and connect the outlet to an AC plug.

Insert the USB Type-C connector in the terminal’s charging port, located on the left side, below the Volume control button. The terminal begins charging.

NOTE: The terminal’s charging port may have a protective cover; you will need to remove it before inserting the USB Type-C connector.

If the supplied roll of printer paper was not already installed in the terminal when you received it, you will need to install it before you can print any transaction receipts.

TIP: This procedure also applies to replacing a roll of printer paper.

On the back of the terminal near the top, lift the lever to unlock and open the printer cover.

NOTE: The printer cover opens on a hinge, it does not come off the terminal.

The paper tray contains an illustration of how to install the roll of paper.

Place the roll of printer paper in the paper tray, leaving about 2 inches (5 cm) of paper beyond the printer's cutter.

IMPORTANT! Make sure the paper unrolls from the back of the roll, otherwise the printer will be unable to print the transaction receipt.

Close the printer cover until it snaps into place and remove any excess paper.

The terminal requires a network connection to communicate with the payment processor server to process transactions.

The PAX A920 Pro is a mobile payment terminal that can connect to mobile (LTE) and wireless (Wi-Fi) networks.

Mobile network access is required for delivery and transportation use, but it can also serve as a backup connection if your Wi-Fi network reception is unreliable in certain areas.

If you plan to use your terminal outside of your usual wi-fi network, you need to install the mobile SIM card, provided by PayFacto or your mobile communications provider. The SIM card will connect you to a mobile network, allowing you to process payments anywhere the terminal has reception. Mobile network access can also serve as a backup connection if your wi-fi network reception is unreliable in certain areas. The terminal uses the micro-SIM card size.

NOTE: If you plan to use your terminal only on your wi-fi network, you can skip this procedure and proceed directly to Configuring the Terminal Wi-Fi Connection.

Make sure the terminal is powered off and turn the terminal over.

On the back of the terminal at the bottom, slide the battery cover locking switch to the right.

Lift the battery cover off the terminal.

Lift the battery from the terminal to remove and set aside.

The terminal has illustrations for the different cards it can accept. Insert your SIM card in the space identified as SIM1 so the diagonal corner is facing the top left side.

IMPORTANT! The SIM card goes into the lower space and should not require great force to insert.

Re-install the battery and push on the bottom of the battery to seat it correctly.

Re-install the battery cover on the terminal and slide the lock switch to the lock position on the left.

Power on the terminal by pressing and holding the Power button for 3 seconds.

The terminal should identify the SIM card and configure the mobile network settings automatically.

This section explains how to turn Wi-Fi on and connect to your network.

On the terminal’s main screen, touch the Settings icon.

On the Settings screen, touch the Please Input Password field and use the keypad to type the password: either pax9876@@ or 9876.

Touch the checkmark icon on the keypad when you are done and touch OK.

On the Settings page, touch Network & Internet.

On the Network & Internet page, touch Wi-Fi.

On the Wi-Fi page, if Wi-Fi is Off, touch the toggle to turn it on. If Wi-Fi is already on, a list of available networks appears.

From the list of available networks, touch the name of the network you want to connect to.

Enter the password for the selected network and touch CONNECT.

TIP: You can touch Show password before typing to ensure you are entering the password correctly.

After the terminal displays Connected for the selected network, touch the Back icon to return to the Network & Internet page.

By default, the terminal displays all information in English. This procedure explains how to change the terminal’s display language if necessary.

IMPORTANT! Selecting a different language changes all text that appears on the terminal.

On the terminal’s main screen, touch the Settings icon.

On the Settings screen, touch the Please Input Password field and use the keypad to type the password: either pax9876@@ or 9876.

Touch the checkmark icon on the keypad when you are done and touch OK.

On the Settings page, scroll to the bottom and touch System.

On the System page, touch Languages & input.

On the Languages & input page, touch Languages.

On the Language preferences page, touch Add a language.

On the Add a language page, scroll to and touch the desired language.

NOTE: If the language has localized variants, select the appropriate regional option for your country.

If the selected language does not appear automatically, you can drag the language to the top of the list, as shown below:

If you want to offer your customers the ability to withdraw cash in addition to their purchase, you can do so for debit card transactions only. By default, cashback is disabled on the terminal.

From the main screen, touch the Menu button.

Enter the merchant password and touch Confirm.

Scroll to the Configure application section.

Touch Terminal options.

Scroll to the Cashback section.

Toggle the Cashback processing switch to the right.

If you have more than one terminal, repeat steps 1 to 6 for each additional terminal where you want to enable cashback.

When you enable cashback for a debit transaction, the terminal automatically displays three preset values (defaults are $20, $40, and $60) as options to the customer. The customer can touch one of the preset values or manually enter an amount for cashback.

NOTE: When you enable cashback, the terminal automatically adds an option for the customer to enter a custom amount.

From the main screen, touch the Menu button.

Enter the merchant password and touch Confirm.

Scroll to the Configure application section.

Touch Terminal options.

Scroll to the Cashback section.

The Amount presets display the current values.

If you have more than one terminal, repeat steps 1 to 6 for each additional terminal where you want to view the terminal's preset cashback amounts.

When you enable cashback for debit transactions, the terminal automatically offers preset cashback values to the customer. By default, the preset amounts are set to 20, 40, and 60, but you can easily change one or more of these values as needed.

From the main screen, touch the Menu button.

Enter the merchant password and touch Confirm.

Scroll to the Configure application section.

Touch Terminal options.

Scroll to the Cashback section.

Touch Amount presets.

On the Cashback amount presets screen, touch the cashback preset field you want to change (Cashback preset no. 1, Cashback preset no. 2, or Cashback preset no. 3) and replace the current amount with a new value.

Repeat step 7 for any additional cashback amount preset value you want to change.

If you have more than one terminal, repeat steps 1 to 8 for each additional terminal where you want to change a preset cashback amount

NOTE: If you have multiple terminals, you should ensure that they are all configured to offer the same preset cashback amounts to avoid one terminal displaying different cashback amounts from the other terminal(s).

As a security measure, you can require customers receiving any cashback amount to confirm they received the cash by signing on the merchant copy of the transaction receipt. By default, this feature is disabled.

When you enable this function, the terminal prints a signature line on the transaction receipt where the customer can sign as proof that they received the requested cashback amount.

From the main screen, touch the Menu button.

Enter the merchant password and touch Confirm.

In the Configure application section, touch Printer options.